Quantitative Analysts specialize in developing mathematical models to assess financial risks and optimize investment strategies, often utilizing advanced statistical techniques and programming skills. Data Analysts primarily focus on collecting, processing, and interpreting financial data to generate actionable insights and support decision-making within business frameworks. While both roles require strong analytical abilities, Quantitative Analysts emphasize predictive modeling in finance, whereas Data Analysts concentrate on data visualization and reporting.

Table of Comparison

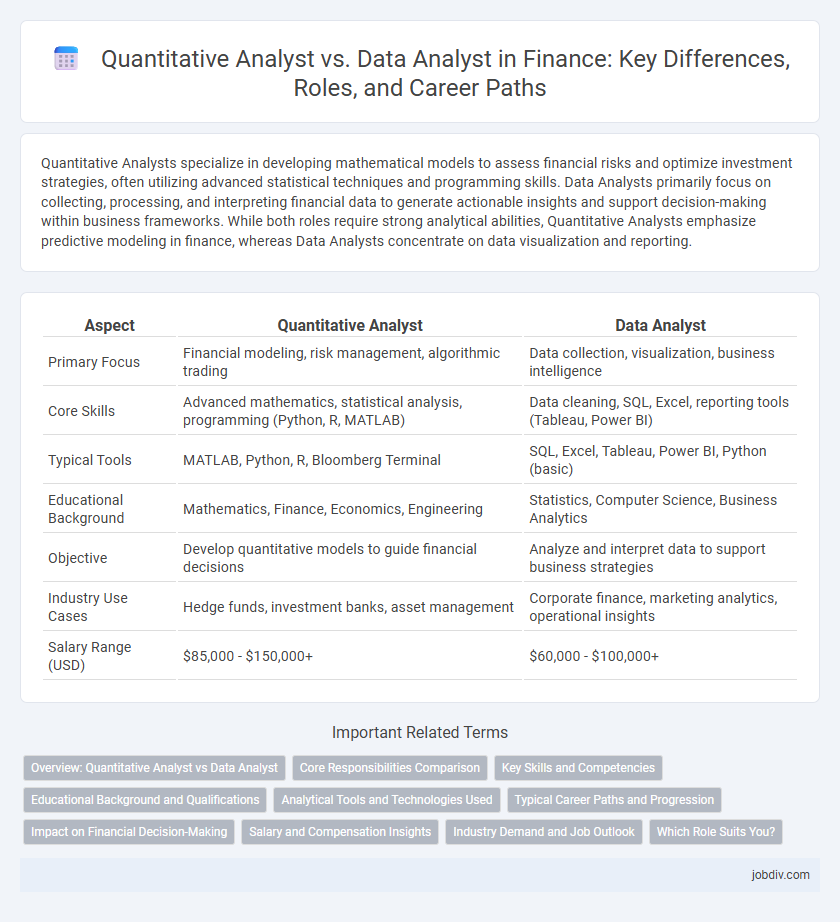

| Aspect | Quantitative Analyst | Data Analyst |

|---|---|---|

| Primary Focus | Financial modeling, risk management, algorithmic trading | Data collection, visualization, business intelligence |

| Core Skills | Advanced mathematics, statistical analysis, programming (Python, R, MATLAB) | Data cleaning, SQL, Excel, reporting tools (Tableau, Power BI) |

| Typical Tools | MATLAB, Python, R, Bloomberg Terminal | SQL, Excel, Tableau, Power BI, Python (basic) |

| Educational Background | Mathematics, Finance, Economics, Engineering | Statistics, Computer Science, Business Analytics |

| Objective | Develop quantitative models to guide financial decisions | Analyze and interpret data to support business strategies |

| Industry Use Cases | Hedge funds, investment banks, asset management | Corporate finance, marketing analytics, operational insights |

| Salary Range (USD) | $85,000 - $150,000+ | $60,000 - $100,000+ |

Overview: Quantitative Analyst vs Data Analyst

Quantitative Analysts in finance specialize in developing mathematical models to assess risk, optimize portfolios, and drive algorithmic trading strategies using advanced statistical techniques and programming languages like Python and R. Data Analysts focus on interpreting financial data, generating reports, and uncovering actionable insights through data visualization tools and SQL queries to support business decision-making. While both roles leverage data analytics, Quantitative Analysts emphasize mathematical rigor and predictive modeling, whereas Data Analysts prioritize data cleansing and exploratory analysis.

Core Responsibilities Comparison

Quantitative Analysts primarily develop complex mathematical models to support trading strategies, risk management, and portfolio optimization, leveraging advanced statistical techniques and financial theory. Data Analysts focus on extracting, cleaning, and visualizing data to generate actionable insights, improve business processes, and support decision-making through tools like SQL, Python, and BI software. Both roles require strong analytical skills, but Quantitative Analysts emphasize model-driven forecasts and algorithmic implementations, whereas Data Analysts prioritize data interpretation and reporting across various financial datasets.

Key Skills and Competencies

Quantitative Analysts excel in advanced mathematical modeling, statistical analysis, and proficiency in programming languages like Python, R, and MATLAB to build predictive financial models. Data Analysts specialize in data visualization, data cleaning, and SQL database management to interpret large datasets and support decision-making processes. Both roles require strong analytical thinking and domain knowledge, but Quantitative Analysts emphasize complex algorithm development while Data Analysts focus on data-driven insights and reporting.

Educational Background and Qualifications

Quantitative Analysts typically hold advanced degrees in mathematics, statistics, engineering, or quantitative finance, often possessing strong programming skills in languages such as Python, R, and MATLAB. Data Analysts usually have degrees in fields like statistics, computer science, or business analytics, and are proficient in data visualization tools like Tableau, SQL, and Excel. Certifications such as CFA or FRM benefit Quantitative Analysts, while Data Analysts may pursue Google Data Analytics or Microsoft Certified: Data Analyst Associate credentials.

Analytical Tools and Technologies Used

Quantitative Analysts predominantly utilize programming languages such as Python, R, and MATLAB alongside advanced statistical models, machine learning algorithms, and financial econometrics to develop pricing models and risk management strategies. Data Analysts focus on tools like SQL, Excel, Tableau, and Power BI for data extraction, cleaning, visualization, and reporting, providing actionable insights from structured and unstructured datasets. Both roles leverage big data platforms and cloud computing, but Quantitative Analysts emphasize algorithmic trading systems and stochastic calculus, while Data Analysts prioritize business intelligence and trend analysis.

Typical Career Paths and Progression

Quantitative analysts typically begin their careers in finance-focused roles such as risk management, algorithmic trading, or portfolio optimization, advancing to senior quant positions or quantitative research leadership. Data analysts often start with data cleaning, reporting, and visualization tasks before progressing to data science, business intelligence, or analytics management roles in various sectors including finance. Career progression for quants heavily relies on advanced mathematical modeling and programming skills, while data analysts benefit from expertise in data manipulation, statistical analysis, and domain-specific knowledge.

Impact on Financial Decision-Making

Quantitative analysts apply advanced mathematical models and statistical techniques to evaluate investment strategies, significantly enhancing risk assessment and portfolio optimization. Data analysts process financial datasets to identify trends and actionable insights, supporting operational decision-making and performance tracking. The quantitative analyst's expertise directly influences strategic financial decisions through predictive modeling, while data analysts improve accuracy and efficiency in reporting and data interpretation.

Salary and Compensation Insights

Quantitative Analysts in finance typically earn higher salaries than Data Analysts due to their specialized expertise in mathematical modeling, risk management, and derivative pricing, with average base salaries ranging from $100,000 to $150,000 annually. Data Analysts in finance generally have salaries between $65,000 and $95,000, reflecting their focus on data interpretation, reporting, and business intelligence. Bonus structures for Quantitative Analysts often include substantial performance-based incentives and profit-sharing, significantly increasing total compensation compared to the more fixed bonus schemes in typical Data Analyst roles.

Industry Demand and Job Outlook

Quantitative Analysts in finance are increasingly sought after for their expertise in developing complex mathematical models to drive investment strategies, with job growth projected at 10% over the next decade due to rising reliance on algorithmic trading. Data Analysts also remain in high demand, particularly for their skills in interpreting large datasets to inform risk management and regulatory compliance, with an expected growth rate of 12% fueled by expanding financial technology adoption. Both roles are critical, but Quantitative Analysts often command higher salaries reflecting their specialized quantitative skills and impact on portfolio optimization.

Which Role Suits You?

Quantitative Analysts specialize in developing mathematical models to evaluate financial risks and pricing, making them ideal for those strong in statistics, calculus, and programming languages like Python or R. Data Analysts focus on interpreting large datasets to generate actionable business insights, often relying on SQL, Excel, and data visualization tools, which suits professionals interested in reporting and trend analysis. Your career choice depends on whether you prefer complex model-driven problem solving or data interpretation to influence strategic decisions in finance.

Quantitative Analyst vs Data Analyst Infographic

jobdiv.com

jobdiv.com