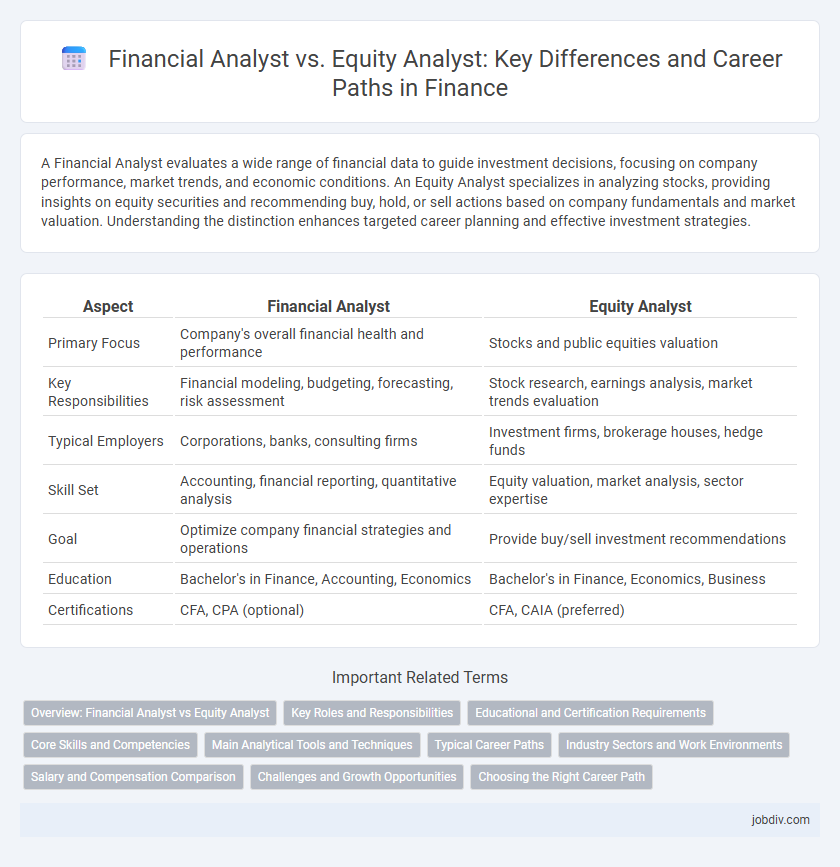

A Financial Analyst evaluates a wide range of financial data to guide investment decisions, focusing on company performance, market trends, and economic conditions. An Equity Analyst specializes in analyzing stocks, providing insights on equity securities and recommending buy, hold, or sell actions based on company fundamentals and market valuation. Understanding the distinction enhances targeted career planning and effective investment strategies.

Table of Comparison

| Aspect | Financial Analyst | Equity Analyst |

|---|---|---|

| Primary Focus | Company's overall financial health and performance | Stocks and public equities valuation |

| Key Responsibilities | Financial modeling, budgeting, forecasting, risk assessment | Stock research, earnings analysis, market trends evaluation |

| Typical Employers | Corporations, banks, consulting firms | Investment firms, brokerage houses, hedge funds |

| Skill Set | Accounting, financial reporting, quantitative analysis | Equity valuation, market analysis, sector expertise |

| Goal | Optimize company financial strategies and operations | Provide buy/sell investment recommendations |

| Education | Bachelor's in Finance, Accounting, Economics | Bachelor's in Finance, Economics, Business |

| Certifications | CFA, CPA (optional) | CFA, CAIA (preferred) |

Overview: Financial Analyst vs Equity Analyst

Financial analysts evaluate a broad range of financial data, including company performance, market trends, and economic conditions, to provide investment recommendations and support corporate decision-making. Equity analysts specialize in analyzing publicly traded stocks, focusing on company earnings, industry positioning, and stock valuation to advise investors on buy, hold, or sell decisions. Both roles require strong quantitative skills and market knowledge, but equity analysts maintain a narrower focus on equity securities within the financial markets.

Key Roles and Responsibilities

Financial analysts evaluate overall financial data, market trends, and economic conditions to provide investment recommendations and support business decision-making. Equity analysts specialize in researching specific stocks, analyzing company financials, earnings reports, and industry performance to predict stock price movements and advise on buy, hold, or sell positions. Both roles require strong analytical skills, proficiency in financial modeling, and the ability to interpret complex data sets for strategic insights.

Educational and Certification Requirements

Financial analysts typically require a bachelor's degree in finance, accounting, economics, or business administration, with certifications like the Chartered Financial Analyst (CFA) designation enhancing their credentials. Equity analysts, specializing in stock market investments, often hold degrees in finance or economics and prioritize earning the CFA certification to demonstrate expertise in equity research and valuation. Both roles benefit from strong analytical skills and professional certifications to advance in competitive financial sectors.

Core Skills and Competencies

Financial analysts possess strong skills in quantitative analysis, financial modeling, and risk assessment, enabling them to evaluate overall financial health and guide investment decisions across diverse sectors. Equity analysts specialize in equity markets with deep expertise in company valuation, earnings forecasting, and industry-specific research, providing detailed stock recommendations and portfolio insights. Both roles require proficiency in financial statement analysis, advanced Excel capabilities, and strong communication skills to interpret complex data for stakeholders.

Main Analytical Tools and Techniques

Financial analysts utilize a broad range of tools including financial modeling, forecasting, and ratio analysis to evaluate overall company performance and market trends. Equity analysts concentrate more specifically on stock valuation techniques, such as discounted cash flow (DCF) models, price-to-earnings (P/E) ratios, and comparative company analysis to assess individual equities. Both roles heavily rely on Excel, Bloomberg Terminals, and advanced statistical software for data analysis and interpretation.

Typical Career Paths

Financial Analysts often start in corporate finance or investment banking, progressing to roles such as portfolio managers or finance directors, with a broad exposure to various industries and financial instruments. Equity Analysts typically begin as junior analysts within asset management or brokerage firms, advancing to senior equity analyst roles or fund manager positions specializing in stock market research and equity valuations. Both career paths emphasize strong analytical skills but diverge in their focus, with Financial Analysts maintaining a wider scope and Equity Analysts honing expertise in equity markets.

Industry Sectors and Work Environments

Financial analysts often work across various industry sectors, including banking, insurance, and corporate finance, providing broad financial insights and investment recommendations. Equity analysts specialize in analyzing stocks within specific sectors such as technology, healthcare, or energy, focusing on company performance and market trends to advise on stock investments. Work environments for financial analysts typically include banks, investment firms, and corporate finance departments, while equity analysts are commonly employed by brokerage firms, asset management companies, and specialized equity research firms.

Salary and Compensation Comparison

Financial Analysts typically earn an average salary of $65,000 to $85,000 annually, with bonuses and benefits pushing total compensation higher in top financial hubs. Equity Analysts often command slightly higher salaries, ranging from $75,000 to $95,000 per year, due to their specialized focus on stock market investments and equity research. Compensation for Equity Analysts tends to be more variable, heavily influenced by market performance and firm profitability.

Challenges and Growth Opportunities

Financial Analysts face challenges in managing diverse portfolios and forecasting market trends amid economic volatility, while Equity Analysts navigate intense pressure to deliver precise stock valuations under rapidly changing market conditions. Growth opportunities for Financial Analysts often include roles in corporate finance, risk management, and strategic planning, whereas Equity Analysts can advance through specialization in sector research or portfolio management. Both roles demand continuous learning and adaptation to regulatory changes and technological advancements like AI-driven analytics, driving career progression and expertise development.

Choosing the Right Career Path

Financial analysts evaluate a broad range of investment opportunities across sectors, offering versatile skills applicable in corporate finance, investment banking, and portfolio management. Equity analysts specialize in analyzing stock performance and company fundamentals within specific industries, providing deep insights critical for equity trading and investment decisions. Choosing between these paths depends on whether you prefer a wider financial scope or a focused expertise in stock markets and equity research.

Financial Analyst vs Equity Analyst Infographic

jobdiv.com

jobdiv.com