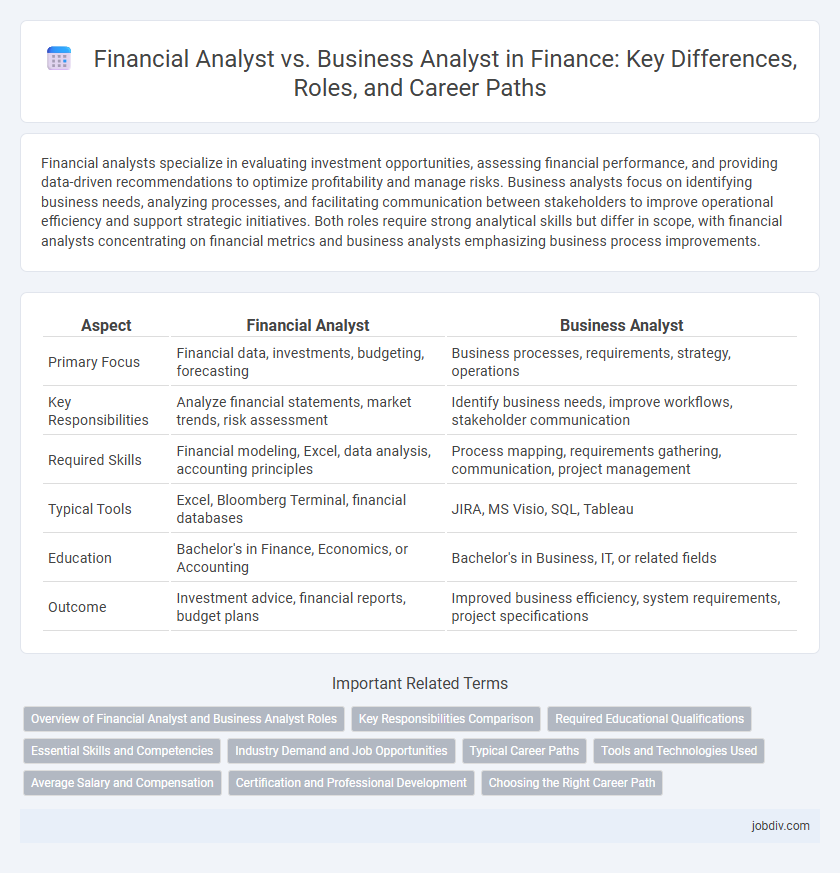

Financial analysts specialize in evaluating investment opportunities, assessing financial performance, and providing data-driven recommendations to optimize profitability and manage risks. Business analysts focus on identifying business needs, analyzing processes, and facilitating communication between stakeholders to improve operational efficiency and support strategic initiatives. Both roles require strong analytical skills but differ in scope, with financial analysts concentrating on financial metrics and business analysts emphasizing business process improvements.

Table of Comparison

| Aspect | Financial Analyst | Business Analyst |

|---|---|---|

| Primary Focus | Financial data, investments, budgeting, forecasting | Business processes, requirements, strategy, operations |

| Key Responsibilities | Analyze financial statements, market trends, risk assessment | Identify business needs, improve workflows, stakeholder communication |

| Required Skills | Financial modeling, Excel, data analysis, accounting principles | Process mapping, requirements gathering, communication, project management |

| Typical Tools | Excel, Bloomberg Terminal, financial databases | JIRA, MS Visio, SQL, Tableau |

| Education | Bachelor's in Finance, Economics, or Accounting | Bachelor's in Business, IT, or related fields |

| Outcome | Investment advice, financial reports, budget plans | Improved business efficiency, system requirements, project specifications |

Overview of Financial Analyst and Business Analyst Roles

Financial Analysts evaluate investment opportunities, analyze financial data, and forecast economic trends to guide business decisions and maximize profitability. Business Analysts focus on identifying organizational needs, improving processes, and implementing technology solutions to enhance overall business performance. Both roles require strong analytical skills but differ in their primary objectives, with Financial Analysts centered on financial health and Business Analysts on operational efficiency.

Key Responsibilities Comparison

Financial Analysts primarily focus on evaluating investment opportunities, analyzing financial data, and preparing reports on market trends to support decision-making and portfolio management. Business Analysts concentrate on identifying business needs, designing processes, and facilitating communication between stakeholders to improve operational efficiency and project outcomes. Both roles require strong analytical skills, but Financial Analysts emphasize financial forecasting and risk assessment, while Business Analysts prioritize requirements gathering and process optimization.

Required Educational Qualifications

Financial analysts typically require a bachelor's degree in finance, economics, accounting, or a related field, with many employers preferring candidates who hold certifications such as the Chartered Financial Analyst (CFA) designation. Business analysts often pursue degrees in business administration, information technology, or management, emphasizing coursework in data analysis, project management, and systems analysis. Advanced certifications like Certified Business Analysis Professional (CBAP) or Project Management Professional (PMP) can enhance qualifications for business analysts.

Essential Skills and Competencies

Financial Analysts excel in quantitative skills, financial modeling, and market analysis, enabling precise investment recommendations and risk assessments. Business Analysts demonstrate strong proficiency in requirements gathering, process mapping, and stakeholder communication, ensuring effective business process improvements and strategic alignment. Both roles require analytical thinking and problem-solving, but Financial Analysts emphasize financial expertise while Business Analysts prioritize business process and IT knowledge.

Industry Demand and Job Opportunities

Financial analysts are in high demand within investment banking, asset management, and corporate finance, driven by the need for expertise in financial modeling and market trend analysis. Business analysts are sought after across diverse industries such as IT, healthcare, and consulting, focusing on process improvement, requirement gathering, and stakeholder communication. Job opportunities for financial analysts often center around roles requiring quantitative skills and market insights, while business analysts find broader prospects due to their versatility in bridging business needs with technology solutions.

Typical Career Paths

Financial Analysts typically progress from entry-level analyst roles to senior analyst positions, specializing in investment strategies, portfolio management, or corporate finance before advancing to roles like Finance Manager or Chief Financial Officer (CFO). Business Analysts often start as junior analysts or associates, gaining expertise in process improvement and data analysis, then move into senior roles such as Business Architect, Product Manager, or Business Consultant. Both career paths value strong analytical skills, but Financial Analysts focus on financial data and market trends, whereas Business Analysts concentrate on optimizing business processes and technology solutions.

Tools and Technologies Used

Financial analysts primarily utilize tools such as Excel, Bloomberg Terminal, and financial modeling software like MATLAB and SAS to perform data analysis, forecasting, and investment evaluation. Business analysts rely on technologies including SQL, Tableau, Jira, and SAP for requirements gathering, data visualization, and process improvement. Both roles increasingly incorporate AI-powered analytics platforms and machine learning tools to enhance decision-making accuracy and efficiency.

Average Salary and Compensation

Financial Analysts typically earn an average salary of $85,000 to $95,000 annually, with total compensation packages often including bonuses and profit sharing that can increase earnings by 10-20%. Business Analysts have an average salary range of $75,000 to $90,000, with compensation varying based on industry and certifications, sometimes including performance-based incentives. Salary differences are influenced by skill sets, job responsibilities, and market demand within sectors such as finance, technology, and consulting.

Certification and Professional Development

Financial Analysts often pursue certifications such as the Chartered Financial Analyst (CFA) designation, which emphasizes investment analysis, portfolio management, and financial modeling, enhancing their expertise in financial markets and asset valuation. Business Analysts typically obtain certifications like the Certified Business Analysis Professional (CBAP) or PMI Professional in Business Analysis (PMI-PBA), focusing on requirements management, business process improvement, and stakeholder communication. Continuous professional development for Financial Analysts involves staying updated with market trends and regulatory changes, while Business Analysts engage in training on agile methodologies, data analytics, and strategic planning to bridge the gap between business needs and technical solutions.

Choosing the Right Career Path

Financial analysts specialize in evaluating investment opportunities and interpreting market trends to guide business decisions, while business analysts focus on improving organizational processes and bridging the gap between IT and business teams. Career choices depend on whether one prefers data-driven investment analysis or strategic process optimization within a company. Key factors to consider include interest in finance markets, analytical skills, and alignment with long-term professional goals.

Financial Analyst vs Business Analyst Infographic

jobdiv.com

jobdiv.com