Back office functions in finance primarily handle administrative and support tasks such as trade settlement, record maintenance, and compliance monitoring, ensuring smooth operational workflows. Middle office teams focus on risk management, profit and loss analysis, and regulatory reporting, bridging the gap between front office trading activities and back office processes. Understanding the distinct roles of back office versus middle office is crucial for optimizing efficiency and maintaining financial integrity within firms.

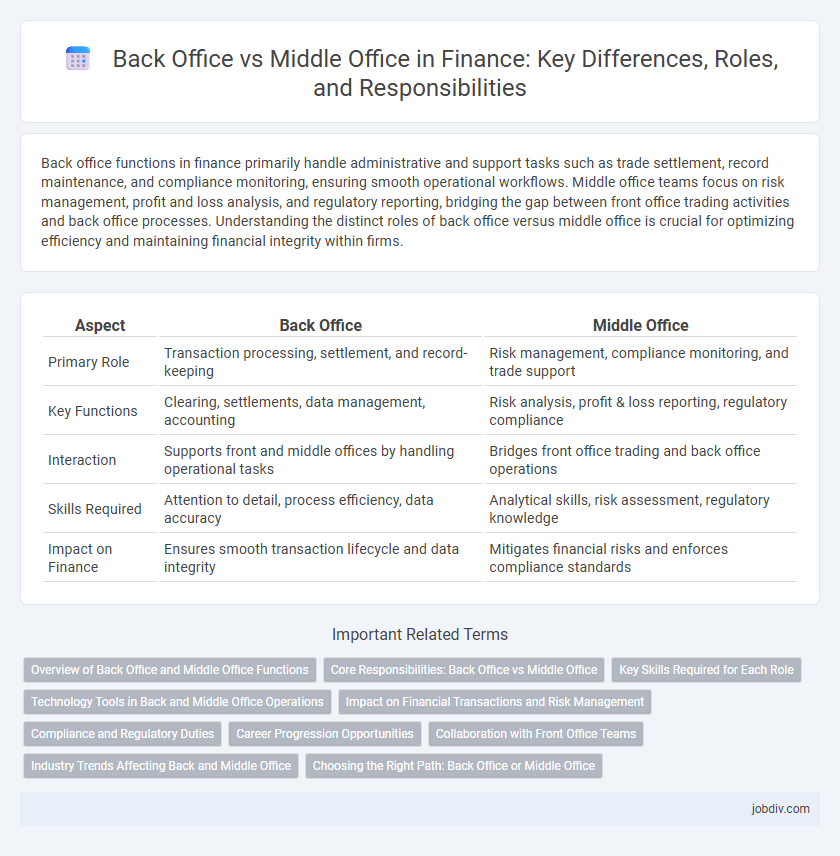

Table of Comparison

| Aspect | Back Office | Middle Office |

|---|---|---|

| Primary Role | Transaction processing, settlement, and record-keeping | Risk management, compliance monitoring, and trade support |

| Key Functions | Clearing, settlements, data management, accounting | Risk analysis, profit & loss reporting, regulatory compliance |

| Interaction | Supports front and middle offices by handling operational tasks | Bridges front office trading and back office operations |

| Skills Required | Attention to detail, process efficiency, data accuracy | Analytical skills, risk assessment, regulatory knowledge |

| Impact on Finance | Ensures smooth transaction lifecycle and data integrity | Mitigates financial risks and enforces compliance standards |

Overview of Back Office and Middle Office Functions

Back office functions in finance primarily involve administrative and support tasks such as trade settlement, record maintenance, compliance, and IT services, ensuring operational efficiency and accuracy in transaction processing. Middle office roles focus on risk management, financial control, and reporting, acting as a bridge between the front office's client-facing activities and the back office's administrative processes. Both offices work together to maintain regulatory compliance, manage risk exposure, and support the trading and investment strategies of financial institutions.

Core Responsibilities: Back Office vs Middle Office

Back Office in finance primarily handles trade settlements, record maintenance, compliance reporting, and managing payment processing, ensuring operational efficiency and risk mitigation. Middle Office focuses on risk management, financial controls, performance monitoring, and validating trade accuracy to support front office decision-making. Both offices play crucial roles in maintaining the integrity and stability of financial institutions, with distinct responsibilities tailored to operational and risk oversight functions.

Key Skills Required for Each Role

Back Office roles demand proficiency in data management, transaction processing, and regulatory compliance to ensure accurate and efficient support for financial operations. Middle Office professionals require strong analytical skills, risk assessment capabilities, and expertise in financial modeling to bridge front office decision-making with operational controls. Both roles benefit from attention to detail, knowledge of financial systems, and effective communication skills to maintain seamless workflow and mitigate risks.

Technology Tools in Back and Middle Office Operations

Back office and middle office operations leverage distinct technology tools to enhance efficiency and risk management; back office relies heavily on enterprise resource planning (ERP) systems, automated reconciliation software, and robotic process automation (RPA) to streamline transaction processing and record-keeping. Middle office operations utilize advanced risk management platforms, trade capture systems, and real-time analytics software to monitor compliance, assess market risk, and support portfolio management. Integration of cloud computing and machine learning innovations increasingly optimize workflows and data accuracy across both offices, driving improved operational resilience and regulatory adherence.

Impact on Financial Transactions and Risk Management

Back office functions ensure accurate settlement, reconciliation, and record-keeping of financial transactions, minimizing operational risks and errors. Middle office teams focus on real-time risk management, validating trades, and monitoring compliance to mitigate market and credit risks. Together, their coordinated activities enhance overall transaction integrity and reduce financial exposure.

Compliance and Regulatory Duties

Back office functions primarily handle compliance by ensuring accurate record-keeping, regulatory reporting, and risk data management essential to meeting financial regulations. Middle office teams focus on monitoring risk exposures, validating trades, and implementing control frameworks to ensure regulatory adherence and prevent operational failures. Both offices collaborate to uphold comprehensive compliance standards, minimizing regulatory penalties and maintaining organizational integrity in financial operations.

Career Progression Opportunities

Back office roles in finance typically involve operational support, data management, and compliance tasks with limited direct client interaction, offering career progression toward specialized expertise or managerial positions within operations. Middle office positions bridge the gap between front and back office functions, focusing on risk management, reporting, and regulatory compliance, providing opportunities to advance into risk management, financial analysis, or strategic planning roles. Professionals aiming for dynamic, client-facing careers often transition from middle to front office, leveraging their understanding of risk and operations to pursue higher-profile positions in trading, sales, or portfolio management.

Collaboration with Front Office Teams

Back office and middle office teams play crucial roles in supporting front office operations by ensuring efficient trade processing, risk management, and compliance monitoring. Collaborative workflows between these units enhance data accuracy, reduce operational risks, and streamline communication channels through integrated technology platforms like trade capture systems and risk analytics tools. This synergy enables front office teams to focus on client interactions and revenue generation with confidence in the underlying operational and risk controls.

Industry Trends Affecting Back and Middle Office

Industry trends impacting back office and middle office functions include increased automation through robotic process automation (RPA) and artificial intelligence (AI), driving efficiency and reducing operational risks. Regulatory changes such as GDPR, MiFID II, and Basel III require enhanced data management and compliance controls, influencing middle office responsibilities. Cloud adoption and advanced analytics are also transforming workflows, enabling real-time reporting and improved decision-making across both offices.

Choosing the Right Path: Back Office or Middle Office

Selecting the right path between Back Office and Middle Office roles in finance depends on one's skill set and career goals, with Back Office focusing on operations, settlements, and compliance, while Middle Office emphasizes risk management, analytics, and trade support. Professionals aiming for meticulous attention to detail and process optimization may thrive in Back Office environments, whereas those interested in strategic risk assessment and client-facing analytics might prefer Middle Office positions. Understanding the distinct functions and growth opportunities within these sectors helps finance professionals align their expertise with organizational needs and long-term advancement.

Back Office vs Middle Office Infographic

jobdiv.com

jobdiv.com