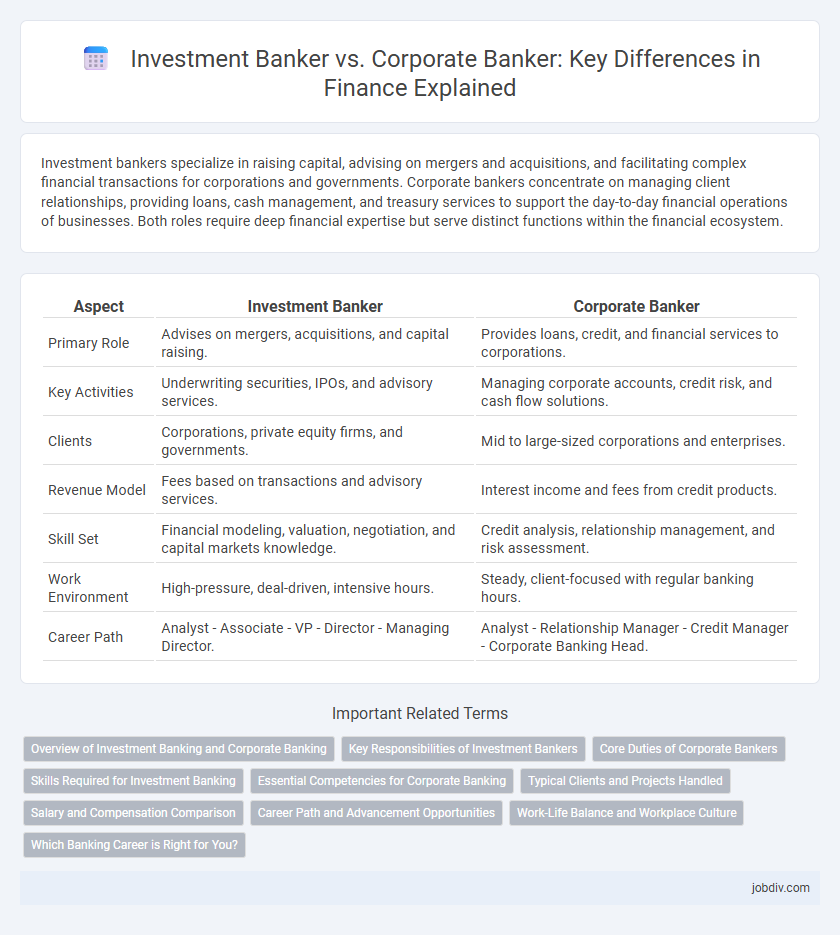

Investment bankers specialize in raising capital, advising on mergers and acquisitions, and facilitating complex financial transactions for corporations and governments. Corporate bankers concentrate on managing client relationships, providing loans, cash management, and treasury services to support the day-to-day financial operations of businesses. Both roles require deep financial expertise but serve distinct functions within the financial ecosystem.

Table of Comparison

| Aspect | Investment Banker | Corporate Banker |

|---|---|---|

| Primary Role | Advises on mergers, acquisitions, and capital raising. | Provides loans, credit, and financial services to corporations. |

| Key Activities | Underwriting securities, IPOs, and advisory services. | Managing corporate accounts, credit risk, and cash flow solutions. |

| Clients | Corporations, private equity firms, and governments. | Mid to large-sized corporations and enterprises. |

| Revenue Model | Fees based on transactions and advisory services. | Interest income and fees from credit products. |

| Skill Set | Financial modeling, valuation, negotiation, and capital markets knowledge. | Credit analysis, relationship management, and risk assessment. |

| Work Environment | High-pressure, deal-driven, intensive hours. | Steady, client-focused with regular banking hours. |

| Career Path | Analyst - Associate - VP - Director - Managing Director. | Analyst - Relationship Manager - Credit Manager - Corporate Banking Head. |

Overview of Investment Banking and Corporate Banking

Investment banking involves capital raising, mergers and acquisitions advisory, and complex financial transactions primarily for corporations, governments, and institutional clients. Corporate banking focuses on providing tailored financial services such as loans, credit, treasury management, and trade finance to businesses of various sizes. Both sectors play crucial roles in facilitating corporate growth but differ in client engagement, risk profiles, and product offerings.

Key Responsibilities of Investment Bankers

Investment bankers specialize in capital raising activities such as underwriting initial public offerings (IPOs), facilitating mergers and acquisitions (M&A), and providing strategic financial advisory services to corporations. Their key responsibilities include conducting detailed financial analysis, preparing valuation models, and structuring complex transactions to maximize client value. They also manage investor relations and negotiate deal terms to ensure successful execution and compliance with regulatory requirements.

Core Duties of Corporate Bankers

Corporate bankers specialize in managing relationships with large businesses, providing tailored financial solutions such as credit facilities, cash management, and treasury services. They analyze company financials to assess credit risk, structure loans, and facilitate mergers and acquisitions financing. Their core duties center around ensuring liquidity, optimizing capital structures, and supporting corporate growth through customized banking products.

Skills Required for Investment Banking

Investment bankers require strong analytical skills, proficiency in financial modeling, and expertise in valuation techniques to advise clients on mergers, acquisitions, and capital raising activities. Advanced knowledge of market trends, regulatory frameworks, and complex deal structuring is essential for successful investment banking. Effective communication skills and the ability to perform under high-pressure environments are also critical for navigating client negotiations and transaction executions.

Essential Competencies for Corporate Banking

Corporate banking requires strong skills in credit analysis, risk assessment, and relationship management to effectively serve business clients and manage loan portfolios. Proficiency in financial modeling, regulatory compliance, and understanding industry-specific financial statements are essential competencies that distinguish successful corporate bankers. Expertise in negotiation and strategic advisory enables corporate bankers to tailor solutions that meet evolving client needs and drive long-term partnerships.

Typical Clients and Projects Handled

Investment bankers typically serve corporations, governments, and institutional investors by managing mergers and acquisitions, underwriting new securities, and facilitating large capital raises. Corporate bankers focus on providing loans, credit, and treasury services to mid-sized businesses and large corporations, supporting their day-to-day financial operations and growth strategies. The projects handled by investment bankers involve high-stakes transactions and strategic advisory, whereas corporate bankers manage structured financing and cash flow optimization.

Salary and Compensation Comparison

Investment bankers typically earn higher base salaries and bonuses, with total compensation often exceeding $200,000 annually, driven by deal closures and underwriting fees. Corporate bankers generally receive steadier salaries averaging between $80,000 and $150,000, supplemented by performance-based incentives tied to client relationship management. The variable compensation in investment banking reflects market volatility and deal flow, whereas corporate banking offers more predictable, relationship-focused earnings.

Career Path and Advancement Opportunities

Investment bankers typically progress through analyst and associate roles, advancing to vice president and managing director levels by developing expertise in mergers, acquisitions, and capital markets, enabling high earning potential and leadership in deal-making. Corporate bankers follow a career path from credit analyst or relationship manager to senior banker and regional or global head, focusing on client management, credit risk assessment, and long-term lending solutions for corporations. Advancement opportunities in investment banking often depend on deal volume and financial performance, while corporate banking rewards strong client relationships and risk management skills.

Work-Life Balance and Workplace Culture

Investment bankers often face long hours and high-pressure environments due to deal-driven deadlines, resulting in a demanding work-life balance. Corporate bankers typically experience more structured schedules with regular office hours, promoting a healthier balance between work and personal life. Workplace culture in investment banking emphasizes fast-paced, client-focused performance, while corporate banking fosters collaborative relationships and steady business management.

Which Banking Career is Right for You?

Investment bankers specialize in capital raising, mergers and acquisitions, and advisory services, making this career ideal for those interested in high-stakes financial transactions and deal-making. Corporate bankers focus on managing relationships with business clients, providing loans, treasury services, and risk management, suited for professionals who prefer client interaction and long-term financial strategy. Choosing between investment banking and corporate banking depends on your preference for transaction-driven roles versus relationship management and financial planning.

Investment Banker vs Corporate Banker Infographic

jobdiv.com

jobdiv.com