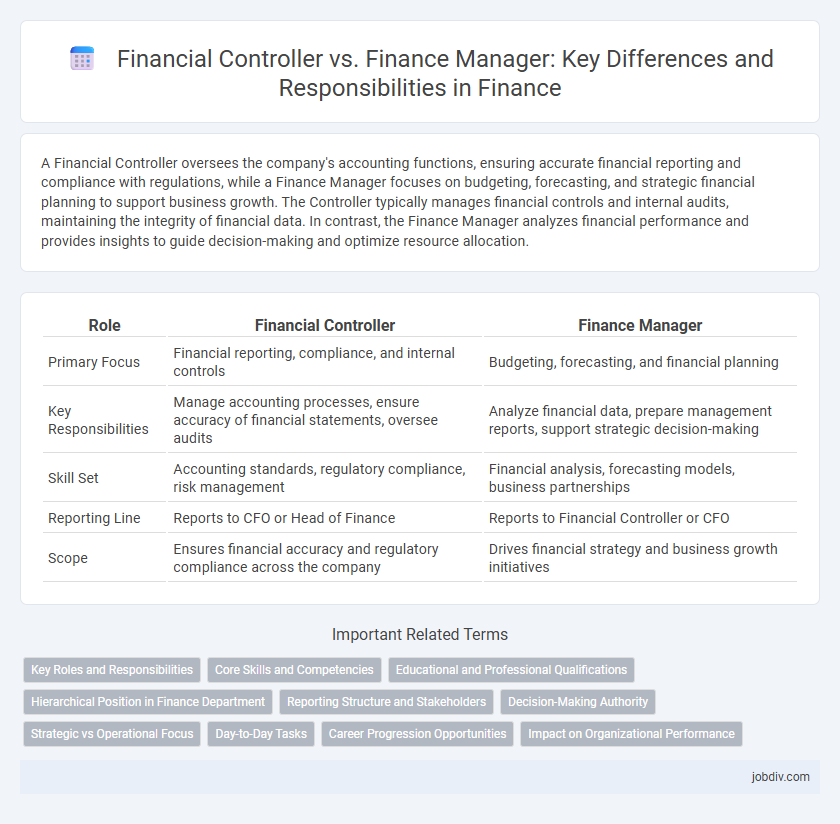

A Financial Controller oversees the company's accounting functions, ensuring accurate financial reporting and compliance with regulations, while a Finance Manager focuses on budgeting, forecasting, and strategic financial planning to support business growth. The Controller typically manages financial controls and internal audits, maintaining the integrity of financial data. In contrast, the Finance Manager analyzes financial performance and provides insights to guide decision-making and optimize resource allocation.

Table of Comparison

| Role | Financial Controller | Finance Manager |

|---|---|---|

| Primary Focus | Financial reporting, compliance, and internal controls | Budgeting, forecasting, and financial planning |

| Key Responsibilities | Manage accounting processes, ensure accuracy of financial statements, oversee audits | Analyze financial data, prepare management reports, support strategic decision-making |

| Skill Set | Accounting standards, regulatory compliance, risk management | Financial analysis, forecasting models, business partnerships |

| Reporting Line | Reports to CFO or Head of Finance | Reports to Financial Controller or CFO |

| Scope | Ensures financial accuracy and regulatory compliance across the company | Drives financial strategy and business growth initiatives |

Key Roles and Responsibilities

Financial Controllers oversee financial reporting, budgeting, and compliance, ensuring accuracy in financial statements and adherence to regulatory standards. Finance Managers focus on strategic financial planning, managing cash flow, and analyzing financial performance to support business growth initiatives. Both roles require strong analytical skills, but Controllers prioritize internal controls while Finance Managers emphasize decision-making and resource allocation.

Core Skills and Competencies

Financial Controllers excel in financial reporting, compliance, and internal controls, ensuring accuracy and regulatory adherence in financial statements. Finance Managers focus on budgeting, forecasting, and strategic financial planning to optimize company performance and resource allocation. Both roles require strong analytical skills, proficiency in financial software, and leadership capabilities, but Controllers emphasize risk management while Managers prioritize financial strategy and decision-making.

Educational and Professional Qualifications

Financial Controllers typically hold a CPA or CMA certification alongside advanced degrees such as an MBA in Finance or Accounting, highlighting their expertise in regulatory compliance and financial reporting. Finance Managers often possess a bachelor's or master's degree in Finance, Business Administration, or Economics, with certifications like CFA or FRM enhancing their strategic financial planning and investment analysis skills. Both roles demand strong analytical capabilities and proficiency in financial software, but Controllers emphasize audit and process control qualifications while Managers focus on market analysis and budget management credentials.

Hierarchical Position in Finance Department

Financial Controllers typically occupy a senior hierarchical position within the finance department, responsible for overseeing financial reporting, compliance, and internal controls. Finance Managers often report to Financial Controllers and focus on managing day-to-day financial operations, budgeting, and analysis. The Financial Controller's role is more strategic and supervisory, whereas the Finance Manager handles tactical financial management tasks.

Reporting Structure and Stakeholders

The Financial Controller typically reports to the Chief Financial Officer (CFO) and oversees internal financial reporting, ensuring accurate compliance with accounting standards for stakeholders such as auditors and regulatory bodies. In contrast, the Finance Manager often reports to the Financial Controller or directly to senior management, focusing on budgeting, forecasting, and providing financial insights to department heads and operational teams. Stakeholders for the Finance Manager primarily include internal business units requiring financial analysis to support decision-making and performance management.

Decision-Making Authority

Financial Controllers primarily focus on overseeing accounting accuracy and regulatory compliance, ensuring financial reporting integrity with limited strategic decision-making authority. Finance Managers hold broader decision-making power, shaping budgeting, forecasting, and financial planning to influence company strategy and operational investments. The differentiation in decision-making authority highlights the Finance Manager's role in driving financial strategy, while Financial Controllers emphasize control and risk management.

Strategic vs Operational Focus

A Financial Controller primarily emphasizes operational focus by managing financial reporting, compliance, and internal controls to ensure accurate and timely financial data. A Finance Manager adopts a strategic focus, driving financial planning, budgeting, and analysis to support long-term business growth and decision-making. Both roles collaborate to align financial accuracy with strategic objectives, enhancing overall organizational performance.

Day-to-Day Tasks

Financial Controllers oversee the accuracy of financial reporting, manage budgeting processes, and ensure compliance with regulatory standards, focusing on internal controls and audit preparation. Finance Managers concentrate on analyzing financial performance, developing forecasts, and managing cash flow to support strategic decision-making and operational efficiency. Both roles require collaboration with accounting teams but differ in scope, with Controllers emphasizing financial governance and Managers driving financial planning and analysis.

Career Progression Opportunities

Financial Controllers oversee company-wide accounting operations and ensure regulatory compliance, often serving as a critical step before advancing to CFO roles, while Finance Managers typically manage team budgets and financial reporting within specific departments, acting as a foundation for senior managerial positions. Career progression from Finance Manager to Financial Controller involves acquiring broader strategic skills, enhanced leadership capabilities, and deeper expertise in financial regulations. Professionals aiming for executive financial leadership benefit from transitioning from Finance Manager roles to Financial Controller positions to gain comprehensive organizational financial oversight.

Impact on Organizational Performance

A Financial Controller enhances organizational performance by ensuring accurate financial reporting, robust internal controls, and compliance with regulatory standards, which safeguards assets and supports strategic decision-making. In contrast, a Finance Manager drives performance through budgeting, forecasting, and financial analysis, aligning financial resources with business objectives to optimize operational efficiency and profitability. Both roles are critical; the controller maintains financial integrity while the manager focuses on financial strategy to improve overall business outcomes.

Financial Controller vs Finance Manager Infographic

jobdiv.com

jobdiv.com