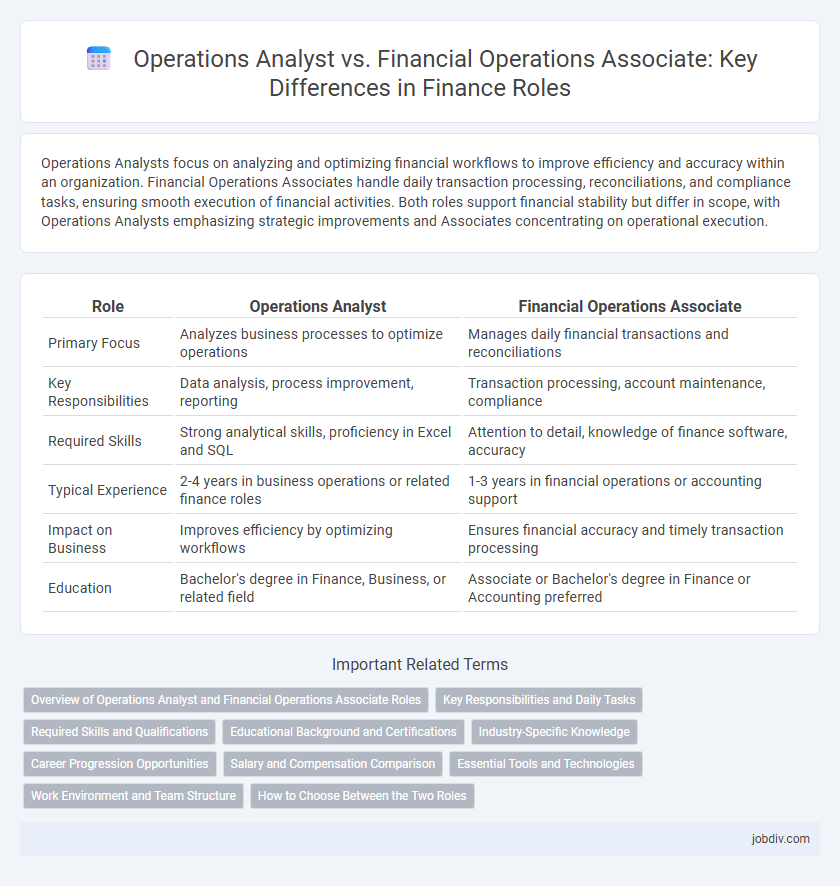

Operations Analysts focus on analyzing and optimizing financial workflows to improve efficiency and accuracy within an organization. Financial Operations Associates handle daily transaction processing, reconciliations, and compliance tasks, ensuring smooth execution of financial activities. Both roles support financial stability but differ in scope, with Operations Analysts emphasizing strategic improvements and Associates concentrating on operational execution.

Table of Comparison

| Role | Operations Analyst | Financial Operations Associate |

|---|---|---|

| Primary Focus | Analyzes business processes to optimize operations | Manages daily financial transactions and reconciliations |

| Key Responsibilities | Data analysis, process improvement, reporting | Transaction processing, account maintenance, compliance |

| Required Skills | Strong analytical skills, proficiency in Excel and SQL | Attention to detail, knowledge of finance software, accuracy |

| Typical Experience | 2-4 years in business operations or related finance roles | 1-3 years in financial operations or accounting support |

| Impact on Business | Improves efficiency by optimizing workflows | Ensures financial accuracy and timely transaction processing |

| Education | Bachelor's degree in Finance, Business, or related field | Associate or Bachelor's degree in Finance or Accounting preferred |

Overview of Operations Analyst and Financial Operations Associate Roles

Operations Analysts focus on optimizing financial processes through data analysis, identifying inefficiencies, and supporting system improvements within finance departments. Financial Operations Associates manage transaction processing, reconcile accounts, and ensure compliance with regulatory requirements to maintain accurate financial records. Both roles support organizational finance functions but differ in scope, with Operations Analysts emphasizing strategic analysis and Associates concentrating on operational execution.

Key Responsibilities and Daily Tasks

Operations Analysts monitor financial processes by analyzing data trends, identifying inefficiencies, and optimizing workflows to enhance operational efficiency. Financial Operations Associates handle transaction processing, reconcile accounts, and support compliance through accurate record-keeping and timely reporting. Both roles require collaboration with cross-functional teams to ensure seamless execution of financial operations and risk mitigation.

Required Skills and Qualifications

Operations Analysts typically require strong analytical skills, proficiency in data analysis tools like Excel and SQL, and a solid understanding of financial modeling and risk management. Financial Operations Associates need expertise in transaction processing, reconciliation, regulatory compliance, and experience with financial software such as SAP or Oracle. Both roles demand excellent problem-solving abilities, attention to detail, and effective communication skills to ensure accurate financial operations and reporting.

Educational Background and Certifications

Operations Analysts typically possess a bachelor's degree in finance, economics, or business administration, emphasizing data analysis and process optimization. Financial Operations Associates often hold degrees in accounting or finance and benefit from certifications like CPA or CFA for advanced financial expertise. Both roles value strong quantitative skills, but certified credentials enhance career advancement within financial operations.

Industry-Specific Knowledge

Operations Analysts specialize in analyzing workflow processes and financial data within industries like banking, insurance, and asset management, using advanced tools such as SQL and Excel for process optimization. Financial Operations Associates focus on transactional accuracy and compliance in sectors like investment banking and wealth management, with expertise in regulatory frameworks such as SOX and anti-money laundering (AML) protocols. Industry-specific knowledge enables Operations Analysts to design efficient financial models, while Financial Operations Associates ensure adherence to industry standards and risk mitigation.

Career Progression Opportunities

Operations Analysts often advance to roles such as Senior Analyst, Operations Manager, or Business Process Consultant by leveraging skills in data analysis, process optimization, and strategic planning. Financial Operations Associates typically progress toward positions like Financial Analyst, Treasury Analyst, or Finance Manager by gaining expertise in financial reporting, cash management, and compliance. The career trajectory for Operations Analysts emphasizes analytical and operational proficiency, while Financial Operations Associates focus on financial management and regulatory knowledge to unlock higher-level responsibilities.

Salary and Compensation Comparison

Operations Analysts typically earn a median salary ranging from $65,000 to $85,000 annually, reflecting their analytical responsibilities in optimizing business processes. Financial Operations Associates usually have a salary range between $55,000 and $75,000, with compensation influenced by their focus on executing financial transactions and maintaining compliance. Both roles offer performance bonuses and benefits, but Operations Analysts often receive higher variable compensation due to their strategic impact on operational efficiency.

Essential Tools and Technologies

Operations Analysts rely heavily on advanced data analytics software like SQL, Python, and Excel for detailed financial modeling and process optimization. Financial Operations Associates utilize enterprise resource planning (ERP) systems such as SAP and Oracle Financials, along with transaction processing tools and financial reporting software to ensure accurate day-to-day operations. Mastery of these technologies directly impacts efficiency and accuracy in financial data management and operational workflows.

Work Environment and Team Structure

Operations Analysts typically work in dynamic corporate settings such as investment firms or banks, collaborating closely with cross-functional teams including finance, risk management, and IT departments. Financial Operations Associates often operate within centralized finance departments of larger organizations, focusing on transactional processes and reporting with a more hierarchical team structure. Both roles require strong coordination skills but differ in their interaction breadth and organizational integration.

How to Choose Between the Two Roles

Choosing between an Operations Analyst and a Financial Operations Associate depends on your expertise and career goals in finance. Operations Analysts focus on data analysis, process optimization, and reporting to improve financial workflows, requiring strong analytical and technical skills. Financial Operations Associates concentrate on transactional processes, reconciliation, and compliance, ideal for those with attention to detail and a preference for operational execution within finance departments.

Operations Analyst vs Financial Operations Associate Infographic

jobdiv.com

jobdiv.com