Investment banking specializes in capital raising, mergers, and acquisitions, helping companies access the financial markets for growth and strategic transactions. Corporate banking focuses on providing tailored financial services such as loans, credit, and treasury management to businesses for their operational needs. Both sectors play vital roles, but investment banking drives market activities while corporate banking supports daily business finance.

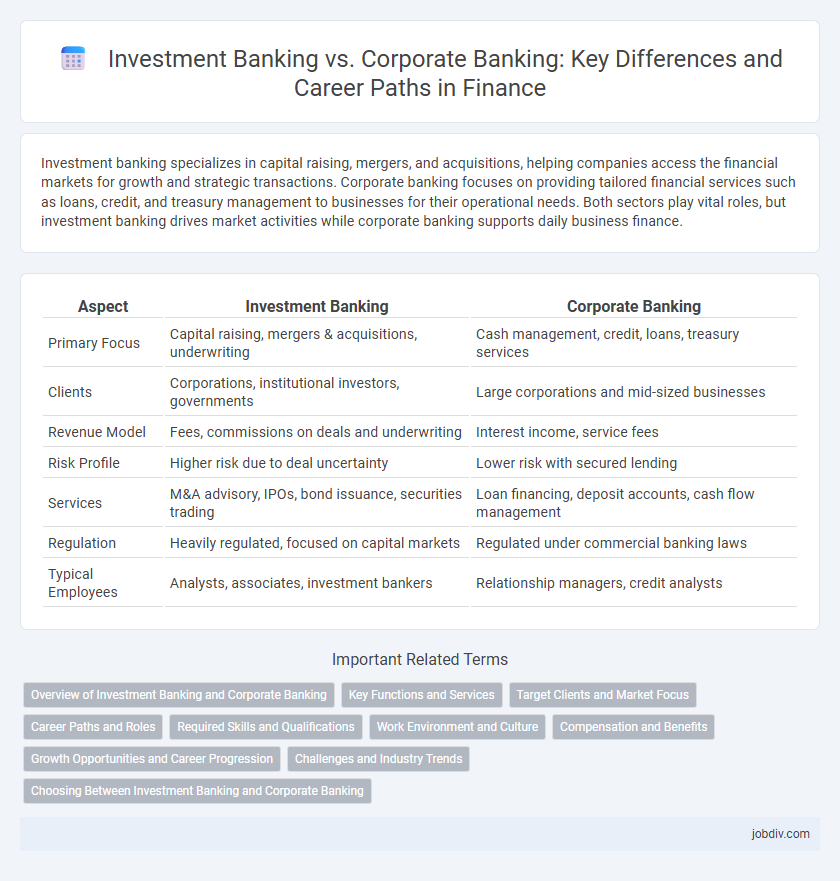

Table of Comparison

| Aspect | Investment Banking | Corporate Banking |

|---|---|---|

| Primary Focus | Capital raising, mergers & acquisitions, underwriting | Cash management, credit, loans, treasury services |

| Clients | Corporations, institutional investors, governments | Large corporations and mid-sized businesses |

| Revenue Model | Fees, commissions on deals and underwriting | Interest income, service fees |

| Risk Profile | Higher risk due to deal uncertainty | Lower risk with secured lending |

| Services | M&A advisory, IPOs, bond issuance, securities trading | Loan financing, deposit accounts, cash flow management |

| Regulation | Heavily regulated, focused on capital markets | Regulated under commercial banking laws |

| Typical Employees | Analysts, associates, investment bankers | Relationship managers, credit analysts |

Overview of Investment Banking and Corporate Banking

Investment banking specializes in capital raising, mergers and acquisitions, and advisory services for corporations, governments, and institutions by underwriting securities and facilitating complex financial transactions. Corporate banking primarily serves businesses by providing tailored lending solutions, treasury management, and cash flow optimization to support daily operations and long-term growth. Both sectors employ distinct client engagement models and risk management strategies aligned with their specific financial services.

Key Functions and Services

Investment banking specializes in capital raising, mergers and acquisitions, and advisory services for large corporations and institutional clients. Corporate banking focuses on providing credit, treasury, and cash management solutions tailored to meet the operational needs of businesses. Both sectors play crucial roles in supporting corporate growth but differ in risk profiles and client engagement strategies.

Target Clients and Market Focus

Investment banking primarily targets corporations, governments, and institutional investors seeking capital market access and complex financial advisory services such as mergers, acquisitions, and underwriting. Corporate banking focuses on providing tailored lending, treasury management, and cash flow solutions to middle-market companies and large enterprises with ongoing operational financing needs. The market focus in investment banking revolves around capital raising and strategic advisory, whereas corporate banking centers on relationship-driven credit and deposit services for business clients.

Career Paths and Roles

Investment banking careers involve advising on mergers and acquisitions, underwriting securities, and facilitating capital raising, requiring strong analytical skills and long working hours. Corporate banking focuses on managing client relationships, providing loans, treasury services, and risk management solutions to businesses, emphasizing client interaction and credit analysis. Professionals in investment banking often pursue roles such as analysts or associates in deal execution, while corporate bankers progress towards relationship management and portfolio oversight positions.

Required Skills and Qualifications

Investment banking demands strong analytical skills, proficiency in financial modeling, and the ability to work under high pressure, often requiring degrees in finance, economics, or business along with certifications like CFA or MBA. Corporate banking requires expertise in credit analysis, risk assessment, and relationship management, typically necessitating qualifications in accounting, finance, or business administration, with relevant certifications such as CPA or CFA preferred. Both sectors value excellent communication skills, attention to detail, and a solid understanding of financial regulations and market trends.

Work Environment and Culture

Investment banking environments are often fast-paced and high-pressure, characterized by long hours and a competitive culture focused on deal-making and client acquisitions. Corporate banking typically offers a more structured and client-focused atmosphere, emphasizing relationship management and risk assessment within a collaborative team setting. Employees in investment banking often face intense deadlines, while corporate banking professionals experience a steadier workflow with greater work-life balance.

Compensation and Benefits

Investment banking typically offers higher compensation packages, including substantial bonuses tied to deal performance, reflecting the high-pressure, transaction-driven environment. Corporate banking compensation tends to be more stable, with a greater emphasis on base salary and long-term benefits such as retirement plans and health insurance, aligning with its focus on client relationship management and risk assessment. Both fields provide competitive benefits, but investment banking rewards short-term success while corporate banking prioritizes consistent earnings and job security.

Growth Opportunities and Career Progression

Investment banking offers accelerated career progression through high-stakes deal execution, mergers and acquisitions, and capital raising, attracting professionals seeking rapid advancement and exposure to global markets. Corporate banking provides stable growth opportunities by managing client relationships, credit analysis, and tailored financial solutions for corporations, ideal for those aiming for long-term client engagement and leadership roles within financial institutions. Both sectors demand strong analytical skills, but investment banking careers often lead to lucrative private equity and hedge fund positions, while corporate banking can pave the way to executive roles in corporate finance and risk management.

Challenges and Industry Trends

Investment banking faces challenges such as increased regulatory scrutiny, market volatility, and the need for digital transformation to enhance deal-making efficiency. Corporate banking is navigating rising credit risks, evolving client demands for tailored financing solutions, and the integration of fintech technologies to streamline operations. Industry trends highlight a shift towards data-driven decision-making, sustainable finance initiatives, and the adoption of artificial intelligence to optimize risk assessment and client engagement in both sectors.

Choosing Between Investment Banking and Corporate Banking

Choosing between investment banking and corporate banking depends on career goals, risk tolerance, and desired work environment. Investment banking offers high-stakes deal-making, mergers and acquisitions, and capital raising with significant pressure and long hours. Corporate banking emphasizes relationship management, credit analysis, and steady revenue generation through loans and treasury services for established corporations, providing a more stable work-life balance.

Investment Banking vs Corporate Banking Infographic

jobdiv.com

jobdiv.com