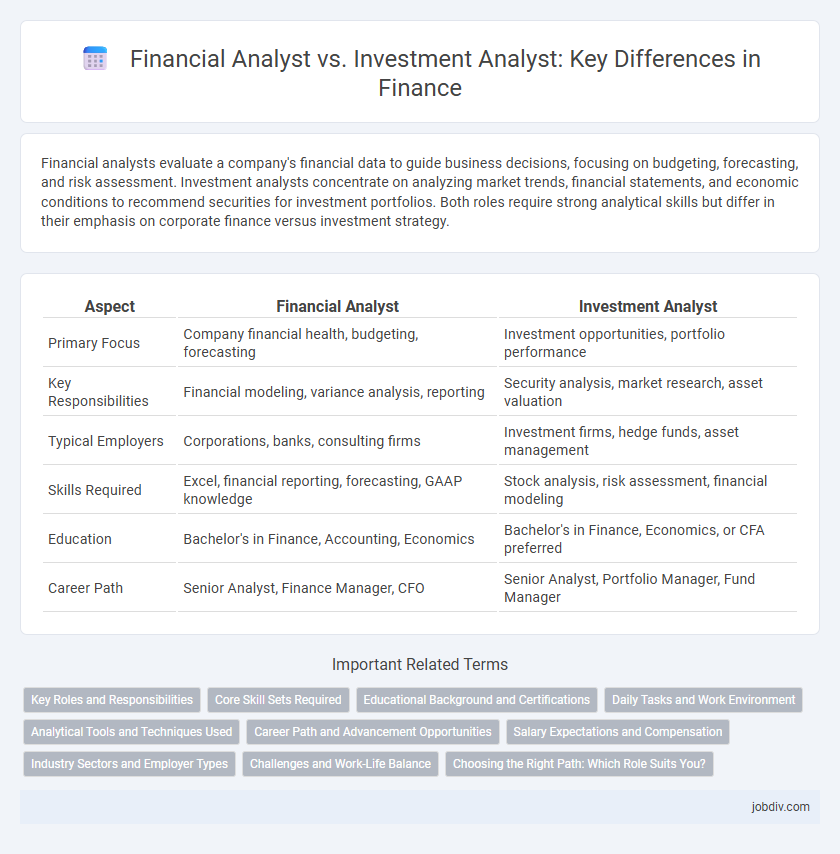

Financial analysts evaluate a company's financial data to guide business decisions, focusing on budgeting, forecasting, and risk assessment. Investment analysts concentrate on analyzing market trends, financial statements, and economic conditions to recommend securities for investment portfolios. Both roles require strong analytical skills but differ in their emphasis on corporate finance versus investment strategy.

Table of Comparison

| Aspect | Financial Analyst | Investment Analyst |

|---|---|---|

| Primary Focus | Company financial health, budgeting, forecasting | Investment opportunities, portfolio performance |

| Key Responsibilities | Financial modeling, variance analysis, reporting | Security analysis, market research, asset valuation |

| Typical Employers | Corporations, banks, consulting firms | Investment firms, hedge funds, asset management |

| Skills Required | Excel, financial reporting, forecasting, GAAP knowledge | Stock analysis, risk assessment, financial modeling |

| Education | Bachelor's in Finance, Accounting, Economics | Bachelor's in Finance, Economics, or CFA preferred |

| Career Path | Senior Analyst, Finance Manager, CFO | Senior Analyst, Portfolio Manager, Fund Manager |

Key Roles and Responsibilities

Financial analysts evaluate financial data, prepare reports, and develop financial models to guide business decisions and strategy. Investment analysts specialize in assessing investment opportunities, analyzing market trends, and recommending securities for portfolio management and client advisory. Both roles require strong analytical skills, financial expertise, and proficiency in interpreting market data to support organizational growth.

Core Skill Sets Required

Financial Analysts require expertise in financial modeling, forecasting, and interpreting balance sheets to evaluate company performance and advise on budgeting. Investment Analysts focus on portfolio management, market trend analysis, and asset valuation to guide investment decisions and optimize returns. Both roles demand strong analytical abilities, proficiency in Excel and financial software, and solid understanding of market dynamics.

Educational Background and Certifications

Financial analysts typically hold degrees in finance, economics, or accounting and often pursue certifications such as the Chartered Financial Analyst (CFA) designation to deepen their expertise in financial modeling and portfolio management. Investment analysts also commonly have strong educational foundations in finance or economics but may emphasize certifications like the Financial Risk Manager (FRM) or Certified Investment Management Analyst (CIMA) to specialize in investment strategies and risk assessment. Both roles require proficiency in data analysis and financial principles, but distinct certifications align with their specialized career paths in financial services.

Daily Tasks and Work Environment

Financial analysts primarily evaluate financial data to guide budgeting, forecasting, and investment decisions within corporate settings, often working closely with accounting and management teams. Investment analysts concentrate on researching market trends, analyzing securities, and providing recommendations to portfolio managers or clients, typically operating within investment firms or asset management companies. Both roles require strong analytical skills and proficiency in financial modeling, but financial analysts usually engage in broader organizational financial planning while investment analysts focus deeper on market performance and asset valuation.

Analytical Tools and Techniques Used

Financial Analysts commonly utilize tools such as Excel, Bloomberg Terminal, and financial modeling software to assess company performance and forecast trends. Investment Analysts often apply quantitative analysis techniques, including regression analysis, asset valuation models, and portfolio management software like FactSet and Morningstar Direct. Both roles rely heavily on data visualization tools and statistical software to interpret market data and support investment decisions.

Career Path and Advancement Opportunities

Financial analysts typically begin their careers evaluating financial data to guide business decisions, with advancement opportunities leading to senior analyst roles, portfolio management, or corporate finance leadership. Investment analysts, focused on securities and market trends, often progress toward portfolio manager positions, hedge fund management, or research director roles within asset management firms. Both paths benefit from certifications like CFA and advanced degrees, enhancing prospects in competitive financial sectors.

Salary Expectations and Compensation

Financial analysts typically earn a median salary of $83,660 annually, with compensation varying based on industry and experience, while investment analysts often command higher wages averaging $95,000 due to their specialized skills in portfolio management and securities analysis. Bonuses and performance-based incentives significantly influence total compensation for both roles, with investment analysts frequently benefiting from larger bonuses tied to asset growth. Geographic location and firm size also play crucial roles in salary expectations, with major financial hubs like New York and London offering premium pay scales for these professionals.

Industry Sectors and Employer Types

Financial analysts typically work across diverse industry sectors such as banking, insurance, and corporate finance, providing insights on company performance and financial health; employers range from commercial banks and insurance firms to corporate finance departments of large corporations. Investment analysts primarily focus on sectors related to securities, asset management, and capital markets, analyzing stocks, bonds, and other investment vehicles for investment firms, hedge funds, and mutual funds. While both roles require strong analytical skills, financial analysts often have broader industry exposure, whereas investment analysts specialize more narrowly in investment portfolios and market trends.

Challenges and Work-Life Balance

Financial analysts often face challenges balancing extensive data analysis and client reporting deadlines, which can lead to unpredictable work hours, particularly during earnings season or fiscal year-end. Investment analysts confront high-pressure environments driven by market volatility and the need for rapid decision-making, impacting their work-life balance due to long hours and constant market monitoring. Both roles require strong time management skills to mitigate stress and maintain productivity in fast-paced financial sectors.

Choosing the Right Path: Which Role Suits You?

Financial analysts primarily evaluate company financials, market trends, and economic data to guide internal business decisions, while investment analysts focus on researching securities and investment opportunities to advise portfolio management and investors. Choosing the right path depends on whether you prefer a broader corporate finance role or a specialized investment strategy position. Assess your strengths in quantitative analysis, risk assessment, and long-term market forecasting to determine which analyst role aligns with your career goals.

Financial Analyst vs Investment Analyst Infographic

jobdiv.com

jobdiv.com