A tax accountant specializes in preparing tax returns, ensuring compliance with tax laws, and providing strategic tax planning to minimize liabilities for individuals or businesses. An audit accountant focuses on examining financial statements, verifying accuracy, and assessing internal controls to ensure compliance with regulatory standards and detect fraud. Both roles require strong accounting knowledge but differ in their primary objectives and regulatory focus within finance.

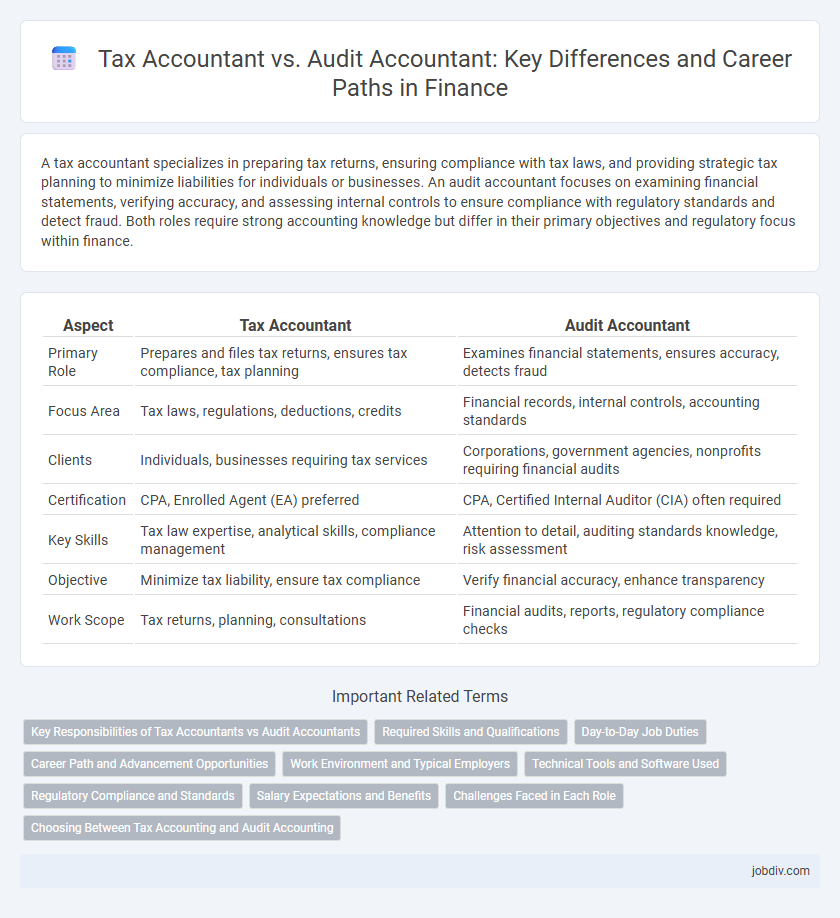

Table of Comparison

| Aspect | Tax Accountant | Audit Accountant |

|---|---|---|

| Primary Role | Prepares and files tax returns, ensures tax compliance, tax planning | Examines financial statements, ensures accuracy, detects fraud |

| Focus Area | Tax laws, regulations, deductions, credits | Financial records, internal controls, accounting standards |

| Clients | Individuals, businesses requiring tax services | Corporations, government agencies, nonprofits requiring financial audits |

| Certification | CPA, Enrolled Agent (EA) preferred | CPA, Certified Internal Auditor (CIA) often required |

| Key Skills | Tax law expertise, analytical skills, compliance management | Attention to detail, auditing standards knowledge, risk assessment |

| Objective | Minimize tax liability, ensure tax compliance | Verify financial accuracy, enhance transparency |

| Work Scope | Tax returns, planning, consultations | Financial audits, reports, regulatory compliance checks |

Key Responsibilities of Tax Accountants vs Audit Accountants

Tax accountants specialize in preparing and filing tax returns, ensuring compliance with tax regulations, and advising clients on tax planning strategies to minimize liabilities. Audit accountants focus on examining financial records and statements, verifying accuracy, and assessing internal controls to provide assurance on financial reporting reliability. Both roles require expertise in accounting principles but differ primarily in their objectives: tax accountants prioritize tax compliance and optimization, while audit accountants concentrate on financial verification and risk assessment.

Required Skills and Qualifications

Tax accountants require in-depth knowledge of tax codes, regulations, and compliance, along with strong analytical skills and proficiency in tax software. Audit accountants must possess expertise in financial reporting standards, risk assessment, and internal controls, combined with meticulous attention to detail and experience with auditing tools. Both roles demand a bachelor's degree in accounting or finance and certifications like CPA or CMA to ensure credibility and professional competence.

Day-to-Day Job Duties

Tax accountants specialize in preparing and filing tax returns, ensuring compliance with tax laws, and strategizing to minimize tax liabilities for individuals and businesses. Audit accountants conduct detailed examinations of financial statements, verifying accuracy and adherence to regulatory standards through systematic reviews and internal controls assessment. While tax accountants focus on tax-related documentation and strategic planning, audit accountants are dedicated to evaluating financial records for integrity and detecting any discrepancies or fraud.

Career Path and Advancement Opportunities

Tax accountants specialize in preparing tax returns and advising on tax planning strategies, often progressing to senior tax advisor or tax manager roles, with opportunities to become certified public accountants (CPAs) or tax consultants. Audit accountants focus on examining financial records to ensure compliance and accuracy, advancing to senior auditor, audit manager, or internal auditor positions, often pursuing certifications like CPA or Certified Internal Auditor (CIA). Both career paths offer growth through specialization, leadership roles, and expertise in regulatory frameworks within corporate finance, public accounting firms, or government agencies.

Work Environment and Typical Employers

Tax accountants typically work in office settings within accounting firms, corporate finance departments, or government tax agencies, focusing on preparing tax returns and ensuring compliance with tax laws. Audit accountants often operate in varied environments, including client sites and office settings, employed by public accounting firms, internal audit departments, or regulatory bodies to assess financial statements' accuracy. Both roles require strong attention to detail but differ in daily interactions and employer types, with tax accountants emphasizing tax regulations and audit accountants concentrating on financial compliance and controls.

Technical Tools and Software Used

Tax accountants primarily utilize software like TurboTax, H&R Block, and specialized tax preparation tools such as Intuit ProConnect and Drake Tax to manage complex tax calculations, compliance, and filing processes. Audit accountants rely heavily on data analytics and audit software like ACL, IDEA, and CaseWare to perform risk assessments, detect anomalies, and verify financial accuracy. Both professions increasingly integrate cloud-based platforms like QuickBooks Online and Microsoft Excel for enhanced data organization and real-time collaboration.

Regulatory Compliance and Standards

Tax accountants specialize in ensuring compliance with tax laws and regulations by preparing accurate tax returns and advising on tax planning strategies under the Internal Revenue Code. Audit accountants focus on examining financial statements to verify adherence to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) and regulatory requirements set by bodies like the SEC. Both roles require a deep understanding of regulatory frameworks, but tax accountants prioritize tax law compliance while audit accountants emphasize financial statement accuracy and regulatory reporting standards.

Salary Expectations and Benefits

Tax accountants typically earn an average salary ranging from $55,000 to $85,000 annually, with benefits often including tax preparation software discounts and professional development opportunities. Audit accountants generally command higher salaries, between $60,000 and $95,000, reflecting the complexity of financial statement analysis, and receive comprehensive benefits such as performance bonuses and health insurance packages. Both roles offer growth potential, but audit accountants may access more lucrative incentives linked to regulatory compliance and risk management expertise.

Challenges Faced in Each Role

Tax accountants encounter challenges such as navigating complex and frequently changing tax regulations, ensuring accurate tax filings under tight deadlines, and managing client expectations to minimize liabilities legally. Audit accountants face difficulties in assessing financial statements for compliance, detecting fraud or discrepancies through detailed examinations, and maintaining independence while managing pressure from stakeholders. Both roles require staying updated with regulatory changes, but tax accountants focus on precise interpretation for compliance, whereas audit accountants emphasize verification and risk assessment.

Choosing Between Tax Accounting and Audit Accounting

Choosing between tax accounting and audit accounting depends on your career goals and interests in finance. Tax accountants specialize in preparing tax returns, ensuring compliance with tax laws, and advising on tax strategies to minimize liabilities. Audit accountants focus on examining financial records to verify accuracy and adherence to regulations, providing assurance to stakeholders about the integrity of financial statements.

Tax Accountant vs Audit Accountant Infographic

jobdiv.com

jobdiv.com