Equity research evaluates company stocks by analyzing financial statements, market trends, and industry conditions to assess investment potential and guide portfolio decisions. Fixed income research concentrates on debt securities, examining credit risk, interest rate movements, and macroeconomic factors to determine bond valuations and yield expectations. Both disciplines require deep market insight but differ in asset focus, risk assessment, and valuation methodologies.

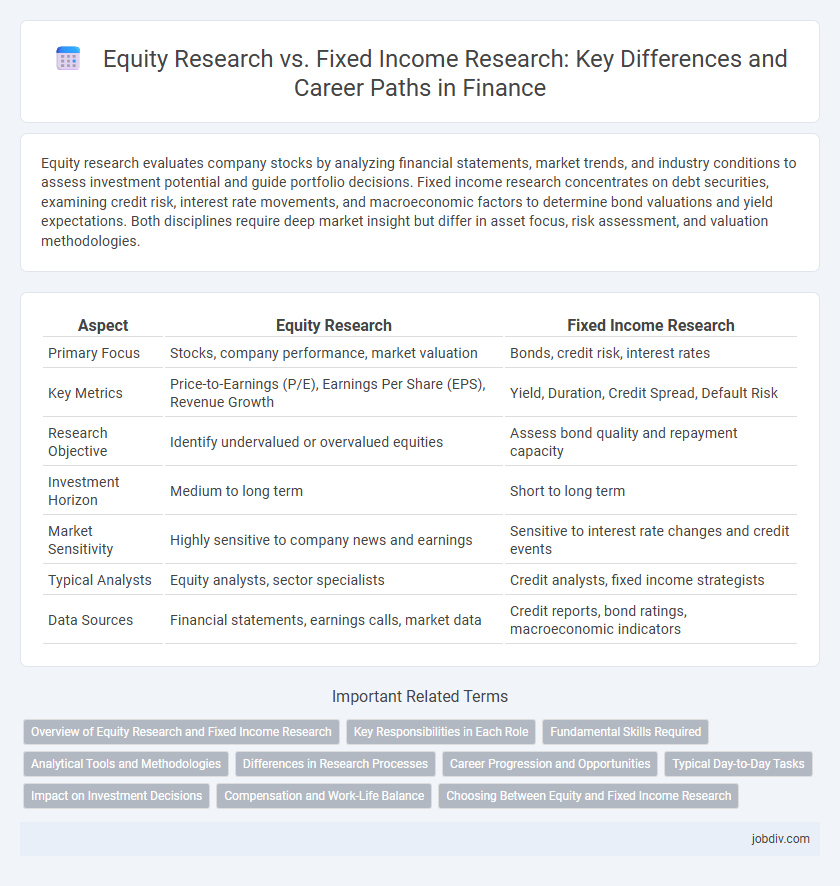

Table of Comparison

| Aspect | Equity Research | Fixed Income Research |

|---|---|---|

| Primary Focus | Stocks, company performance, market valuation | Bonds, credit risk, interest rates |

| Key Metrics | Price-to-Earnings (P/E), Earnings Per Share (EPS), Revenue Growth | Yield, Duration, Credit Spread, Default Risk |

| Research Objective | Identify undervalued or overvalued equities | Assess bond quality and repayment capacity |

| Investment Horizon | Medium to long term | Short to long term |

| Market Sensitivity | Highly sensitive to company news and earnings | Sensitive to interest rate changes and credit events |

| Typical Analysts | Equity analysts, sector specialists | Credit analysts, fixed income strategists |

| Data Sources | Financial statements, earnings calls, market data | Credit reports, bond ratings, macroeconomic indicators |

Overview of Equity Research and Fixed Income Research

Equity Research involves analyzing company stocks to provide investment recommendations based on financial statements, market trends, and economic indicators, focusing on growth potential and valuation metrics. Fixed Income Research centers on evaluating bonds and debt instruments by assessing credit risk, interest rate movements, and yield curves to determine investment suitability and risk exposure. Both disciplines utilize quantitative models and qualitative analysis but differ fundamentally in asset type, risk factors, and return expectations.

Key Responsibilities in Each Role

Equity Research analysts focus on evaluating a company's financial statements, market position, and growth potential to provide buy, hold, or sell recommendations on stocks. Fixed Income Research professionals analyze credit risk, interest rate trends, and issuer financial health to assess bond valuations and advise on debt securities. Both roles require strong financial modeling skills but differ in asset focus and risk assessment methodologies.

Fundamental Skills Required

Equity research demands strong analytical skills for evaluating company financial statements, industry trends, and earnings forecasts to determine stock valuation and growth potential. Fixed income research requires expertise in credit analysis, interest rate modeling, and macroeconomic factors to assess bond risk, yield, and default probabilities. Both roles rely on proficiency in financial modeling, market data interpretation, and understanding regulatory environments but differ in asset focus and risk assessment techniques.

Analytical Tools and Methodologies

Equity research relies heavily on financial modeling, discounted cash flow (DCF) analysis, and relative valuation techniques such as price-to-earnings (P/E) and price-to-book (P/B) ratios to assess a company's potential for stock price appreciation. Fixed income research emphasizes credit analysis, duration and convexity measures, yield curve analysis, and scenario stress testing to evaluate bond risk, interest rate sensitivity, and issuer creditworthiness. Both approaches utilize quantitative data and qualitative insights but differ fundamentally in their risk metrics and valuation frameworks aligned with equity and debt instruments.

Differences in Research Processes

Equity research involves analyzing company financials, industry trends, and management quality to forecast stock price movements and earnings potential, relying heavily on financial modeling and qualitative assessments. Fixed income research centers on credit risk evaluation, interest rate trends, and bond valuation techniques to assess debt securities' safety and yield prospects, using metrics like credit ratings and duration analysis. The research process in equities emphasizes growth projections and market sentiment, while fixed income research prioritizes creditworthiness and macroeconomic factors impacting interest rates.

Career Progression and Opportunities

Equity research professionals typically experience career progression through roles such as junior analyst, senior analyst, and portfolio manager, with opportunities to specialize in sectors or companies, often leading to positions in investment banking or asset management. Fixed income research careers focus on analyzing bond markets, credit risk, and macroeconomic factors, advancing from analyst to senior analyst and credit strategist, with pathways to risk management or treasury roles. Both fields offer strong growth potential, but equity research tends to provide broader exposure to public markets and corporate finance, while fixed income research emphasizes macroeconomic trends and credit analysis.

Typical Day-to-Day Tasks

Equity Research analysts typically focus on analyzing company financials, earnings reports, and industry trends to provide stock recommendations and valuation models. Fixed Income Research professionals concentrate on credit analysis, interest rate movements, and bond market trends to assess risk and yield potential on debt securities. Both roles involve monitoring market developments and preparing detailed investment reports to support portfolio management decisions.

Impact on Investment Decisions

Equity Research provides in-depth analysis of company financials, market trends, and growth prospects, enabling investors to identify high-potential stocks and assess risk-reward profiles. Fixed Income Research focuses on interest rate movements, credit quality, and macroeconomic indicators, guiding decisions on bond investments and portfolio diversification. Together, these research types influence investment strategies by balancing growth opportunities with income stability and risk management.

Compensation and Work-Life Balance

Equity research analysts generally receive higher compensation driven by the volatility and growth potential of stock markets, whereas fixed income researchers tend to have more stable but comparatively lower salaries due to the steady nature of bond markets. Work-life balance in fixed income research is often better, with less pressure during market hours, while equity research professionals frequently face longer hours and more intense deadlines linked to earnings reports and market movements. Compensation packages in equity research often include substantial bonuses tied to performance, contrasting with fixed income roles where bonuses are smaller and more predictable.

Choosing Between Equity and Fixed Income Research

Choosing between equity research and fixed income research depends on your analytical skills and investment focus. Equity research emphasizes company fundamentals, earnings growth, and stock valuation metrics such as P/E ratios to drive stock recommendations. Fixed income research prioritizes credit risk analysis, interest rate trends, and bond yield spreads to assess debt securities' value and risk profiles.

Equity Research vs Fixed Income Research Infographic

jobdiv.com

jobdiv.com