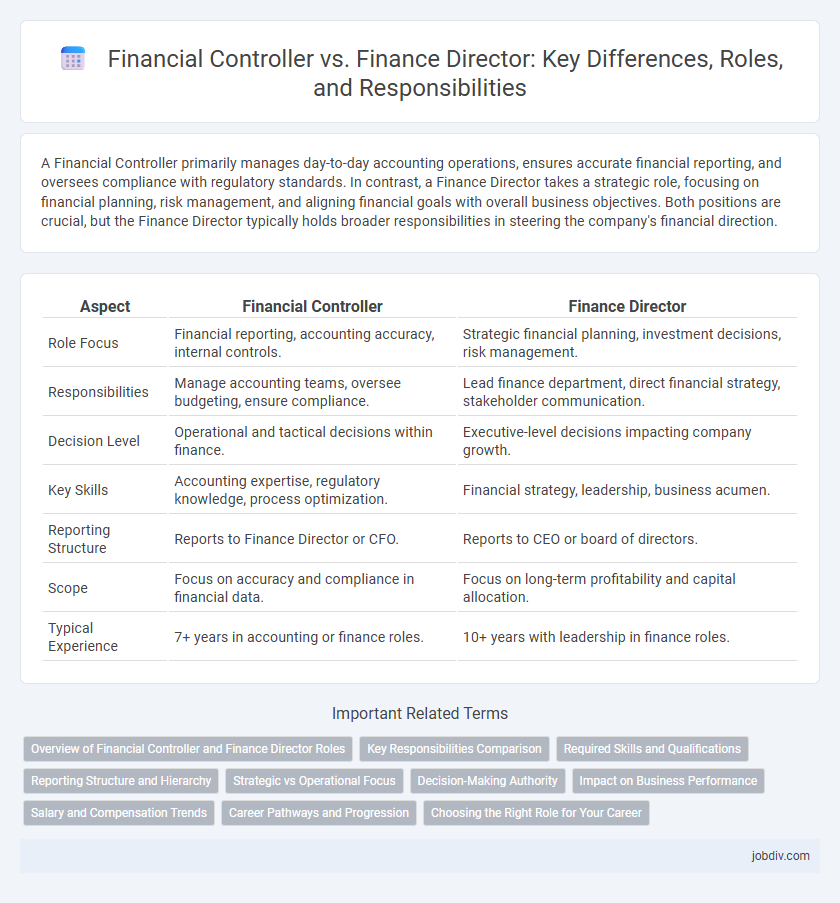

A Financial Controller primarily manages day-to-day accounting operations, ensures accurate financial reporting, and oversees compliance with regulatory standards. In contrast, a Finance Director takes a strategic role, focusing on financial planning, risk management, and aligning financial goals with overall business objectives. Both positions are crucial, but the Finance Director typically holds broader responsibilities in steering the company's financial direction.

Table of Comparison

| Aspect | Financial Controller | Finance Director |

|---|---|---|

| Role Focus | Financial reporting, accounting accuracy, internal controls. | Strategic financial planning, investment decisions, risk management. |

| Responsibilities | Manage accounting teams, oversee budgeting, ensure compliance. | Lead finance department, direct financial strategy, stakeholder communication. |

| Decision Level | Operational and tactical decisions within finance. | Executive-level decisions impacting company growth. |

| Key Skills | Accounting expertise, regulatory knowledge, process optimization. | Financial strategy, leadership, business acumen. |

| Reporting Structure | Reports to Finance Director or CFO. | Reports to CEO or board of directors. |

| Scope | Focus on accuracy and compliance in financial data. | Focus on long-term profitability and capital allocation. |

| Typical Experience | 7+ years in accounting or finance roles. | 10+ years with leadership in finance roles. |

Overview of Financial Controller and Finance Director Roles

Financial Controllers manage day-to-day accounting operations, financial reporting, and compliance, ensuring accuracy and regulatory adherence, while Finance Directors focus on strategic financial planning, risk management, and long-term business growth. The Financial Controller typically oversees budgeting processes and internal controls, providing detailed financial insights to support operational decisions. Finance Directors engage with executive leadership to formulate financial policies, investment strategies, and corporate financial goals aligned with organizational objectives.

Key Responsibilities Comparison

Financial Controllers primarily oversee the accuracy of financial reporting, budgeting, and compliance with accounting standards, ensuring internal controls are robust and financial data is reliable. Finance Directors focus on strategic financial planning, capital structure management, and aligning financial goals with overall business objectives to drive growth and shareholder value. While Financial Controllers manage day-to-day accounting operations, Finance Directors lead long-term financial strategy, investor relations, and risk management at the executive level.

Required Skills and Qualifications

A Financial Controller typically requires strong expertise in accounting principles, financial reporting, budgeting, and regulatory compliance, often holding certifications such as CPA or ACCA. In contrast, a Finance Director demands advanced strategic planning abilities, leadership skills, and experience in financial analysis, corporate finance, and stakeholder management, usually supported by an MBA or equivalent executive education. Both roles require proficiency in financial software and analytical tools, but the Finance Director emphasizes broader business acumen and decision-making capabilities.

Reporting Structure and Hierarchy

A Financial Controller typically reports to the Finance Director and oversees the day-to-day management of accounting and financial reporting teams, ensuring accuracy and compliance with regulatory standards. The Finance Director holds a senior executive position responsible for strategic financial planning, liaising with the CEO and board, and aligning financial goals with business objectives. In corporate hierarchy, the Finance Director outranks the Financial Controller, with broader responsibilities that include risk management, budgeting, and long-term financial strategy.

Strategic vs Operational Focus

A Financial Controller primarily oversees the operational focus, managing day-to-day accounting, financial reporting, and internal controls to ensure accuracy and compliance. In contrast, a Finance Director adopts a strategic perspective, driving financial planning, long-term budgeting, risk management, and aligning finance initiatives with overall business objectives. The Finance Director influences corporate strategy, whereas the Financial Controller ensures operational efficiency and financial integrity.

Decision-Making Authority

Financial Controllers typically focus on managing day-to-day financial operations, ensuring accurate reporting and compliance, with limited strategic decision-making authority. Finance Directors hold broader responsibilities, including setting financial strategy, influencing corporate governance, and making high-level investment and budgeting decisions. The Finance Director's role requires a comprehensive understanding of business objectives to drive long-term financial growth, whereas the Financial Controller's role emphasizes operational control and financial accuracy.

Impact on Business Performance

Financial Controllers drive business performance by ensuring accurate financial reporting, effective budget management, and stringent internal controls, which enhance operational efficiency and reduce risk. Finance Directors influence business outcomes through strategic planning, capital allocation, and long-term financial forecasting, directly shaping growth and investment decisions. Both roles are pivotal, with Controllers focusing on financial integrity and Directors steering overall financial strategy and business value creation.

Salary and Compensation Trends

Financial Controllers typically earn between $80,000 and $120,000 annually, reflecting their operational focus on budgeting, auditing, and financial reporting, while Finance Directors command higher salaries ranging from $120,000 to $200,000 due to their strategic role in financial planning and corporate governance. Compensation trends indicate that Finance Directors often receive larger bonuses and equity options, aligning with their influence on company-wide financial decisions and shareholder value. Salary growth for both roles is driven by industry, company size, and geographic location, with Finance Directors experiencing more rapid increases in total compensation as responsibilities expand.

Career Pathways and Progression

Financial Controllers typically focus on managing accounting operations, financial reporting, and ensuring compliance, serving as a critical step toward senior finance roles. Finance Directors oversee broader financial strategies, driving business growth and stakeholder value, often requiring extensive experience in leadership and strategic planning. Progression from Financial Controller to Finance Director commonly involves acquiring advanced qualifications, leadership skills, and expanded responsibilities in financial planning and analysis.

Choosing the Right Role for Your Career

A Financial Controller focuses on managing accounting processes, financial reporting, and internal controls, making it ideal for professionals keen on operational finance and compliance. The Finance Director plays a strategic role, overseeing financial planning, business growth, and stakeholder communication, suited for those aiming to influence corporate direction and decision-making. Career advancement depends on aligning your skills with the tactical precision of controlling or the visionary leadership required in finance direction.

Financial Controller vs Finance Director Infographic

jobdiv.com

jobdiv.com