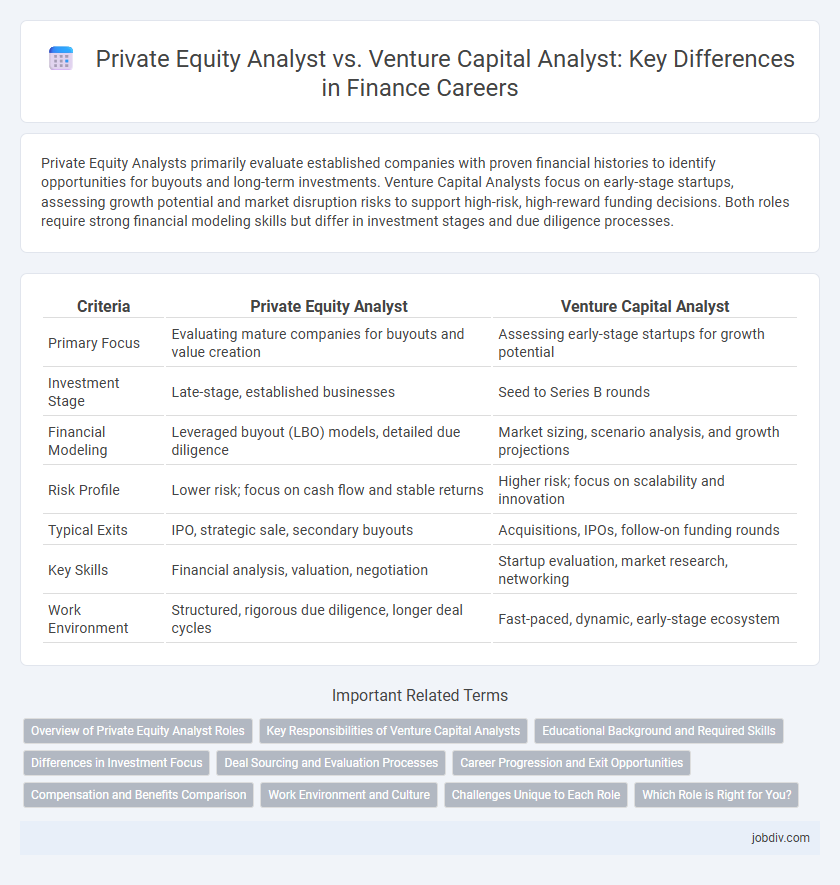

Private Equity Analysts primarily evaluate established companies with proven financial histories to identify opportunities for buyouts and long-term investments. Venture Capital Analysts focus on early-stage startups, assessing growth potential and market disruption risks to support high-risk, high-reward funding decisions. Both roles require strong financial modeling skills but differ in investment stages and due diligence processes.

Table of Comparison

| Criteria | Private Equity Analyst | Venture Capital Analyst |

|---|---|---|

| Primary Focus | Evaluating mature companies for buyouts and value creation | Assessing early-stage startups for growth potential |

| Investment Stage | Late-stage, established businesses | Seed to Series B rounds |

| Financial Modeling | Leveraged buyout (LBO) models, detailed due diligence | Market sizing, scenario analysis, and growth projections |

| Risk Profile | Lower risk; focus on cash flow and stable returns | Higher risk; focus on scalability and innovation |

| Typical Exits | IPO, strategic sale, secondary buyouts | Acquisitions, IPOs, follow-on funding rounds |

| Key Skills | Financial analysis, valuation, negotiation | Startup evaluation, market research, networking |

| Work Environment | Structured, rigorous due diligence, longer deal cycles | Fast-paced, dynamic, early-stage ecosystem |

Overview of Private Equity Analyst Roles

Private Equity Analysts evaluate mature companies, focusing on financial modeling, due diligence, and market analysis to identify investment opportunities and assess risk. They collaborate closely with portfolio companies to enhance operational performance and guide strategic growth initiatives. Their role requires a deep understanding of valuation techniques, industry trends, and deal structuring within buyouts or leveraged acquisitions.

Key Responsibilities of Venture Capital Analysts

Venture Capital Analysts conduct in-depth market research to identify emerging startups with high growth potential and assess their competitive positioning within dynamic industries. They perform detailed financial modeling and valuation analysis to evaluate investment opportunities and forecast future returns. Their role includes monitoring portfolio company performance, preparing investment memoranda, and supporting due diligence efforts to guide strategic decision-making in early-stage funding.

Educational Background and Required Skills

Private Equity Analysts typically hold degrees in finance, accounting, or economics, with strong expertise in financial modeling, valuation techniques, and due diligence processes. Venture Capital Analysts often have backgrounds in business, entrepreneurship, or technology, emphasizing market research, startup evaluation, and trend analysis skills. Both roles require proficiency in Excel and financial software, but Private Equity demands deeper analytical rigor in leveraged buyouts, while Venture Capital focuses on growth potential and innovation metrics.

Differences in Investment Focus

Private Equity Analysts primarily evaluate established companies with stable cash flows for buyouts and long-term value creation, focusing on operational improvements and financial restructuring. Venture Capital Analysts target early-stage startups with high growth potential, emphasizing market size, innovation, and scalability risk. The investment focus divergence lies in maturity, risk profile, and return timelines of portfolio companies.

Deal Sourcing and Evaluation Processes

Private Equity Analysts prioritize deal sourcing through extensive industry networks and financial due diligence, targeting mature companies with established cash flows for leveraged buyouts. Venture Capital Analysts emphasize evaluating early-stage startups by assessing innovative potential, market scalability, and founder expertise to identify high-growth opportunities. Both roles require rigorous deal evaluation, but Private Equity focuses on financial modeling and risk mitigation, while Venture Capital leans toward market trends and disruptive technology analysis.

Career Progression and Exit Opportunities

Private Equity Analysts typically advance by moving into Associate, Vice President, and Principal roles, gaining expertise in buyouts and portfolio management, with exit opportunities often leading to roles in corporate development, hedge funds, or private equity firms. Venture Capital Analysts progress through similar titles, focusing on early-stage company evaluation, networking with startups, and deal sourcing, with exits frequently available in startup leadership, entrepreneurship, or venture capital firms. Both career paths demand strong financial modeling and due diligence skills but diverge in industry focus and potential long-term positions.

Compensation and Benefits Comparison

Private Equity Analysts typically earn higher base salaries and bonuses compared to Venture Capital Analysts, reflecting the larger deal sizes and asset management responsibilities in private equity firms. Venture Capital Analysts often receive equity stakes or carry interest, providing long-term incentive potential tied to startup growth, whereas private equity compensation leans more on immediate financial performance metrics. Benefits in both roles commonly include health insurance, retirement plans, and performance-based bonuses, but private equity firms may offer more substantial signing bonuses and profit-sharing opportunities.

Work Environment and Culture

Private Equity Analysts typically operate in more structured, corporate environments with established firms emphasizing detailed financial modeling and long-term investment strategies. Venture Capital Analysts work within dynamic, fast-paced startup ecosystems where collaboration and innovation drive decision-making and deal sourcing. Both roles demand strong analytical skills but differ significantly in cultural pace and risk tolerance, with private equity favoring stability and venture capital embracing agility and growth potential.

Challenges Unique to Each Role

Private Equity Analysts face challenges such as conducting extensive due diligence on mature companies, managing complex financial models, and navigating negotiation processes for leveraged buyouts. Venture Capital Analysts encounter difficulties in evaluating early-stage startups with limited financial history, assessing market potential under high uncertainty, and identifying disruptive innovation trends with rapid scalability. Both roles demand specialized expertise, but Private Equity emphasizes financial rigor and deal structuring while Venture Capital focuses on market insight and growth potential analysis.

Which Role is Right for You?

Private Equity Analysts focus on evaluating established companies with stable cash flows, conducting detailed financial modeling, and driving value creation through operational improvements. Venture Capital Analysts specialize in assessing early-stage startups, emphasizing market potential, innovation, and scalability within high-growth sectors like technology and biotechnology. Choosing between these roles depends on your preference for working with mature businesses versus dynamic startups, risk tolerance, and interest in long-term operational involvement versus rapid market disruption.

Private Equity Analyst vs Venture Capital Analyst Infographic

jobdiv.com

jobdiv.com