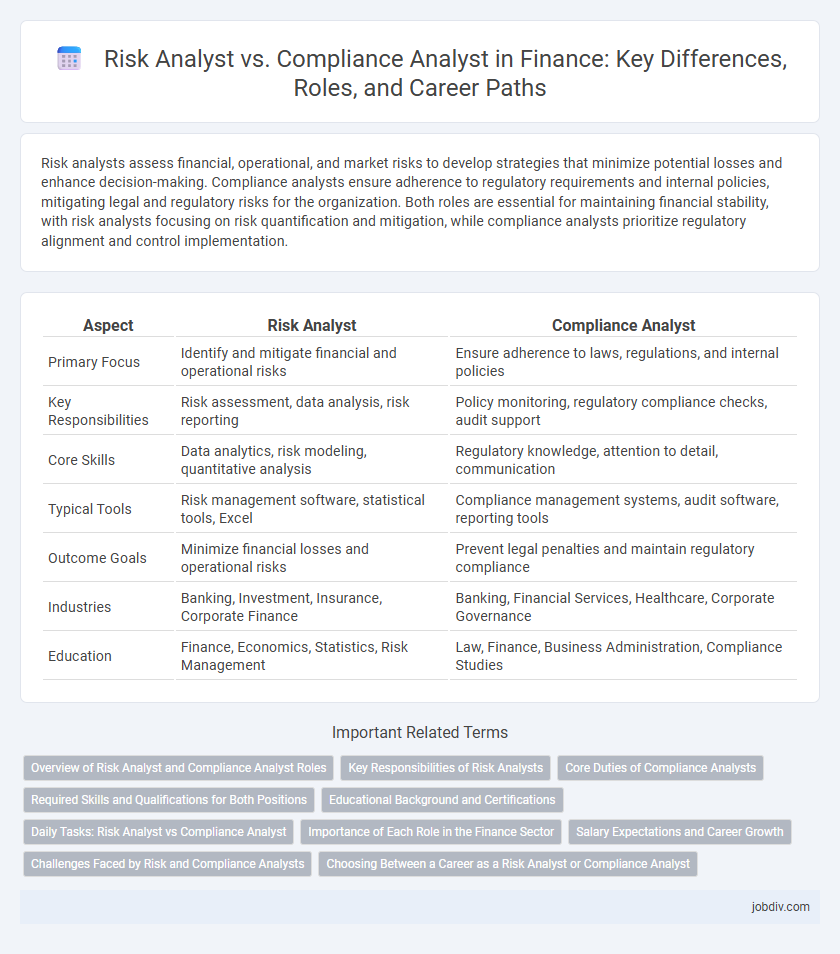

Risk analysts assess financial, operational, and market risks to develop strategies that minimize potential losses and enhance decision-making. Compliance analysts ensure adherence to regulatory requirements and internal policies, mitigating legal and regulatory risks for the organization. Both roles are essential for maintaining financial stability, with risk analysts focusing on risk quantification and mitigation, while compliance analysts prioritize regulatory alignment and control implementation.

Table of Comparison

| Aspect | Risk Analyst | Compliance Analyst |

|---|---|---|

| Primary Focus | Identify and mitigate financial and operational risks | Ensure adherence to laws, regulations, and internal policies |

| Key Responsibilities | Risk assessment, data analysis, risk reporting | Policy monitoring, regulatory compliance checks, audit support |

| Core Skills | Data analytics, risk modeling, quantitative analysis | Regulatory knowledge, attention to detail, communication |

| Typical Tools | Risk management software, statistical tools, Excel | Compliance management systems, audit software, reporting tools |

| Outcome Goals | Minimize financial losses and operational risks | Prevent legal penalties and maintain regulatory compliance |

| Industries | Banking, Investment, Insurance, Corporate Finance | Banking, Financial Services, Healthcare, Corporate Governance |

| Education | Finance, Economics, Statistics, Risk Management | Law, Finance, Business Administration, Compliance Studies |

Overview of Risk Analyst and Compliance Analyst Roles

Risk Analysts assess financial risks by analyzing market trends, credit data, and economic conditions to develop strategies that minimize potential losses for organizations. Compliance Analysts ensure that financial institutions and businesses adhere to regulatory requirements, internal policies, and industry standards to prevent legal risks and maintain operational integrity. Both roles are critical in managing risk exposure, but Risk Analysts focus on forecasting and mitigating risks, while Compliance Analysts emphasize regulatory adherence and control monitoring.

Key Responsibilities of Risk Analysts

Risk Analysts identify, assess, and prioritize financial risks to minimize potential losses and enhance decision-making processes within organizations. They analyze market trends, credit data, and economic indicators to develop risk models and recommend mitigation strategies. Their work ensures regulatory compliance and supports strategic planning by forecasting risk exposure and evaluating the effectiveness of internal controls.

Core Duties of Compliance Analysts

Compliance Analysts primarily ensure that financial institutions adhere to regulatory requirements by conducting thorough reviews of internal policies and practices. They monitor transactions and identify potential violations of laws such as anti-money laundering (AML) and Know Your Customer (KYC) regulations. Their core duties include preparing detailed compliance reports, coordinating with regulatory bodies, and implementing risk mitigation strategies to maintain organizational integrity.

Required Skills and Qualifications for Both Positions

Risk Analysts require strong analytical skills, proficiency in statistical software, and a deep understanding of financial modeling to identify and mitigate potential threats to an organization's assets. Compliance Analysts need expertise in regulatory frameworks, meticulous attention to detail, and experience with auditing processes to ensure adherence to laws and internal policies. Both roles demand excellent communication abilities and a solid foundation in finance, but Risk Analysts focus more on quantitative risk assessment while Compliance Analysts emphasize legal and regulatory compliance.

Educational Background and Certifications

Risk Analysts typically hold degrees in finance, economics, or statistics, complemented by certifications such as Financial Risk Manager (FRM) or Professional Risk Manager (PRM) to demonstrate expertise in risk assessment and mitigation. Compliance Analysts often have educational backgrounds in law, business administration, or finance, with certifications like Certified Regulatory Compliance Manager (CRCM) or Certified Compliance & Ethics Professional (CCEP) emphasizing knowledge in regulatory frameworks and corporate governance. Both roles require strong analytical skills, but their educational paths and certifications align closely with their specialized functions in risk management versus regulatory compliance.

Daily Tasks: Risk Analyst vs Compliance Analyst

Risk Analysts primarily assess financial data and market trends to identify potential risks affecting an organization's assets, often creating risk models and reporting to senior management. Compliance Analysts focus on monitoring internal policies and external regulations, conducting audits, and ensuring adherence to legal standards to prevent compliance breaches. Both roles involve detailed analysis and reporting, but Risk Analysts emphasize predictive risk management while Compliance Analysts concentrate on regulatory enforcement.

Importance of Each Role in the Finance Sector

Risk analysts play a critical role in identifying, assessing, and mitigating financial risks by analyzing market trends, credit data, and operational processes to safeguard company assets and ensure profitability. Compliance analysts ensure that financial institutions adhere to laws, regulations, and internal policies, reducing the risk of legal penalties and reputational damage through rigorous monitoring and reporting. Both roles are essential for maintaining financial stability and organizational integrity, with risk analysts focusing on proactive risk management and compliance analysts ensuring regulatory adherence.

Salary Expectations and Career Growth

Risk Analysts typically command higher salary expectations due to their specialized expertise in assessing and mitigating financial risks, with average salaries ranging from $70,000 to $100,000 annually. Compliance Analysts earn between $60,000 and $90,000, reflecting their focus on regulatory adherence and policy enforcement within financial institutions. Career growth for Risk Analysts often leads to senior roles in risk management or chief risk officer positions, while Compliance Analysts may advance toward compliance director or chief compliance officer roles, both offering significant leadership opportunities in finance.

Challenges Faced by Risk and Compliance Analysts

Risk analysts face challenges in accurately quantifying potential financial losses and adapting to evolving market risks, requiring advanced statistical models and real-time data analysis. Compliance analysts struggle with interpreting complex and frequently changing regulations, ensuring organizational adherence while minimizing disruptions. Both roles demand ongoing vigilance and collaboration to mitigate financial risks and regulatory penalties effectively.

Choosing Between a Career as a Risk Analyst or Compliance Analyst

Risk Analysts specialize in identifying, assessing, and mitigating potential financial threats to minimize losses and enhance decision-making within organizations. Compliance Analysts focus on ensuring that companies adhere to regulatory standards and internal policies to avoid legal penalties and reputational damage. Selecting a career depends on your interest in quantitative risk modeling and data analysis versus regulatory frameworks and policy enforcement within the financial industry.

Risk Analyst vs Compliance Analyst Infographic

jobdiv.com

jobdiv.com