Equity Research Analysts specialize in evaluating public companies' financials, market trends, and competitive positioning to provide investment recommendations on stocks. Credit Analysts assess the creditworthiness of individuals or companies, analyzing financial statements and repayment capacity to determine risk levels for lending decisions. Both roles require strong analytical skills but focus on different aspects of financial health and investment risk.

Table of Comparison

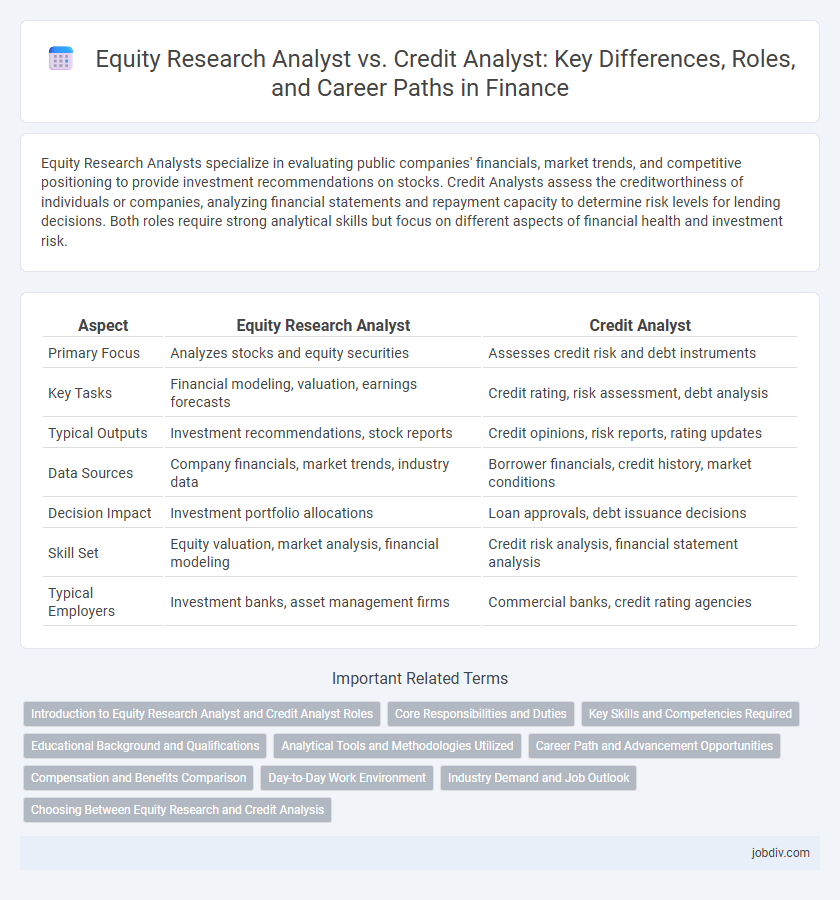

| Aspect | Equity Research Analyst | Credit Analyst |

|---|---|---|

| Primary Focus | Analyzes stocks and equity securities | Assesses credit risk and debt instruments |

| Key Tasks | Financial modeling, valuation, earnings forecasts | Credit rating, risk assessment, debt analysis |

| Typical Outputs | Investment recommendations, stock reports | Credit opinions, risk reports, rating updates |

| Data Sources | Company financials, market trends, industry data | Borrower financials, credit history, market conditions |

| Decision Impact | Investment portfolio allocations | Loan approvals, debt issuance decisions |

| Skill Set | Equity valuation, market analysis, financial modeling | Credit risk analysis, financial statement analysis |

| Typical Employers | Investment banks, asset management firms | Commercial banks, credit rating agencies |

Introduction to Equity Research Analyst and Credit Analyst Roles

Equity Research Analysts evaluate publicly traded companies by analyzing financial statements, market trends, and industry dynamics to provide investment recommendations on stocks. Credit Analysts assess the creditworthiness of individuals or businesses by examining financial history, repayment capacity, and economic factors to determine risk levels for lending decisions. Both roles require strong analytical skills and a deep understanding of financial metrics, but Equity Analysts focus on stock performance while Credit Analysts prioritize credit risk assessment.

Core Responsibilities and Duties

Equity Research Analysts conduct detailed financial modeling and valuation of publicly traded companies to provide investment recommendations based on earnings forecasts and market trends. Credit Analysts assess the creditworthiness of entities by analyzing financial statements, cash flows, and debt structures to determine risk for lending or investment purposes. Both roles require strong analytical skills, but Equity Research focuses on equity valuation, while Credit Analysis centers on credit risk evaluation and debt sustainability.

Key Skills and Competencies Required

Equity Research Analysts require strong financial modeling skills, in-depth knowledge of stock valuation techniques, and the ability to analyze market trends and company fundamentals to provide investment recommendations. Credit Analysts must excel in credit risk assessment, understanding debt instruments, and evaluating borrower's financial statements to determine creditworthiness and potential default risks. Both roles demand advanced analytical abilities, proficiency in financial software, and effective communication skills to convey complex financial insights to stakeholders.

Educational Background and Qualifications

Equity research analysts typically hold a bachelor's degree in finance, economics, or accounting, often complemented by the Chartered Financial Analyst (CFA) designation, which enhances their expertise in analyzing company performance and market trends. Credit analysts usually possess degrees in finance, economics, or business administration, with a strong emphasis on risk assessment and credit evaluation, often supported by certifications like the Certified Credit Analyst (CCA) or Chartered Financial Analyst (CFA) credentials. Both roles require strong analytical skills and knowledge of financial statements, but equity analysts focus more on stock valuation while credit analysts specialize in creditworthiness and debt risk management.

Analytical Tools and Methodologies Utilized

Equity Research Analysts primarily utilize valuation models such as discounted cash flow (DCF), price-to-earnings (P/E) ratios, and comparative market analysis to assess stock performance and company growth potential. Credit Analysts focus on credit scoring models, cash flow analysis, and debt coverage ratios to evaluate borrower creditworthiness and default risk. Both roles employ financial statement analysis and macroeconomic data but tailor methodologies to different investment and risk assessment objectives.

Career Path and Advancement Opportunities

Equity Research Analysts typically advance by specializing in industries, managing larger portfolios, or transitioning to portfolio management roles within asset management firms. Credit Analysts often progress by deepening expertise in risk assessment, moving into senior credit officer positions, or transitioning into corporate lending and risk management departments. Both career paths offer opportunities for leadership roles in financial institutions, but Equity Analysts tend to have broader market exposure, while Credit Analysts focus more on credit risk and debt instruments.

Compensation and Benefits Comparison

Equity Research Analysts typically earn higher base salaries averaging $85,000 to $120,000 annually, with bonuses tied to market performance and stock recommendations, reflecting the high demand for sector-specific expertise. Credit Analysts usually receive base salaries ranging from $65,000 to $95,000, supplemented by performance bonuses linked to risk assessment accuracy and portfolio management success. Equity Research roles often offer stock options and profit-sharing plans as part of benefits, whereas Credit Analysts benefit more from consistent healthcare packages and pension contributions due to the risk-averse nature of their work.

Day-to-Day Work Environment

Equity Research Analysts spend their day analyzing financial statements, market trends, and company performance to provide investment recommendations on stocks. Credit Analysts focus on assessing credit risk by examining borrowers' credit histories, financial health, and repayment capacity to guide lending decisions. Both roles require strong analytical skills but differ as Equity Analysts prioritize market valuation and growth potential, while Credit Analysts emphasize risk management and creditworthiness.

Industry Demand and Job Outlook

Equity Research Analysts face growing demand driven by an expanding need for detailed company valuations and market trend analysis within investment firms and hedge funds. Credit Analysts enjoy steady job growth fueled by financial institutions' requirement for rigorous risk assessment and creditworthiness evaluation amidst fluctuating economic conditions. Both roles offer competitive outlooks, with equity research positions leaning towards innovation and financial technology integration, while credit analysis remains essential for regulatory compliance and risk management.

Choosing Between Equity Research and Credit Analysis

Equity research analysts focus on evaluating company stocks, analyzing financial statements, and forecasting growth to guide investment decisions and portfolio management. Credit analysts assess the creditworthiness of individuals or businesses by examining financial health, debt levels, and repayment capacity to minimize default risk and optimize loan approvals. Choosing between equity research and credit analysis depends on one's interest in market-driven investment strategies versus risk assessment and debt management within financial institutions.

Equity Research Analyst vs Credit Analyst Infographic

jobdiv.com

jobdiv.com