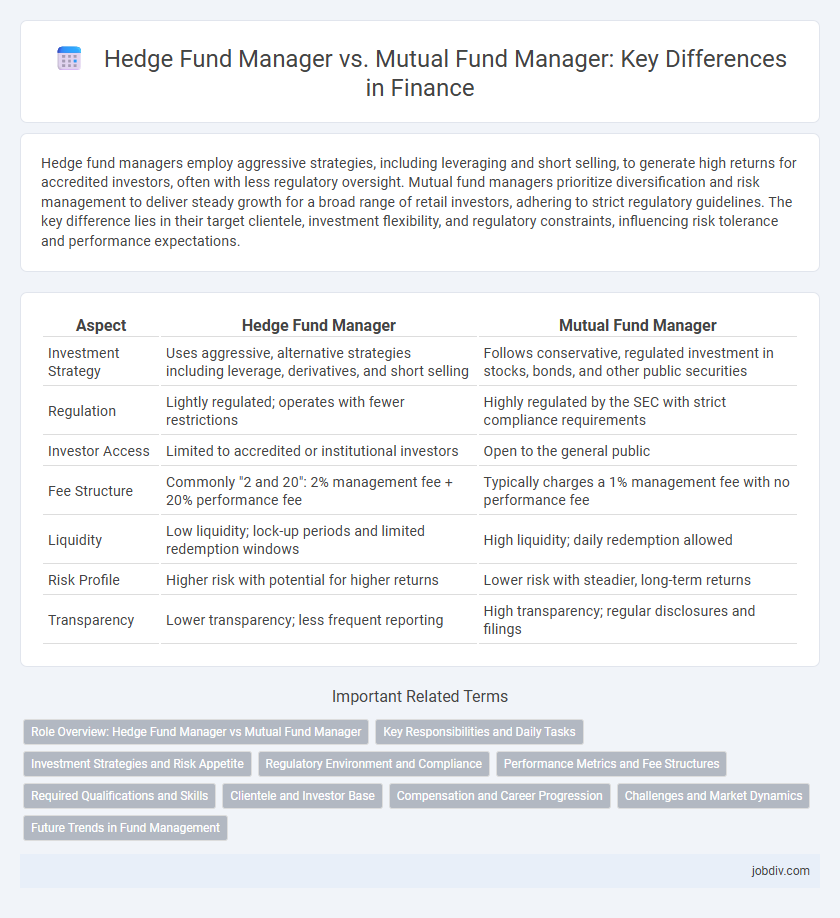

Hedge fund managers employ aggressive strategies, including leveraging and short selling, to generate high returns for accredited investors, often with less regulatory oversight. Mutual fund managers prioritize diversification and risk management to deliver steady growth for a broad range of retail investors, adhering to strict regulatory guidelines. The key difference lies in their target clientele, investment flexibility, and regulatory constraints, influencing risk tolerance and performance expectations.

Table of Comparison

| Aspect | Hedge Fund Manager | Mutual Fund Manager |

|---|---|---|

| Investment Strategy | Uses aggressive, alternative strategies including leverage, derivatives, and short selling | Follows conservative, regulated investment in stocks, bonds, and other public securities |

| Regulation | Lightly regulated; operates with fewer restrictions | Highly regulated by the SEC with strict compliance requirements |

| Investor Access | Limited to accredited or institutional investors | Open to the general public |

| Fee Structure | Commonly "2 and 20": 2% management fee + 20% performance fee | Typically charges a 1% management fee with no performance fee |

| Liquidity | Low liquidity; lock-up periods and limited redemption windows | High liquidity; daily redemption allowed |

| Risk Profile | Higher risk with potential for higher returns | Lower risk with steadier, long-term returns |

| Transparency | Lower transparency; less frequent reporting | High transparency; regular disclosures and filings |

Role Overview: Hedge Fund Manager vs Mutual Fund Manager

Hedge fund managers actively employ advanced strategies such as short selling, leverage, and derivatives to generate high returns for accredited investors, often taking on greater risk and less regulatory oversight compared to mutual fund managers. Mutual fund managers primarily focus on long-term growth and income by investing in diversified portfolios of stocks, bonds, and other securities, adhering to strict regulatory frameworks designed to protect retail investors. The key distinction lies in the target investor base and investment flexibility, with hedge fund managers targeting high-net-worth individuals seeking aggressive performance and mutual fund managers catering to general public investors prioritizing stability and liquidity.

Key Responsibilities and Daily Tasks

Hedge fund managers focus on generating high returns through complex strategies such as leverage, derivatives, and short selling, requiring constant market analysis and risk management. Mutual fund managers prioritize diversification and risk mitigation by investing in a broad portfolio of stocks and bonds, ensuring alignment with the fund's investment objectives and regulatory compliance. Daily tasks for hedge fund managers involve active trading, performance monitoring, and adjusting strategies, while mutual fund managers focus on portfolio rebalancing, client communication, and adherence to investment mandates.

Investment Strategies and Risk Appetite

Hedge fund managers employ aggressive investment strategies including leverage, short selling, and derivatives to achieve high returns, often targeting absolute performance regardless of market conditions. Mutual fund managers focus on diversified portfolios of stocks and bonds with a lower risk appetite, aiming for steady, long-term growth aligned with investors' risk tolerance and regulatory constraints. The risk appetite differs significantly, as hedge funds accept higher volatility and potential losses, while mutual funds prioritize capital preservation and regulatory compliance.

Regulatory Environment and Compliance

Hedge fund managers operate under less stringent regulatory frameworks compared to mutual fund managers, who are subject to rigorous oversight by the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940. Compliance requirements for mutual fund managers include regular disclosure of portfolio holdings, adherence to liquidity rules, and strict rules on marketing and sales practices. Hedge fund managers, often targeting accredited investors, face regulations primarily through the Investment Advisers Act of 1940 but benefit from exemptions allowing more flexible investment strategies and less frequent reporting.

Performance Metrics and Fee Structures

Hedge fund managers typically use performance metrics such as absolute returns, alpha, and the Sharpe ratio to assess fund success, while mutual fund managers often emphasize relative performance against benchmark indices and the beta coefficient. Hedge funds employ fee structures like the "2 and 20" model, charging 2% management fees and 20% performance fees, whereas mutual funds usually charge a lower fixed expense ratio around 0.5% to 1.5% without performance fees. These differences reflect the distinct investment strategies and risk profiles that hedge fund and mutual fund managers pursue.

Required Qualifications and Skills

Hedge fund managers typically require advanced degrees in finance, economics, or mathematics, along with strong analytical skills and experience in risk management and alternative investment strategies. Mutual fund managers often hold certifications such as the CFA designation and possess expertise in portfolio management, regulatory compliance, and fundamental analysis of publicly traded securities. Both roles demand excellent quantitative abilities, decision-making under uncertainty, and proficiency in financial modeling and market research.

Clientele and Investor Base

Hedge fund managers typically serve high-net-worth individuals and institutional investors seeking aggressive growth and are willing to accept higher risks and less liquidity. Mutual fund managers cater to a broader retail investor base, including individual investors, aiming for diversified portfolios with lower risk and greater liquidity. The distinct clientele influences investment strategies, regulatory requirements, and fee structures across the two fund types.

Compensation and Career Progression

Hedge fund managers typically earn higher compensation than mutual fund managers, with significant performance-based bonuses and profit-sharing opportunities driving multi-million dollar incomes. Career progression in hedge funds often involves rapid advancement through managing larger funds and expanding investor relationships, while mutual fund managers usually follow a more structured path with incremental increases tied to fund performance and assets under management. The compensation disparity reflects the higher risk and reward profile inherent to hedge fund strategies compared to the more regulated, stable mutual fund environment.

Challenges and Market Dynamics

Hedge fund managers face challenges such as managing complex strategies, navigating less regulatory oversight, and delivering alpha in highly volatile markets, while mutual fund managers must prioritize liquidity, adhere to strict regulatory frameworks, and manage large asset inflows and outflows. Market dynamics influence hedge funds with opportunities for leverage and short selling, contrasting with mutual funds' focus on diversified portfolios to mitigate risk and meet retail investor expectations. Both roles require adapting to shifting interest rates, economic cycles, and evolving investor sentiment but employ different risk management and performance measurement techniques.

Future Trends in Fund Management

Hedge fund managers are increasingly leveraging artificial intelligence and alternative data to enhance predictive analytics and generate alpha, while mutual fund managers focus on passive investment strategies and ESG integration to meet growing regulatory and investor demands. The rise of decentralized finance (DeFi) and blockchain technology is compelling both hedge and mutual fund managers to innovate in transparency, liquidity, and operational efficiency. Future fund management trends emphasize automation, personalized portfolio solutions using big data, and stronger risk management frameworks driven by advanced machine learning algorithms.

Hedge Fund Manager vs Mutual Fund Manager Infographic

jobdiv.com

jobdiv.com