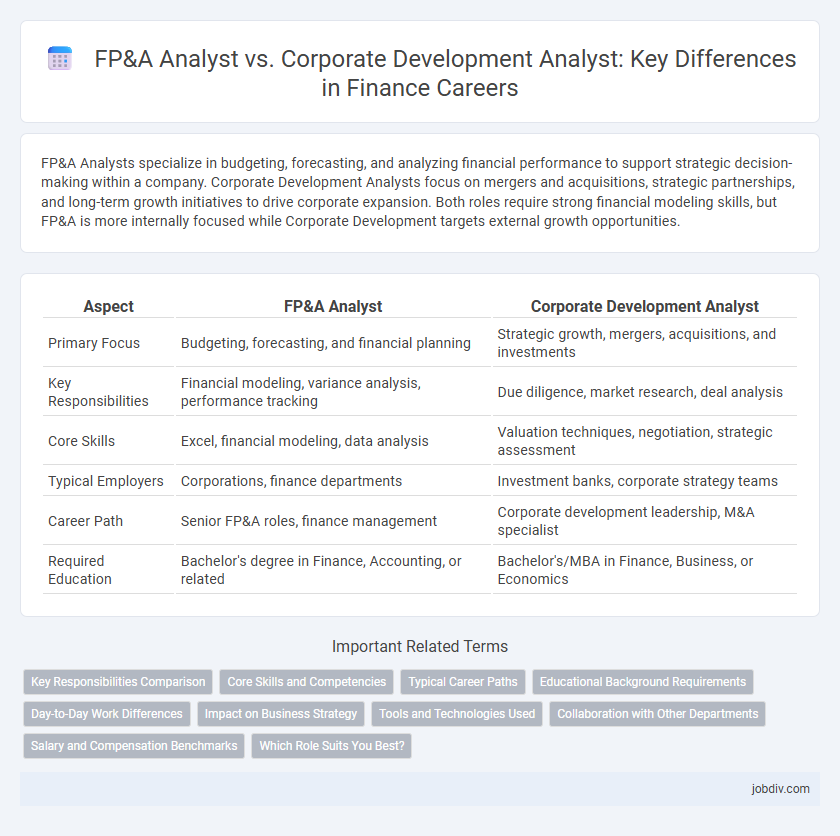

FP&A Analysts specialize in budgeting, forecasting, and analyzing financial performance to support strategic decision-making within a company. Corporate Development Analysts focus on mergers and acquisitions, strategic partnerships, and long-term growth initiatives to drive corporate expansion. Both roles require strong financial modeling skills, but FP&A is more internally focused while Corporate Development targets external growth opportunities.

Table of Comparison

| Aspect | FP&A Analyst | Corporate Development Analyst |

|---|---|---|

| Primary Focus | Budgeting, forecasting, and financial planning | Strategic growth, mergers, acquisitions, and investments |

| Key Responsibilities | Financial modeling, variance analysis, performance tracking | Due diligence, market research, deal analysis |

| Core Skills | Excel, financial modeling, data analysis | Valuation techniques, negotiation, strategic assessment |

| Typical Employers | Corporations, finance departments | Investment banks, corporate strategy teams |

| Career Path | Senior FP&A roles, finance management | Corporate development leadership, M&A specialist |

| Required Education | Bachelor's degree in Finance, Accounting, or related | Bachelor's/MBA in Finance, Business, or Economics |

Key Responsibilities Comparison

FP&A Analysts focus on budgeting, forecasting, and financial reporting to support operational decision-making and business performance analysis. Corporate Development Analysts concentrate on mergers and acquisitions, strategic partnerships, and long-term growth initiatives, driving corporate strategy and investment evaluation. Both roles require strong financial modeling and analytical skills but differ in scope, with FP&A targeting internal financial management and Corporate Development emphasizing external growth opportunities.

Core Skills and Competencies

FP&A Analysts excel in financial modeling, budgeting, forecasting, and variance analysis to support strategic decision-making and operational efficiency. Corporate Development Analysts specialize in mergers and acquisitions, market research, financial due diligence, and strategic planning to drive growth initiatives and corporate restructuring. Both roles require strong analytical skills, proficiency in Excel and financial software, and the ability to communicate complex financial data effectively to stakeholders.

Typical Career Paths

FP&A Analysts often advance into senior financial planning roles, corporate finance, or strategic management positions, leveraging their expertise in budgeting, forecasting, and financial modeling. Corporate Development Analysts typically progress toward roles in mergers and acquisitions, strategy consulting, or executive leadership, benefiting from experience in deal analysis, market assessment, and strategic initiatives. Both career paths offer opportunities for cross-functional growth, with Corporate Development emphasizing external growth strategies and FP&A focusing on internal financial optimization.

Educational Background Requirements

FP&A Analysts typically require a bachelor's degree in finance, accounting, economics, or a related field, with many employers preferring candidates who hold professional certifications such as CFA or CPA. Corporate Development Analysts often have a more diverse educational background, including degrees in business administration, finance, or even engineering, paired with advanced degrees like an MBA to enhance strategic and analytical skills. Both roles demand strong quantitative abilities, but Corporate Development Analysts benefit from coursework in mergers and acquisitions, corporate strategy, and financial modeling.

Day-to-Day Work Differences

FP&A Analysts primarily focus on budgeting, forecasting, and variance analysis to support internal financial planning and decision-making processes. Corporate Development Analysts concentrate on evaluating mergers, acquisitions, and strategic investments, conducting due diligence and financial modeling to assess potential business growth opportunities. While FP&A roles emphasize ongoing financial health and operational efficiency, Corporate Development centers on long-term strategic initiatives and value creation through market expansion.

Impact on Business Strategy

FP&A Analysts play a critical role in shaping business strategy by analyzing financial data to forecast performance, optimize budgeting, and identify cost-saving opportunities that drive operational efficiency. Corporate Development Analysts influence strategy by evaluating mergers, acquisitions, and strategic investments, enabling companies to expand market share and enhance competitive advantage. The strategic insights from FP&A focus on internal financial health, while Corporate Development targets growth and transformation through external opportunities.

Tools and Technologies Used

FP&A Analysts primarily utilize advanced Excel functions, budgeting software like Adaptive Insights, and ERP systems such as Oracle or SAP for financial modeling and forecasting. Corporate Development Analysts leverage data visualization tools like Tableau or Power BI, CRM platforms such as Salesforce, and financial databases including Capital IQ or FactSet for market analysis and M&A evaluation. Both roles increasingly incorporate automation tools and programming languages like Python to streamline data analysis and reporting processes.

Collaboration with Other Departments

FP&A Analysts collaborate closely with accounting, sales, and operations teams to gather accurate financial data and forecast business performance, ensuring budgeting and resource allocation align with strategic goals. Corporate Development Analysts work with legal, strategy, and executive teams to evaluate mergers, acquisitions, and investments, integrating financial analysis with market intelligence for informed decision-making. Both roles require strong cross-functional communication to drive financial planning and corporate growth initiatives.

Salary and Compensation Benchmarks

FP&A Analysts typically earn median base salaries ranging from $70,000 to $100,000 annually, with total compensation increasing to $90,000-$130,000 when including bonuses and benefits, reflecting their focus on budgeting and forecasting. Corporate Development Analysts command higher salary benchmarks, generally between $90,000 and $130,000 at the base level, with total compensation often reaching $120,000 to $160,000 due to deal-making responsibilities and strategic impact. Compensation disparities align with the complexity of roles, with Corporate Development positions attracting premium pay linked to merger and acquisition expertise and long-term value creation.

Which Role Suits You Best?

FP&A Analysts excel in budgeting, forecasting, and variance analysis to optimize financial performance within the company, ideal for those who enjoy detailed data analysis and strategic financial planning. Corporate Development Analysts focus on mergers, acquisitions, and strategic growth initiatives, suitable for professionals interested in high-level deal-making and long-term business expansion. Choosing between these roles depends on whether you prefer internal financial management (FP&A) or external growth strategy and transaction execution (Corporate Development).

FP&A Analyst vs Corporate Development Analyst Infographic

jobdiv.com

jobdiv.com