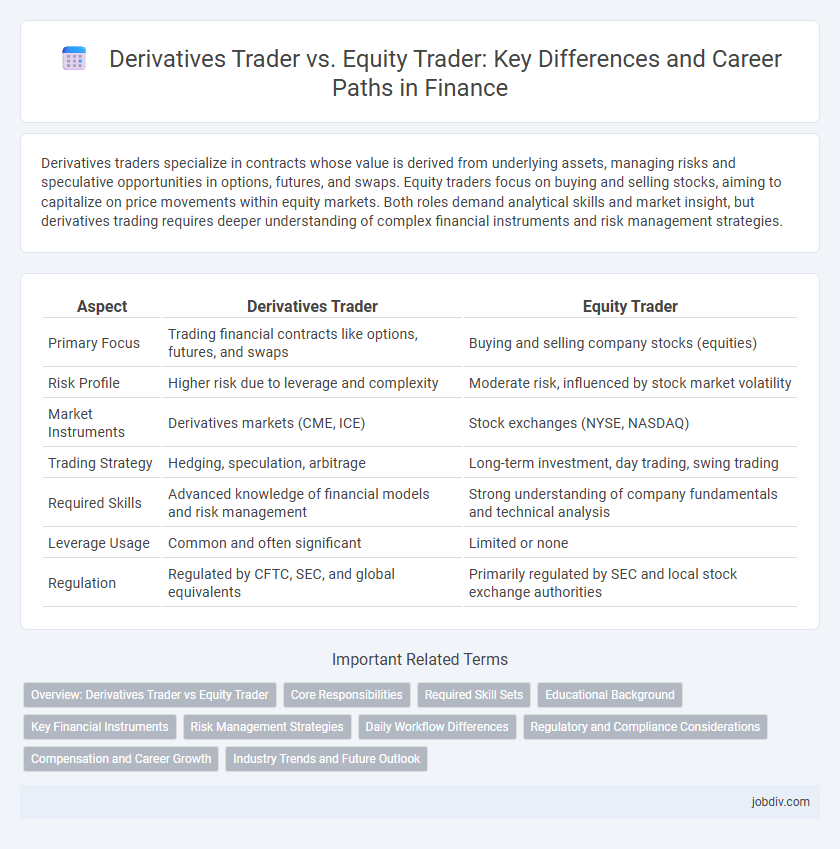

Derivatives traders specialize in contracts whose value is derived from underlying assets, managing risks and speculative opportunities in options, futures, and swaps. Equity traders focus on buying and selling stocks, aiming to capitalize on price movements within equity markets. Both roles demand analytical skills and market insight, but derivatives trading requires deeper understanding of complex financial instruments and risk management strategies.

Table of Comparison

| Aspect | Derivatives Trader | Equity Trader |

|---|---|---|

| Primary Focus | Trading financial contracts like options, futures, and swaps | Buying and selling company stocks (equities) |

| Risk Profile | Higher risk due to leverage and complexity | Moderate risk, influenced by stock market volatility |

| Market Instruments | Derivatives markets (CME, ICE) | Stock exchanges (NYSE, NASDAQ) |

| Trading Strategy | Hedging, speculation, arbitrage | Long-term investment, day trading, swing trading |

| Required Skills | Advanced knowledge of financial models and risk management | Strong understanding of company fundamentals and technical analysis |

| Leverage Usage | Common and often significant | Limited or none |

| Regulation | Regulated by CFTC, SEC, and global equivalents | Primarily regulated by SEC and local stock exchange authorities |

Overview: Derivatives Trader vs Equity Trader

Derivatives traders specialize in financial contracts like options, futures, and swaps, allowing them to hedge risk or speculate on asset price movements without owning the underlying securities. Equity traders focus on buying and selling stocks, aiming to capitalize on price fluctuations in public companies' shares. Both roles require deep market analysis and risk management skills but differ primarily in the instruments traded and strategic approaches.

Core Responsibilities

Derivatives traders specialize in managing risk and speculative opportunities through contracts such as options, futures, and swaps, requiring expertise in market analysis and pricing models. Equity traders focus on buying and selling stocks, emphasizing stock selection, timing, and market trends to maximize portfolio returns. Both roles demand strong analytical skills and the ability to execute trades swiftly in dynamic financial markets.

Required Skill Sets

Derivatives traders require advanced quantitative skills, a deep understanding of complex financial instruments like options and futures, and proficiency in risk management techniques to navigate market volatility. Equity traders emphasize strong analytical abilities related to stock valuation, market trends, and company fundamentals, coupled with effective decision-making under pressure. Both roles demand excellent communication skills and a solid grasp of regulatory environments to ensure compliant and strategic trading execution.

Educational Background

Derivatives traders typically possess strong quantitative skills, often holding degrees in mathematics, finance, economics, or engineering, enabling them to model complex financial instruments. Equity traders usually have educational backgrounds in finance, business administration, or economics, emphasizing market analysis and stock valuation techniques. Both career paths benefit from specialized certifications such as the CFA or FRM to deepen their understanding of financial markets and risk management.

Key Financial Instruments

Derivatives traders primarily focus on instruments such as futures, options, swaps, and forwards, which derive their value from underlying assets like commodities, interest rates, or equities. Equity traders specialize in buying and selling stocks, including common and preferred shares, often employing short-selling and margin trading strategies to maximize returns. The key distinction lies in the complexity and risk profiles of their instruments, with derivatives offering leveraged exposure and hedging opportunities beyond straightforward equity investments.

Risk Management Strategies

Derivatives traders employ dynamic hedging techniques and utilize options, futures, and swaps to manage market, credit, and liquidity risks effectively. Equity traders focus on portfolio diversification, stop-loss orders, and fundamental analysis to mitigate price volatility and company-specific risks. Both roles require continuous risk assessment and the use of advanced analytics to optimize returns while minimizing potential losses.

Daily Workflow Differences

Derivatives traders focus on analyzing futures, options, and swaps to capitalize on price volatility and manage risk, often engaging in intraday trading with a high volume of trades and quick decision-making. Equity traders concentrate on buying and selling shares of individual companies, typically conducting in-depth fundamental analysis and monitoring market sentiment to execute trades over longer time frames. The daily workflow of derivatives traders involves constant market monitoring and rapid adjustments to hedge positions, while equity traders emphasize research, portfolio management, and strategic trade execution.

Regulatory and Compliance Considerations

Derivatives traders face stringent regulatory frameworks such as Dodd-Frank and EMIR, imposing rigorous reporting, margin requirements, and position limits to mitigate systemic risk. Equity traders are primarily governed by regulations like MiFID II and the SEC's Regulation NMS, emphasizing market transparency, fair access, and transaction reporting. Compliance teams for derivatives traders must navigate complex clearing obligations and risk management protocols, while equity traders focus on ensuring adherence to market fairness and anti-manipulation rules.

Compensation and Career Growth

Derivatives traders often command higher compensation due to the complex risk management skills and advanced quantitative expertise required to trade options, futures, and swaps, with bonuses linked to performance metrics and market volatility. Equity traders typically receive strong base salaries supplemented by commissions and bonuses tied to stock market performance and deal flow, with career progression leading to portfolio management or investment advisory roles. Career growth for derivatives traders frequently involves specializing in structured products or risk analytics, while equity traders may advance by expanding sector expertise or moving into institutional sales and corporate finance.

Industry Trends and Future Outlook

Derivatives traders increasingly leverage algorithmic trading and artificial intelligence to capitalize on complex market movements, reflecting a shift toward technology-driven strategies in the finance industry. Equity traders are adapting to declining trading volumes in traditional stocks by focusing on niche sectors and incorporating environmental, social, and governance (ESG) criteria to attract sustainable investment flows. The future outlook foresees both roles evolving with greater integration of big data analytics and regulatory changes influencing risk management frameworks across global markets.

Derivatives Trader vs Equity Trader Infographic

jobdiv.com

jobdiv.com