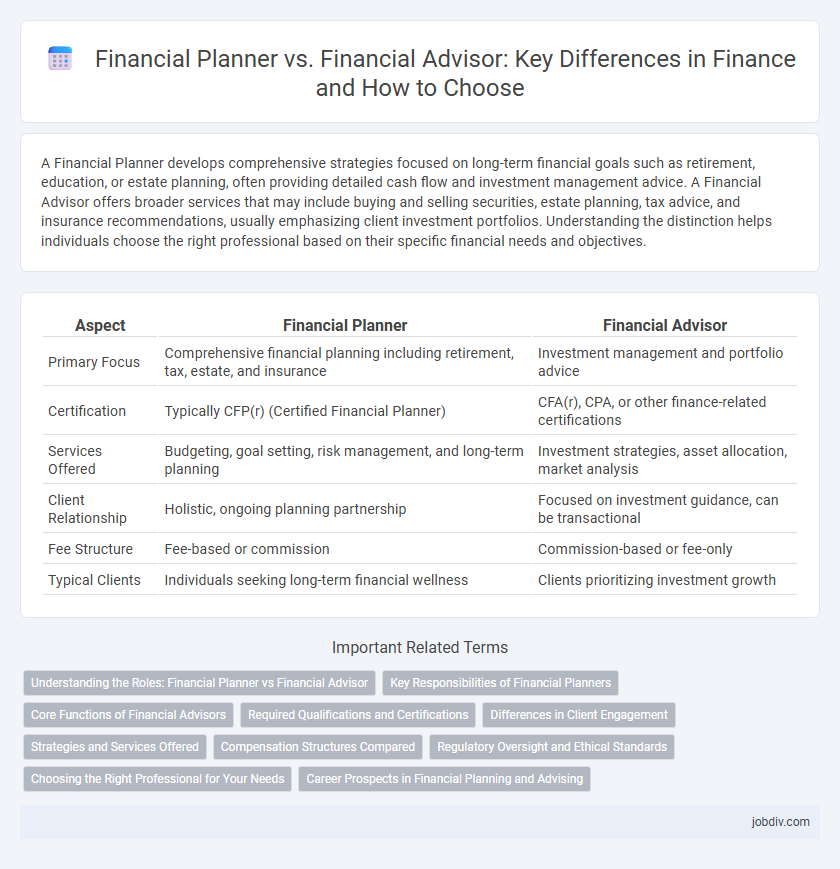

A Financial Planner develops comprehensive strategies focused on long-term financial goals such as retirement, education, or estate planning, often providing detailed cash flow and investment management advice. A Financial Advisor offers broader services that may include buying and selling securities, estate planning, tax advice, and insurance recommendations, usually emphasizing client investment portfolios. Understanding the distinction helps individuals choose the right professional based on their specific financial needs and objectives.

Table of Comparison

| Aspect | Financial Planner | Financial Advisor |

|---|---|---|

| Primary Focus | Comprehensive financial planning including retirement, tax, estate, and insurance | Investment management and portfolio advice |

| Certification | Typically CFP(r) (Certified Financial Planner) | CFA(r), CPA, or other finance-related certifications |

| Services Offered | Budgeting, goal setting, risk management, and long-term planning | Investment strategies, asset allocation, market analysis |

| Client Relationship | Holistic, ongoing planning partnership | Focused on investment guidance, can be transactional |

| Fee Structure | Fee-based or commission | Commission-based or fee-only |

| Typical Clients | Individuals seeking long-term financial wellness | Clients prioritizing investment growth |

Understanding the Roles: Financial Planner vs Financial Advisor

Financial planners specialize in creating comprehensive financial plans tailored to long-term goals such as retirement, education funding, and estate planning. Financial advisors offer broader investment advice and portfolio management, often focusing on short- to medium-term financial objectives and asset allocation. Understanding the distinction helps clients choose the right professional based on their specific financial needs and planning horizon.

Key Responsibilities of Financial Planners

Financial planners specialize in creating comprehensive financial strategies that encompass budgeting, retirement planning, tax optimization, and investment management, ensuring clients achieve long-term financial goals. They assess the client's entire financial situation by analyzing income, expenses, assets, and liabilities to develop personalized financial plans. Financial planners also provide ongoing monitoring and adjustments to plans, helping clients adapt to changing market conditions and life events for sustained financial wellness.

Core Functions of Financial Advisors

Financial advisors primarily offer personalized investment strategies, retirement planning, and risk management to help clients achieve their financial goals. They analyze market trends, assess clients' risk tolerance, and recommend suitable financial products such as mutual funds, stocks, and insurance policies. Core functions also include ongoing portfolio management and regular financial reviews to adapt to changing market conditions and client needs.

Required Qualifications and Certifications

Financial planners often hold certifications such as the Certified Financial Planner (CFP) designation, which requires meeting rigorous education, examination, experience, and ethics criteria. Financial advisors have a broader scope and may need licenses like the Series 7 or Series 65, depending on their specific services and regulatory requirements. Both roles demand adherence to regulatory standards, but CFP certification is especially recognized for comprehensive financial planning expertise.

Differences in Client Engagement

Financial planners typically engage clients through long-term, comprehensive strategies that encompass budgeting, retirement planning, and investment management tailored to individual goals. Financial advisors often provide more flexible, transactional support focusing on specific investment advice, portfolio management, or insurance products. The depth of client engagement with financial planners usually involves ongoing relationship-building and holistic financial assessments, whereas financial advisors may prioritize immediate financial decisions and product recommendations.

Strategies and Services Offered

Financial planners specialize in comprehensive financial strategies including retirement planning, tax management, and estate planning, providing tailored, long-term solutions that align with clients' goals. Financial advisors offer a broader range of investment services such as portfolio management, asset allocation, and risk assessment to optimize clients' investment returns and financial growth. Both roles often overlap but differ primarily in scope, with planners emphasizing holistic financial roadmaps and advisors focusing on investment-centric advice.

Compensation Structures Compared

Financial planners typically earn fees based on a fixed rate, hourly charges, or a percentage of assets under management, promoting transparent and consistent compensation aligned with client interests. Financial advisors may receive commissions, fee-based payments, or salary, depending on whether they sell financial products or offer advisory services, potentially creating conflicts of interest. Understanding these compensation structures helps clients choose professionals whose incentives best match their financial goals.

Regulatory Oversight and Ethical Standards

Financial planners are often required to hold certifications such as the Certified Financial Planner (CFP) designation, which enforces strict fiduciary duties and adherence to the CFP Board's Code of Ethics and Standards of Conduct. Financial advisors may be subject to regulation by bodies like the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA), with varying degrees of fiduciary responsibility depending on their role and licensing. Understanding the specific regulatory oversight and ethical standards ensures clients receive transparent, unbiased advice aligned with their financial goals.

Choosing the Right Professional for Your Needs

Choosing the right financial professional depends on your specific needs, as financial planners typically focus on creating comprehensive, long-term financial strategies including retirement and estate planning, while financial advisors may provide broader investment advice and portfolio management. Understanding key certifications such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst) can help identify expertise relevant to your goals. Evaluating the scope of services, fee structures, and specialization ensures alignment with your financial objectives for effective wealth management.

Career Prospects in Financial Planning and Advising

Career prospects in financial planning and advising are robust, driven by increasing demand for personalized wealth management and retirement strategies. Financial planners often focus on comprehensive financial goal setting and long-term strategies, while financial advisors provide a broader range of investment and portfolio management services. Both roles offer opportunities for specialization, certification such as CFP (Certified Financial Planner), and advancement into senior advisory positions within banks, investment firms, and independent practices.

Financial Planner vs Financial Advisor Infographic

jobdiv.com

jobdiv.com