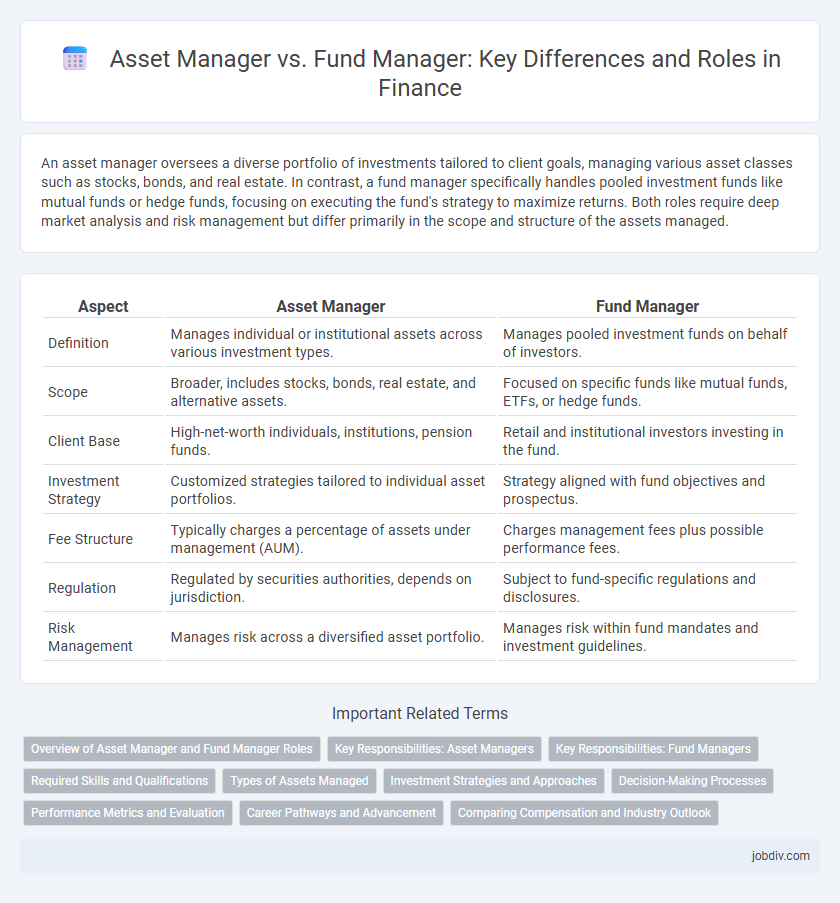

An asset manager oversees a diverse portfolio of investments tailored to client goals, managing various asset classes such as stocks, bonds, and real estate. In contrast, a fund manager specifically handles pooled investment funds like mutual funds or hedge funds, focusing on executing the fund's strategy to maximize returns. Both roles require deep market analysis and risk management but differ primarily in the scope and structure of the assets managed.

Table of Comparison

| Aspect | Asset Manager | Fund Manager |

|---|---|---|

| Definition | Manages individual or institutional assets across various investment types. | Manages pooled investment funds on behalf of investors. |

| Scope | Broader, includes stocks, bonds, real estate, and alternative assets. | Focused on specific funds like mutual funds, ETFs, or hedge funds. |

| Client Base | High-net-worth individuals, institutions, pension funds. | Retail and institutional investors investing in the fund. |

| Investment Strategy | Customized strategies tailored to individual asset portfolios. | Strategy aligned with fund objectives and prospectus. |

| Fee Structure | Typically charges a percentage of assets under management (AUM). | Charges management fees plus possible performance fees. |

| Regulation | Regulated by securities authorities, depends on jurisdiction. | Subject to fund-specific regulations and disclosures. |

| Risk Management | Manages risk across a diversified asset portfolio. | Manages risk within fund mandates and investment guidelines. |

Overview of Asset Manager and Fund Manager Roles

Asset managers oversee a diversified portfolio of investments, including stocks, bonds, real estate, and other assets, aiming to maximize long-term returns while managing risk according to clients' financial goals. Fund managers specialize in managing specific investment funds, such as mutual funds, hedge funds, or pension funds, making decisions on asset allocation and security selection within the fund's mandate. Both roles require analyzing market trends, conducting research, and monitoring portfolio performance to ensure alignment with investment objectives and regulatory requirements.

Key Responsibilities: Asset Managers

Asset managers are responsible for overseeing and managing investment portfolios to maximize returns while minimizing risks for individual and institutional clients. They analyze market trends, select appropriate assets, and continuously monitor portfolio performance to align with client goals. Their duties include asset allocation, risk assessment, and ensuring compliance with regulatory requirements.

Key Responsibilities: Fund Managers

Fund Managers are responsible for making investment decisions and managing portfolios to achieve specific financial objectives, focusing on asset allocation, security selection, and risk management. They analyze market trends, economic data, and company performance to optimize fund returns for investors. Fund Managers also ensure compliance with regulatory requirements and maintain communication with stakeholders regarding fund performance and strategy.

Required Skills and Qualifications

Asset managers need strong analytical skills, a deep understanding of financial markets, and expertise in portfolio management to optimize asset allocation and risk-adjusted returns. Fund managers require advanced qualifications such as the CFA designation or MBA in finance, along with proficiency in fund performance analysis, regulatory compliance, and client communication. Both roles demand proficiency in financial modeling, quantitative analysis, and experience with investment strategies to align with investor objectives.

Types of Assets Managed

Asset managers oversee a broad range of assets, including equities, bonds, real estate, and alternative investments, optimizing portfolios across diverse sectors to meet investor goals. Fund managers specifically focus on managing pooled investment funds such as mutual funds, hedge funds, and exchange-traded funds (ETFs), making decisions about asset allocation within that fund. The distinction lies in asset managers' wider scope of individual and institutional assets versus fund managers' concentrated responsibility over specific investment funds.

Investment Strategies and Approaches

Asset managers prioritize diversification across multiple asset classes, tailoring portfolios to individual client goals and risk tolerance to optimize long-term growth and stability. Fund managers concentrate on managing pooled investment funds, actively selecting securities within specific market sectors or themes to achieve targeted returns. Both roles utilize quantitative analysis and market research but differ in client scope and investment horizons.

Decision-Making Processes

Asset managers oversee a diversified portfolio of assets to maximize long-term value, using comprehensive market analysis and risk assessment to guide strategic allocation decisions. Fund managers concentrate on specific investment funds, employing quantitative models and performance metrics to optimize returns within the fund's mandate. Their decision-making processes differ in scope, with asset managers prioritizing asset diversification and portfolio synergy, while fund managers focus on fund-level performance and compliance.

Performance Metrics and Evaluation

Asset managers focus on optimizing portfolio diversification and risk-adjusted returns using performance metrics such as Sharpe ratio, alpha, and beta to evaluate overall asset class success. Fund managers assess investment fund performance primarily through net asset value (NAV) growth, internal rate of return (IRR), and total return relative to benchmark indices to gauge fund competitiveness and investor value. Both roles emphasize performance attribution analysis to identify drivers of returns, with asset managers concentrating on strategic allocation and fund managers on tactical security selection.

Career Pathways and Advancement

Asset managers typically oversee a broad portfolio of client assets, developing expertise in diverse investment strategies and risk management, which can lead to senior roles such as Chief Investment Officer or Portfolio Director. Fund managers concentrate on managing specific mutual or hedge funds, honing skills in fund performance analysis and regulatory compliance, often advancing to positions like Fund Director or Head of Fund Management. Both career pathways benefit from certifications like CFA and demonstrate strong analytical and leadership abilities to progress within financial institutions.

Comparing Compensation and Industry Outlook

Asset managers typically earn a combination of management fees and performance-based incentives, with average annual bonuses ranging from 10% to 30% of base salary, while fund managers often receive higher performance-linked bonuses that can exceed 50%. The asset management industry shows steady growth driven by increasing global assets under management (AUM), projected to reach $120 trillion by 2025, whereas fund management faces more volatility tied to market performance and investor sentiment. Career prospects for asset managers remain robust due to diversification into alternative investments, whereas fund managers must adapt to regulatory changes and competition from passive funds.

Asset Manager vs Fund Manager Infographic

jobdiv.com

jobdiv.com