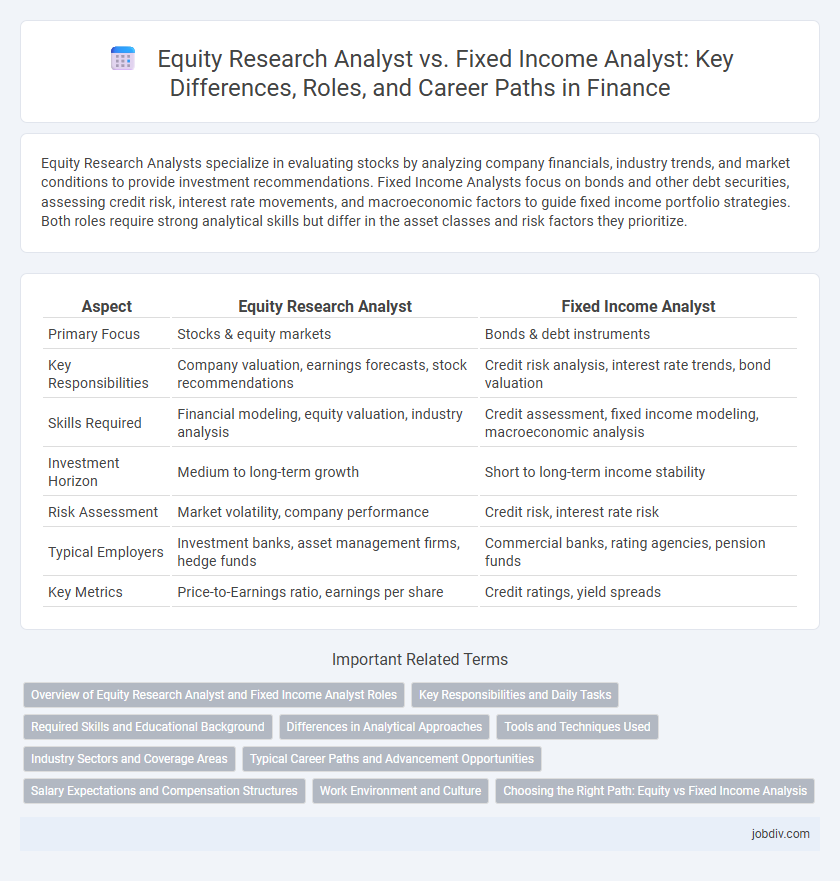

Equity Research Analysts specialize in evaluating stocks by analyzing company financials, industry trends, and market conditions to provide investment recommendations. Fixed Income Analysts focus on bonds and other debt securities, assessing credit risk, interest rate movements, and macroeconomic factors to guide fixed income portfolio strategies. Both roles require strong analytical skills but differ in the asset classes and risk factors they prioritize.

Table of Comparison

| Aspect | Equity Research Analyst | Fixed Income Analyst |

|---|---|---|

| Primary Focus | Stocks & equity markets | Bonds & debt instruments |

| Key Responsibilities | Company valuation, earnings forecasts, stock recommendations | Credit risk analysis, interest rate trends, bond valuation |

| Skills Required | Financial modeling, equity valuation, industry analysis | Credit assessment, fixed income modeling, macroeconomic analysis |

| Investment Horizon | Medium to long-term growth | Short to long-term income stability |

| Risk Assessment | Market volatility, company performance | Credit risk, interest rate risk |

| Typical Employers | Investment banks, asset management firms, hedge funds | Commercial banks, rating agencies, pension funds |

| Key Metrics | Price-to-Earnings ratio, earnings per share | Credit ratings, yield spreads |

Overview of Equity Research Analyst and Fixed Income Analyst Roles

Equity Research Analysts specialize in evaluating publicly traded companies by analyzing financial statements, market trends, and economic data to provide investment recommendations on stocks. Fixed Income Analysts focus on assessing bonds and other debt instruments, analyzing interest rate movements, credit risk, and macroeconomic indicators to guide investment decisions in fixed income securities. Both roles require strong quantitative skills, but Equity Analysts emphasize equity valuation models, while Fixed Income Analysts prioritize credit analysis and interest rate risk management.

Key Responsibilities and Daily Tasks

Equity Research Analysts primarily focus on analyzing company financials, industry trends, and valuation models to provide buy, sell, or hold recommendations on stocks. Fixed Income Analysts concentrate on evaluating credit risk, interest rate movements, and bond market conditions to inform investment decisions in debt securities. Both roles require continuous monitoring of market developments, but equity analysts emphasize earnings forecasts and stock performance, while fixed income analysts prioritize bond pricing and creditworthiness assessments.

Required Skills and Educational Background

Equity Research Analysts require strong financial modeling, valuation expertise, and proficiency in analyzing company fundamentals, often supported by degrees in finance, economics, or business administration along with CFA certification. Fixed Income Analysts specialize in credit risk assessment, bond valuation, and macroeconomic trend analysis, typically backed by education in finance, economics, or quantitative fields, with emphasis on certifications like CFA or FRM. Both roles demand advanced Excel skills, proficiency in financial software, and a deep understanding of market dynamics tailored to their respective asset classes.

Differences in Analytical Approaches

Equity Research Analysts evaluate company fundamentals, market trends, and growth potential by analyzing financial statements, earnings reports, and competitive positioning to forecast stock performance. Fixed Income Analysts concentrate on interest rate trends, credit risk, and bond valuation, utilizing yield curves, credit ratings, and macroeconomic indicators to assess fixed income securities' risk and return. The analytical approach differs as equity research emphasizes growth and profitability metrics, while fixed income focuses on cash flow stability and creditworthiness.

Tools and Techniques Used

Equity Research Analysts primarily utilize discounted cash flow models, price-to-earnings ratios, and comparative company analysis to evaluate stock valuations and forecast earnings growth, leveraging platforms such as Bloomberg Terminal and FactSet for real-time market data. Fixed Income Analysts focus on yield curve analysis, credit spread assessment, and duration management, employing tools like Moody's credit ratings and bond pricing software to assess credit risk and interest rate sensitivity. Both roles integrate advanced Excel modeling and statistical software such as Python or R for quantitative analysis but apply these techniques differently based on asset class-specific metrics.

Industry Sectors and Coverage Areas

Equity Research Analysts specialize in analyzing publicly traded companies across diverse industry sectors such as technology, healthcare, and consumer goods, providing detailed stock performance forecasts and investment recommendations. Fixed Income Analysts focus on debt securities, including corporate bonds, government bonds, and municipal bonds, with expertise in sectors like financial institutions, utilities, and sovereign issuers, assessing credit risk and interest rate impacts. Both roles require in-depth sector knowledge, but Equity Research emphasizes earnings growth and valuation metrics, whereas Fixed Income highlights credit quality and yield analysis.

Typical Career Paths and Advancement Opportunities

Equity Research Analysts often start as junior analysts covering specific sectors before progressing to senior analyst roles, portfolio management, or transitioning into investment banking and asset management. Fixed Income Analysts typically begin by specializing in government bonds, corporate debt, or credit analysis, advancing to senior analyst positions, risk management roles, or strategic advisory within debt markets. Both paths emphasize developing deep market insights and analytical skills, with advancement depending on expertise in valuation models, macroeconomic trends, and regulatory environments.

Salary Expectations and Compensation Structures

Equity Research Analysts typically command higher base salaries and performance bonuses due to the direct impact of their stock recommendations on investment decisions. Fixed Income Analysts often receive more stable compensation structures with fixed salaries and moderate bonuses linked to credit risk assessment and bond portfolio performance. Salary expectations for Equity Analysts range from $70,000 to $150,000 annually, whereas Fixed Income Analysts generally earn between $65,000 and $130,000, depending on experience and firm size.

Work Environment and Culture

Equity Research Analysts typically work in fast-paced environments demanding in-depth analysis of company financials and market trends, often requiring collaboration with sales and trading teams. Fixed Income Analysts operate in a more structured setting focused on credit risk assessment, bond valuation, and macroeconomic factors, with a culture emphasizing precision and risk management. Both roles require strong analytical skills but differ in work dynamics, with equity research fostering more client interaction and fixed income emphasizing detailed quantitative analysis.

Choosing the Right Path: Equity vs Fixed Income Analysis

Equity research analysts focus on evaluating company stocks, analyzing financial statements, market trends, and growth potential to provide investment recommendations. Fixed income analysts specialize in assessing bonds, credit risk, interest rate movements, and economic indicators to guide fixed income portfolios. Selecting between equity and fixed income analysis depends on preference for equity market volatility exposure or the relative stability and income focus of bond markets.

Equity Research Analyst vs Fixed Income Analyst Infographic

jobdiv.com

jobdiv.com