FP&A Analysts specialize in budgeting, forecasting, and financial modeling to drive strategic decision-making within organizations, whereas Business Analysts focus on improving business processes and identifying operational efficiencies across various departments. FP&A Analysts rely heavily on financial data and performance metrics to create actionable insights for senior management, while Business Analysts gather and analyze requirements to implement technology or process improvements. Both roles require strong analytical skills but differ in their primary objectives, with FP&A centered on financial planning and Business Analysts targeting process optimization.

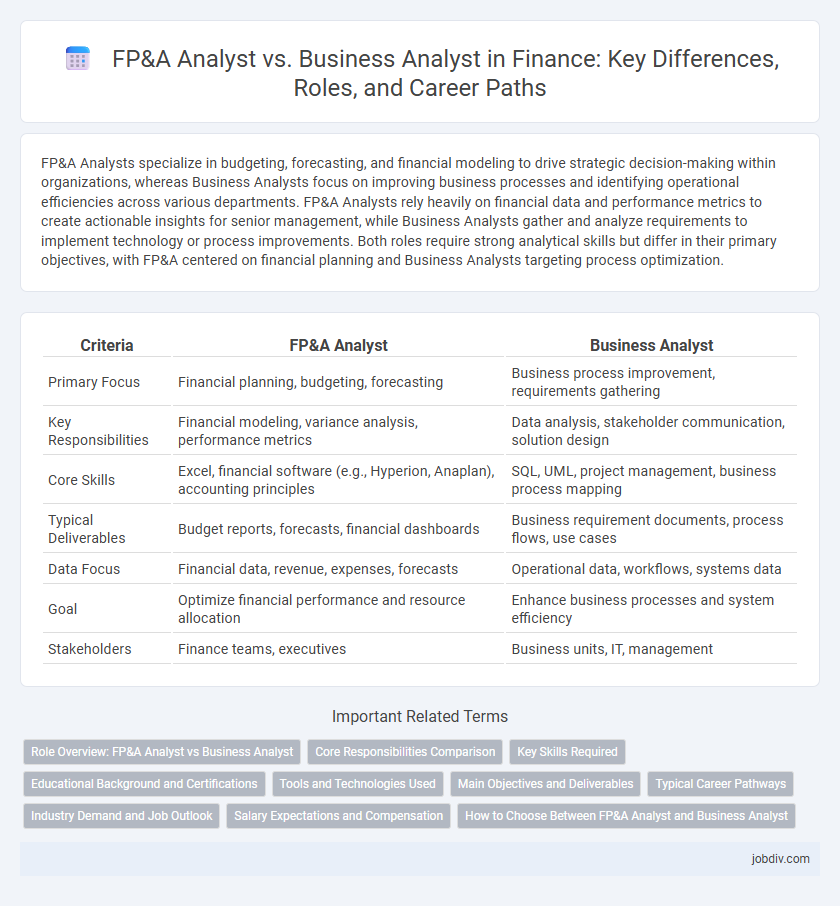

Table of Comparison

| Criteria | FP&A Analyst | Business Analyst |

|---|---|---|

| Primary Focus | Financial planning, budgeting, forecasting | Business process improvement, requirements gathering |

| Key Responsibilities | Financial modeling, variance analysis, performance metrics | Data analysis, stakeholder communication, solution design |

| Core Skills | Excel, financial software (e.g., Hyperion, Anaplan), accounting principles | SQL, UML, project management, business process mapping |

| Typical Deliverables | Budget reports, forecasts, financial dashboards | Business requirement documents, process flows, use cases |

| Data Focus | Financial data, revenue, expenses, forecasts | Operational data, workflows, systems data |

| Goal | Optimize financial performance and resource allocation | Enhance business processes and system efficiency |

| Stakeholders | Finance teams, executives | Business units, IT, management |

Role Overview: FP&A Analyst vs Business Analyst

FP&A Analysts specialize in financial planning, budgeting, forecasting, and variance analysis to support strategic decision-making and financial health monitoring. Business Analysts focus on analyzing business processes, gathering requirements, and facilitating data-driven improvements across various departments to enhance operational efficiency. Both roles require strong analytical skills but differ in scope, with FP&A analysts centered on finance and Business Analysts targeting broader business operations.

Core Responsibilities Comparison

FP&A Analysts concentrate on budgeting, financial forecasting, variance analysis, and strategic financial planning to support business decision-making and optimize financial performance. Business Analysts focus on gathering business requirements, process improvement, data analysis, and cross-functional project management to enhance operational efficiency and align technology solutions with business goals. While FP&A Analysts interpret financial data to guide corporate finance strategy, Business Analysts translate business needs into actionable insights across diverse departments.

Key Skills Required

FP&A Analysts require strong financial modeling, budgeting, and forecasting skills to support strategic financial planning. Business Analysts need expertise in data analysis, process improvement, and stakeholder communication to drive operational efficiency and business growth. Both roles demand proficiency in data visualization tools like Excel and Power BI, with FP&A Analysts emphasizing financial acumen and Business Analysts focusing on cross-functional collaboration.

Educational Background and Certifications

FP&A Analysts typically hold degrees in finance, accounting, or economics, with certifications like CFA or CPA enhancing their expertise in financial planning and analysis. Business Analysts often possess educational backgrounds in business administration, IT, or management, with certifications such as CBAP or PMI-PBA focusing on process improvement and project management skills. Both roles benefit from strong analytical capabilities, but their certifications reflect specialized knowledge tailored to financial strategy versus business process optimization.

Tools and Technologies Used

FP&A Analysts primarily utilize advanced Excel functions, financial planning software like Adaptive Insights, and ERP systems such as Oracle or SAP to perform budgeting, forecasting, and variance analysis. Business Analysts leverage data visualization tools like Tableau, SQL for database querying, and business intelligence platforms such as Power BI to gather requirements and optimize operational workflows. Both roles increasingly adopt cloud-based collaboration tools and automation technologies like RPA to enhance efficiency and data accuracy.

Main Objectives and Deliverables

FP&A Analysts primarily focus on budgeting, forecasting, financial modeling, and variance analysis to support strategic financial planning and decision-making. Business Analysts concentrate on improving business processes, gathering requirements, and delivering data-driven insights to enhance operational efficiency across departments. Deliverables for FP&A Analysts include financial reports, budget plans, and performance dashboards, while Business Analysts produce requirement documents, process maps, and use case scenarios.

Typical Career Pathways

FP&A Analysts typically progress from entry-level financial analyst roles to senior FP&A positions, specializing in budgeting, forecasting, and financial modeling within corporate finance departments. Business Analysts often start in junior analyst roles before advancing to senior or lead business analyst positions, focusing on process improvement, data analysis, and stakeholder collaboration across various business units. Career pathways for FP&A Analysts emphasize deep financial expertise and strategic planning, whereas Business Analysts develop broader skills in cross-functional communication and project management.

Industry Demand and Job Outlook

FP&A Analysts increasingly drive strategic financial planning within corporations, with a projected industry growth rate of 7% over the next decade due to rising demand for data-driven decision-making. Business Analysts remain essential for cross-functional project management, especially in technology and finance sectors, where their job outlook aligns with an 8% growth, reflecting digital transformation trends. Both roles benefit from strong analytical skills, but FP&A Analysts often face higher demand in corporate finance departments, while Business Analysts find broader opportunities across various industries.

Salary Expectations and Compensation

FP&A Analysts typically command higher salaries than Business Analysts due to their specialized focus on financial planning, budgeting, and forecasting, with median annual compensation ranging from $70,000 to $100,000. Business Analysts, who concentrate on process improvement and requirements gathering across various departments, generally earn between $60,000 and $90,000 per year. Compensation for both roles can vary significantly based on industry, experience level, and geographic location, with FP&A Analysts often receiving bonuses linked to financial performance.

How to Choose Between FP&A Analyst and Business Analyst

Choosing between an FP&A Analyst and a Business Analyst depends on your career goals and skill set; FP&A Analysts specialize in financial forecasting, budgeting, and data-driven financial planning, while Business Analysts focus on process improvement, requirements gathering, and cross-functional project management. If you excel in financial modeling, variance analysis, and strategic budgeting, an FP&A role aligns closely with your strengths, whereas strong analytical reasoning, stakeholder communication, and systems analysis favor a Business Analyst position. Consider industry demand, growth opportunities, and whether your interest lies more in finance-specific analysis or broader business operations to make an informed decision.

FP&A Analyst vs Business Analyst Infographic

jobdiv.com

jobdiv.com