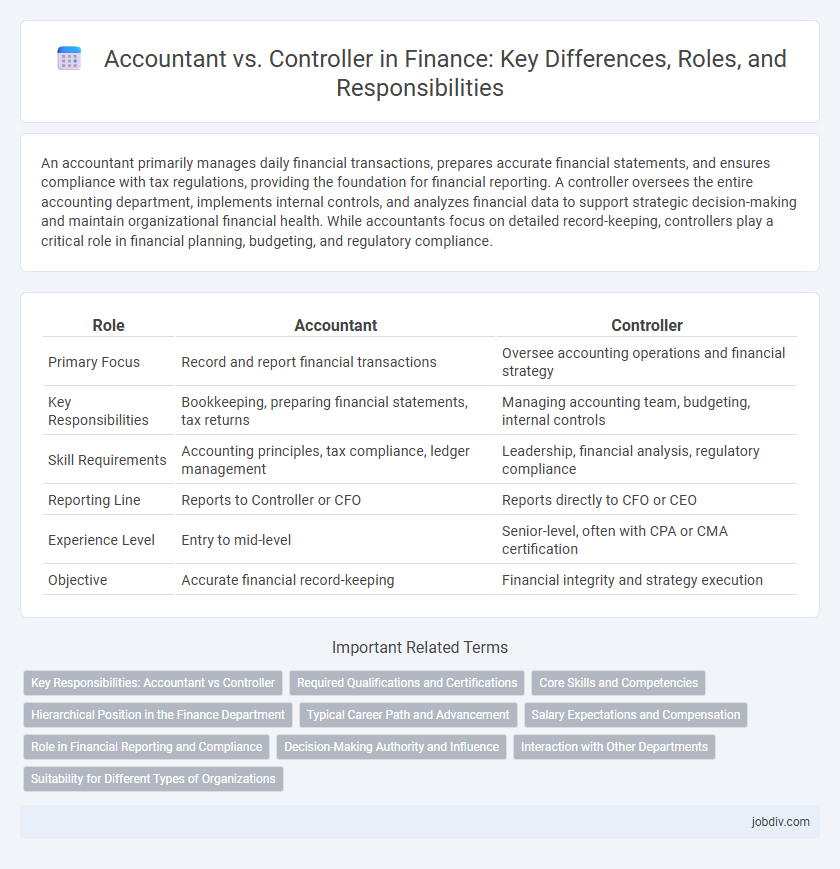

An accountant primarily manages daily financial transactions, prepares accurate financial statements, and ensures compliance with tax regulations, providing the foundation for financial reporting. A controller oversees the entire accounting department, implements internal controls, and analyzes financial data to support strategic decision-making and maintain organizational financial health. While accountants focus on detailed record-keeping, controllers play a critical role in financial planning, budgeting, and regulatory compliance.

Table of Comparison

| Role | Accountant | Controller |

|---|---|---|

| Primary Focus | Record and report financial transactions | Oversee accounting operations and financial strategy |

| Key Responsibilities | Bookkeeping, preparing financial statements, tax returns | Managing accounting team, budgeting, internal controls |

| Skill Requirements | Accounting principles, tax compliance, ledger management | Leadership, financial analysis, regulatory compliance |

| Reporting Line | Reports to Controller or CFO | Reports directly to CFO or CEO |

| Experience Level | Entry to mid-level | Senior-level, often with CPA or CMA certification |

| Objective | Accurate financial record-keeping | Financial integrity and strategy execution |

Key Responsibilities: Accountant vs Controller

Accountants manage day-to-day financial transactions, including bookkeeping, preparing financial statements, and ensuring compliance with tax regulations. Controllers oversee the entire accounting department, focusing on financial reporting accuracy, budgeting, internal controls, and strategic financial planning. The controller's role is more managerial and strategic, while the accountant's tasks are detailed and transactional.

Required Qualifications and Certifications

Accountants typically require a bachelor's degree in accounting or finance, with certifications such as CPA (Certified Public Accountant) enhancing career prospects. Controllers often need extensive experience in accounting management and prefer advanced certifications like CMA (Certified Management Accountant) or CPA, combined with strong leadership skills. Both roles demand thorough knowledge of GAAP, financial reporting, and regulatory compliance to ensure accurate financial management.

Core Skills and Competencies

Accountants specialize in managing financial records, ensuring accuracy in bookkeeping, taxation, and compliance with accounting standards, while controllers emphasize financial reporting, budgeting, and internal controls to support strategic decision-making. Key competencies for accountants include attention to detail, proficiency in accounting software, and knowledge of tax regulations. Controllers require strong analytical skills, leadership abilities, and expertise in financial planning and risk management to oversee the organization's overall financial health.

Hierarchical Position in the Finance Department

Accountants typically hold positions responsible for managing financial records, preparing reports, and ensuring compliance within the finance department. Controllers occupy senior roles, overseeing the accounting team, implementing financial policies, and guiding strategic financial planning. The hierarchical structure places the controller above accountants, reflecting greater authority and responsibility in financial decision-making.

Typical Career Path and Advancement

Accountants typically begin their careers by handling bookkeeping, financial reporting, and compliance tasks before advancing to senior accountant or audit roles, gaining certifications like CPA to enhance their expertise. Controllers usually progress from senior accountant or accounting manager positions into overseeing entire accounting departments, financial strategy, and internal controls, often requiring extensive experience and leadership skills. Career advancement from accountant to controller involves developing strong financial management capabilities, strategic planning, and team leadership, positioning professionals for executive roles such as CFO.

Salary Expectations and Compensation

Accountants typically earn a median salary ranging from $55,000 to $75,000 annually, while Controllers command higher compensation, averaging between $90,000 and $140,000 depending on industry and experience. Controller roles often include bonuses, profit-sharing, and stock options, reflecting their strategic responsibility for financial management and reporting. Salary growth for Controllers is generally faster due to their leadership position and broader oversight within the finance department.

Role in Financial Reporting and Compliance

Accountants prepare and maintain accurate financial records by recording transactions and ensuring compliance with Generally Accepted Accounting Principles (GAAP). Controllers oversee the financial reporting process, ensuring accuracy, completeness, and adherence to regulatory requirements such as Sarbanes-Oxley (SOX) and Securities and Exchange Commission (SEC) guidelines. Controllers also manage internal controls and coordinate audit activities to guarantee compliance and mitigate financial risks.

Decision-Making Authority and Influence

Accountants primarily focus on recording and reporting financial transactions, providing accurate data essential for decision-making, while Controllers hold broader decision-making authority, overseeing accounting departments and shaping financial strategies. Controllers influence budgeting, financial planning, and compliance, ensuring alignment with organizational goals. Their role integrates financial insights with strategic decisions, impacting overall business performance.

Interaction with Other Departments

Accountants primarily gather and analyze financial data, collaborating closely with departments like sales and procurement to ensure accurate transaction recording and expense tracking. Controllers oversee the preparation of financial reports and budgeting, working directly with finance, operations, and executive teams to align financial strategies with organizational goals. Effective interaction between accountants, controllers, and other departments enhances financial transparency and supports informed decision-making.

Suitability for Different Types of Organizations

Accountants excel in small to medium-sized businesses where detailed financial record-keeping and compliance are essential, providing accurate reports and tax preparation. Controllers are better suited for larger organizations needing strategic oversight, internal controls, and financial planning to support complex operational structures. Choosing between an accountant and a controller depends on the organization's scale, complexity, and financial management needs.

Accountant vs Controller Infographic

jobdiv.com

jobdiv.com