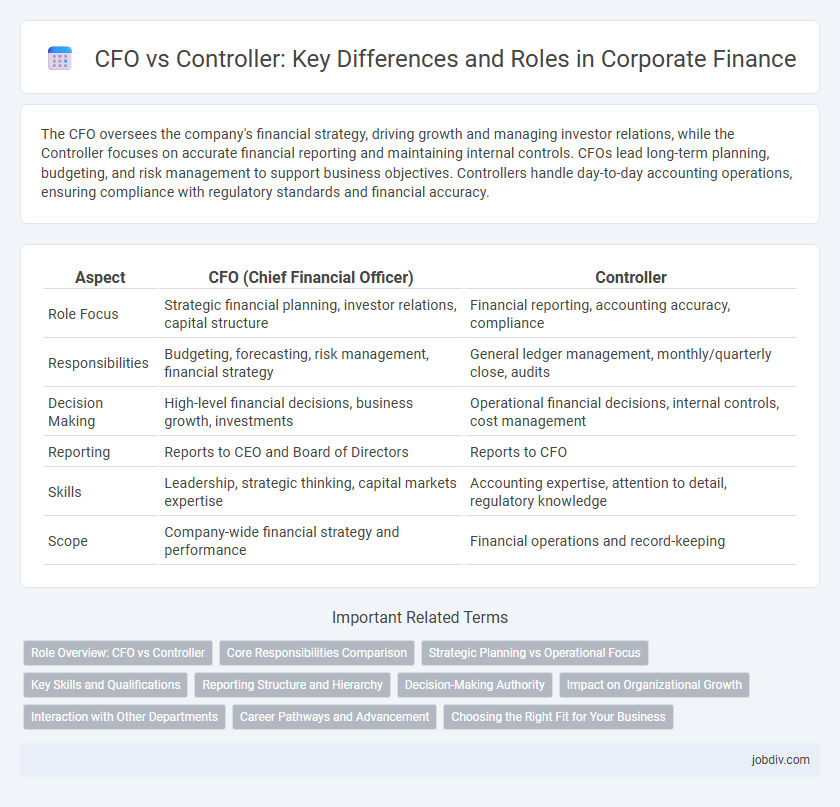

The CFO oversees the company's financial strategy, driving growth and managing investor relations, while the Controller focuses on accurate financial reporting and maintaining internal controls. CFOs lead long-term planning, budgeting, and risk management to support business objectives. Controllers handle day-to-day accounting operations, ensuring compliance with regulatory standards and financial accuracy.

Table of Comparison

| Aspect | CFO (Chief Financial Officer) | Controller |

|---|---|---|

| Role Focus | Strategic financial planning, investor relations, capital structure | Financial reporting, accounting accuracy, compliance |

| Responsibilities | Budgeting, forecasting, risk management, financial strategy | General ledger management, monthly/quarterly close, audits |

| Decision Making | High-level financial decisions, business growth, investments | Operational financial decisions, internal controls, cost management |

| Reporting | Reports to CEO and Board of Directors | Reports to CFO |

| Skills | Leadership, strategic thinking, capital markets expertise | Accounting expertise, attention to detail, regulatory knowledge |

| Scope | Company-wide financial strategy and performance | Financial operations and record-keeping |

Role Overview: CFO vs Controller

The CFO oversees strategic financial planning, risk management, and investor relations to drive long-term company growth and profitability, while the Controller focuses on managing daily accounting operations, financial reporting, and ensuring compliance with regulatory standards. CFOs typically guide budgeting decisions, capital structure, and financial forecasting, whereas Controllers ensure accuracy in ledger management, payroll, and internal controls. Both roles collaborate to maintain financial integrity, but the CFO acts as a chief strategist, and the Controller serves as the operational finance expert.

Core Responsibilities Comparison

The CFO oversees the company's overall financial strategy, including capital structure, risk management, and investor relations, driving long-term growth and profitability. The Controller manages day-to-day accounting operations, financial reporting, internal controls, and compliance, ensuring accuracy and regulatory adherence. While the CFO focuses on strategic leadership and external stakeholder communication, the Controller concentrates on operational financial management and internal process efficiency.

Strategic Planning vs Operational Focus

The CFO drives strategic planning by aligning financial goals with long-term business growth and market expansion, leveraging data analytics and forecasting models to guide executive decisions. The Controller maintains an operational focus, overseeing daily financial activities such as budgeting, compliance, and internal controls to ensure accuracy and regulatory adherence. CFOs prioritize investment strategies and capital allocation, while Controllers concentrate on financial reporting and efficiency in routine processes.

Key Skills and Qualifications

CFOs require strategic financial planning, leadership in capital management, and expertise in investor relations, often holding advanced degrees like an MBA or CPA certification. Controllers specialize in detailed financial reporting, internal controls, and regulatory compliance, typically possessing strong accounting backgrounds with certifications such as CPA or CMA. Both roles demand proficiency in financial software, analytical skills, and understanding of GAAP or IFRS standards to ensure accurate fiscal management.

Reporting Structure and Hierarchy

The CFO typically holds the highest-ranking financial position within an organization, overseeing overall financial strategy, decision-making, and investor relations. The Controller reports directly to the CFO and is responsible for managing day-to-day accounting operations, internal controls, and financial reporting accuracy. This hierarchical structure ensures clear accountability and efficient flow of financial information from operational accounting functions to strategic financial leadership.

Decision-Making Authority

The Chief Financial Officer (CFO) holds primary decision-making authority over strategic financial planning, budgeting, and investments, driving the company's long-term financial goals. In contrast, the Controller focuses on overseeing daily accounting operations, financial reporting, and compliance, ensuring accuracy and regulatory adherence. The CFO's role is oriented towards high-level financial strategy, while the Controller manages detailed financial data critical for informed executive decisions.

Impact on Organizational Growth

The CFO drives organizational growth by developing high-level financial strategies, managing investor relations, and identifying capital allocation opportunities that enhance profitability and scalability. In contrast, the Controller focuses on maintaining accurate financial records, ensuring regulatory compliance, and optimizing internal controls to support operational efficiency and risk management. Effective collaboration between CFO and Controller enables robust financial planning and control, directly contributing to sustainable growth and long-term value creation.

Interaction with Other Departments

The CFO collaborates closely with executive leadership and external stakeholders to align financial strategy with overall business goals, ensuring cross-departmental initiatives receive adequate funding and financial oversight. The Controller works more directly with internal departments like accounting, operations, and HR to manage financial reporting, budgeting, and compliance, facilitating accurate data flow and operational efficiency. Their interaction is complementary, with the CFO driving strategic partnerships and the Controller sustaining day-to-day financial integrity across departments.

Career Pathways and Advancement

CFOs typically advance through strategic leadership roles, gaining experience in financial planning, corporate finance, and investor relations, while controllers often start in accounting or auditing positions and specialize in financial reporting and compliance. The career pathway for CFOs demands strong skills in decision-making, risk management, and stakeholder communication, leading to executive-level responsibilities. Controllers progress by enhancing expertise in internal controls, regulatory standards, and financial operations, often transitioning to CFO roles in larger organizations for career advancement.

Choosing the Right Fit for Your Business

Selecting the right financial leader depends on your business needs: a CFO drives strategic growth, investor relations, and capital management, while a Controller focuses on accurate financial reporting, regulatory compliance, and internal controls. Small to mid-sized companies often benefit from a Controller's operational expertise, whereas larger enterprises or those seeking expansion typically require a CFO's visionary financial leadership. Evaluating your company's stage, complexity, and growth objectives ensures the best fit between CFO and Controller roles for sustainable financial success.

CFO vs Controller Infographic

jobdiv.com

jobdiv.com