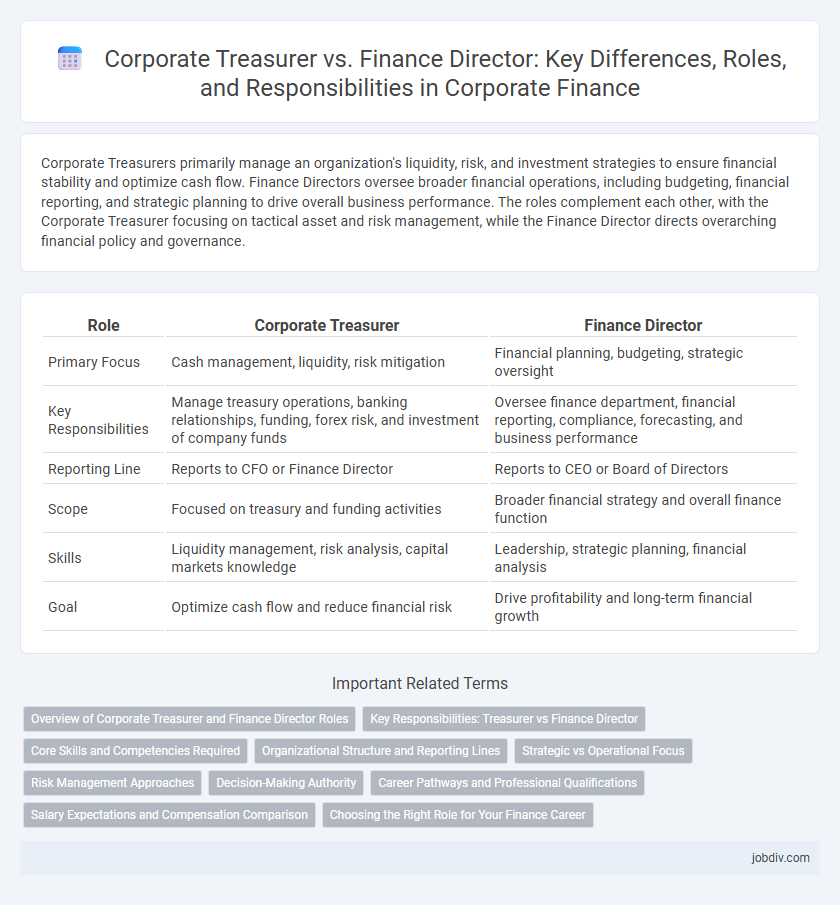

Corporate Treasurers primarily manage an organization's liquidity, risk, and investment strategies to ensure financial stability and optimize cash flow. Finance Directors oversee broader financial operations, including budgeting, financial reporting, and strategic planning to drive overall business performance. The roles complement each other, with the Corporate Treasurer focusing on tactical asset and risk management, while the Finance Director directs overarching financial policy and governance.

Table of Comparison

| Role | Corporate Treasurer | Finance Director |

|---|---|---|

| Primary Focus | Cash management, liquidity, risk mitigation | Financial planning, budgeting, strategic oversight |

| Key Responsibilities | Manage treasury operations, banking relationships, funding, forex risk, and investment of company funds | Oversee finance department, financial reporting, compliance, forecasting, and business performance |

| Reporting Line | Reports to CFO or Finance Director | Reports to CEO or Board of Directors |

| Scope | Focused on treasury and funding activities | Broader financial strategy and overall finance function |

| Skills | Liquidity management, risk analysis, capital markets knowledge | Leadership, strategic planning, financial analysis |

| Goal | Optimize cash flow and reduce financial risk | Drive profitability and long-term financial growth |

Overview of Corporate Treasurer and Finance Director Roles

The Corporate Treasurer manages an organization's liquidity, risk, and capital structure, ensuring efficient cash flow and funding strategies. The Finance Director oversees broader financial planning, budgeting, and reporting, aligning financial goals with corporate strategy. Both roles drive financial stability but differ in scope, with the Treasurer focusing on treasury operations and the Director on overall financial management.

Key Responsibilities: Treasurer vs Finance Director

The Corporate Treasurer manages the organization's liquidity, risk, and cash flow, focusing on treasury operations such as funding, investment, and hedging strategies. The Finance Director oversees overall financial planning, budgeting, reporting, and compliance, ensuring alignment with strategic goals and regulatory requirements. While the Treasurer concentrates on capital management and risk mitigation, the Finance Director leads financial strategy and organizational performance analysis.

Core Skills and Competencies Required

A Corporate Treasurer requires expertise in cash management, risk assessment, and liquidity planning to optimize an organization's financial stability and funding strategies. In contrast, a Finance Director must demonstrate strong skills in financial reporting, strategic budgeting, and regulatory compliance to drive overall financial performance and governance. Both roles demand advanced analytical abilities, leadership, and a deep understanding of market trends and corporate finance principles.

Organizational Structure and Reporting Lines

The Corporate Treasurer typically reports to the Finance Director or CFO, managing liquidity, risk, and capital structure within the organizational hierarchy. The Finance Director holds a broader strategic role, overseeing all financial planning, analysis, and reporting across departments. Clear delineation in reporting lines ensures efficient coordination of treasury operations under the overall financial management led by the Finance Director.

Strategic vs Operational Focus

The Corporate Treasurer primarily handles liquidity management, risk assessment, and strategic capital allocation to ensure long-term financial stability. The Finance Director focuses on operational execution, including budgeting, financial reporting, and compliance to support day-to-day business activities. Both roles intersect in financial planning but differ in scope, with the Treasurer emphasizing strategic financial positioning and the Finance Director overseeing tactical financial management.

Risk Management Approaches

Corporate Treasurers primarily focus on managing liquidity risks, foreign exchange exposures, and funding strategies to optimize cash flow and ensure financial stability. Finance Directors adopt a broader risk management approach, overseeing enterprise-wide risks including credit, operational, and strategic risks alongside compliance and financial reporting. Both roles collaborate to implement comprehensive frameworks that safeguard the organization's assets and enhance long-term value.

Decision-Making Authority

Corporate Treasurers possess specialized decision-making authority in cash management, risk assessment, and liquidity planning, directly influencing short-term financial stability. Finance Directors hold broader decision-making power over overall financial strategy, budgeting, and long-term investment planning, aligning finance operations with corporate goals. Both roles require collaboration, but the Finance Director typically oversees the Treasurer's activities within the wider organizational financial framework.

Career Pathways and Professional Qualifications

Corporate Treasurers typically progress through roles in cash management, risk analysis, and corporate finance, often holding qualifications such as the Chartered Financial Analyst (CFA) or Certified Treasury Professional (CTP). Finance Directors usually advance from accounting or finance management positions, with professional credentials like the Chartered Accountant (CA) or Chartered Management Accountant (CIMA) enhancing their strategic and leadership capabilities. Both career pathways demand strong financial acumen, but Treasurers specialize in liquidity and risk, while Finance Directors focus on broader financial strategy and governance.

Salary Expectations and Compensation Comparison

Corporate Treasurers typically earn salaries ranging from $90,000 to $160,000 annually, influenced by company size and industry, while Finance Directors command higher compensation, often between $120,000 and $220,000, reflecting broader strategic responsibilities. Incentive structures for Finance Directors frequently include performance bonuses, stock options, and profit-sharing, enhancing total compensation beyond base salary. Salary expectations for both roles vary significantly by geographic location, company scale, and individual qualifications, with Finance Directors generally benefiting from more comprehensive executive compensation packages.

Choosing the Right Role for Your Finance Career

A Corporate Treasurer specializes in managing a company's liquidity, risk exposure, and capital structure, focusing on cash flow optimization and financial risk management. A Finance Director oversees broader financial strategies, including budgeting, forecasting, financial reporting, and compliance to drive overall business performance. Choosing the right role depends on your expertise in treasury functions versus strategic financial leadership and your long-term career goals in corporate finance.

Corporate Treasurer vs Finance Director Infographic

jobdiv.com

jobdiv.com