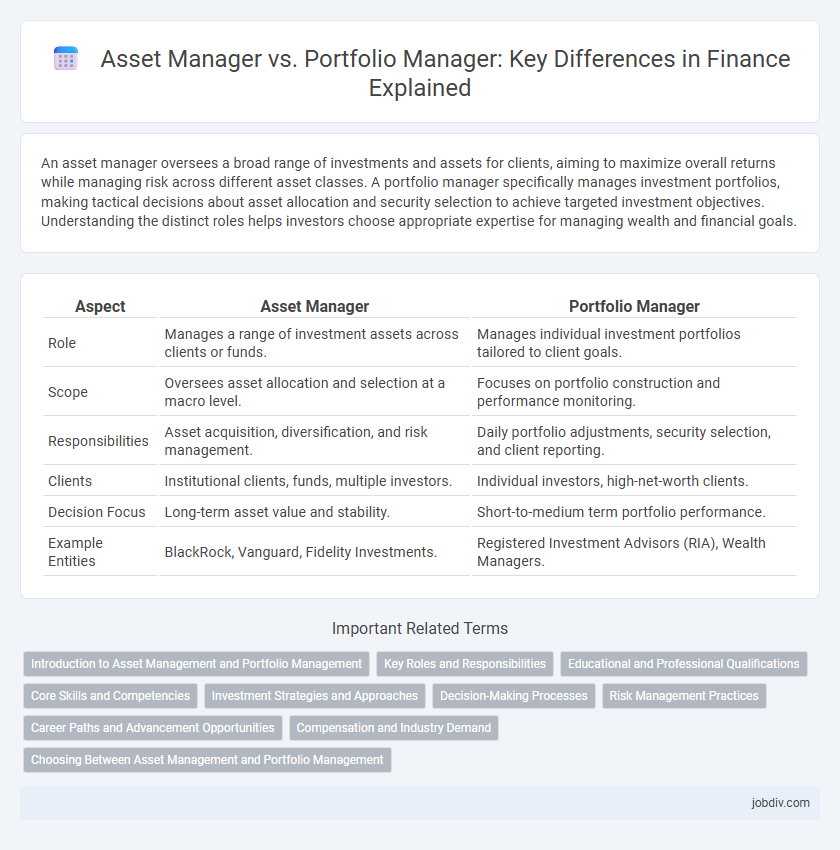

An asset manager oversees a broad range of investments and assets for clients, aiming to maximize overall returns while managing risk across different asset classes. A portfolio manager specifically manages investment portfolios, making tactical decisions about asset allocation and security selection to achieve targeted investment objectives. Understanding the distinct roles helps investors choose appropriate expertise for managing wealth and financial goals.

Table of Comparison

| Aspect | Asset Manager | Portfolio Manager |

|---|---|---|

| Role | Manages a range of investment assets across clients or funds. | Manages individual investment portfolios tailored to client goals. |

| Scope | Oversees asset allocation and selection at a macro level. | Focuses on portfolio construction and performance monitoring. |

| Responsibilities | Asset acquisition, diversification, and risk management. | Daily portfolio adjustments, security selection, and client reporting. |

| Clients | Institutional clients, funds, multiple investors. | Individual investors, high-net-worth clients. |

| Decision Focus | Long-term asset value and stability. | Short-to-medium term portfolio performance. |

| Example Entities | BlackRock, Vanguard, Fidelity Investments. | Registered Investment Advisors (RIA), Wealth Managers. |

Introduction to Asset Management and Portfolio Management

Asset managers specialize in overseeing a broad range of investment products and client assets, focusing on long-term value creation and risk management across multiple portfolios. Portfolio managers concentrate on constructing and managing specific investment portfolios, making tactical decisions to achieve targeted financial goals based on market analysis and asset allocation strategies. Both roles are integral to the investment management industry, ensuring optimal asset performance and client satisfaction through strategic planning and active management.

Key Roles and Responsibilities

Asset managers oversee a broad range of investments, including real estate, stocks, and bonds, focusing on maximizing the overall value and performance of client assets by developing strategic investment plans and conducting risk assessments. Portfolio managers concentrate on managing specific investment portfolios, making buy or sell decisions based on market analysis, asset allocation, and client objectives to achieve targeted financial returns. Both roles require strong analytical skills, market knowledge, and client communication but differ in scope, with asset managers handling diversified assets and portfolio managers focusing on investment selection and execution.

Educational and Professional Qualifications

Asset managers typically require a bachelor's degree in finance, economics, or business administration, with many pursuing certifications such as the Chartered Financial Analyst (CFA) designation to enhance their expertise in managing investment portfolios. Portfolio managers also hold similar educational backgrounds but often demonstrate more specialized knowledge in portfolio construction, risk management, and investment strategies, supported by advanced degrees like an MBA or certifications including the Certified Investment Management Analyst (CIMA). Both roles demand strong analytical skills and regulatory knowledge, but portfolio managers usually undergo rigorous performance evaluation aligned with client-specific investment goals.

Core Skills and Competencies

An Asset Manager excels in evaluating and optimizing diverse asset classes, demonstrating strong analytical skills, risk management expertise, and strategic asset allocation capabilities. A Portfolio Manager specializes in constructing and managing investment portfolios by leveraging market analysis, performance tracking, and client-focused decision-making. Both roles require proficiency in financial modeling, regulatory compliance, and effective communication to align investment strategies with client objectives.

Investment Strategies and Approaches

Asset managers oversee a broad range of investment vehicles, employing diversified strategies to optimize risk-adjusted returns across multiple asset classes. Portfolio managers concentrate on the active selection and allocation of securities within specific portfolios, tailoring investment approaches to meet individual client goals and risk tolerance. Both roles integrate market analysis, asset allocation, and risk management, but asset managers emphasize strategic oversight while portfolio managers focus on tactical execution.

Decision-Making Processes

Asset managers prioritize long-term strategic allocation decisions across diverse asset classes to optimize overall investment performance for clients. Portfolio managers focus on tactical daily trading, security selection, and risk management within specific portfolios to meet targeted investment objectives. Both roles integrate market analysis and client goals but differ primarily in their scope and decision-making horizon.

Risk Management Practices

Asset managers implement comprehensive risk management frameworks to oversee diversified investment portfolios, focusing on asset allocation, compliance, and market risk mitigation. Portfolio managers concentrate on selecting individual securities and adjusting holdings to optimize returns while managing portfolio-specific risks such as volatility and liquidity. Both roles use quantitative models and scenario analysis, but asset managers emphasize broader enterprise risk controls whereas portfolio managers execute tactical risk adjustments within portfolios.

Career Paths and Advancement Opportunities

Asset managers typically oversee a broad range of investment vehicles and client relationships, offering career advancement through roles such as senior asset manager or chief investment officer. Portfolio managers specialize in managing specific investment portfolios, with progression opportunities including lead portfolio manager or head of portfolio management. Both career paths require strong analytical skills, client management expertise, and can lead to executive-level positions within financial institutions.

Compensation and Industry Demand

Asset managers typically earn higher base salaries due to their broader responsibility for managing entire asset classes and client relationships, while portfolio managers often receive significant performance-based bonuses tied to investment returns. Industry demand for asset managers is growing as institutional investors seek holistic management of diverse asset portfolios, whereas portfolio managers remain in strong demand for their expertise in optimizing specific investment strategies. Compensation structures reflect these dynamics, with asset managers benefiting from stability and scale, and portfolio managers rewarded for short-term performance metrics.

Choosing Between Asset Management and Portfolio Management

Choosing between asset management and portfolio management depends on the scope of investment oversight required; asset managers focus on managing entire asset classes or real estate holdings, while portfolio managers concentrate on individual client investment portfolios. Asset managers often handle larger aggregates of assets, emphasizing strategic allocation and long-term value growth, whereas portfolio managers tailor investment decisions to meet specific risk tolerances and financial goals. Evaluating the desired level of customization, investment scale, and client interaction is critical when deciding the appropriate financial management service.

Asset Manager vs Portfolio Manager Infographic

jobdiv.com

jobdiv.com