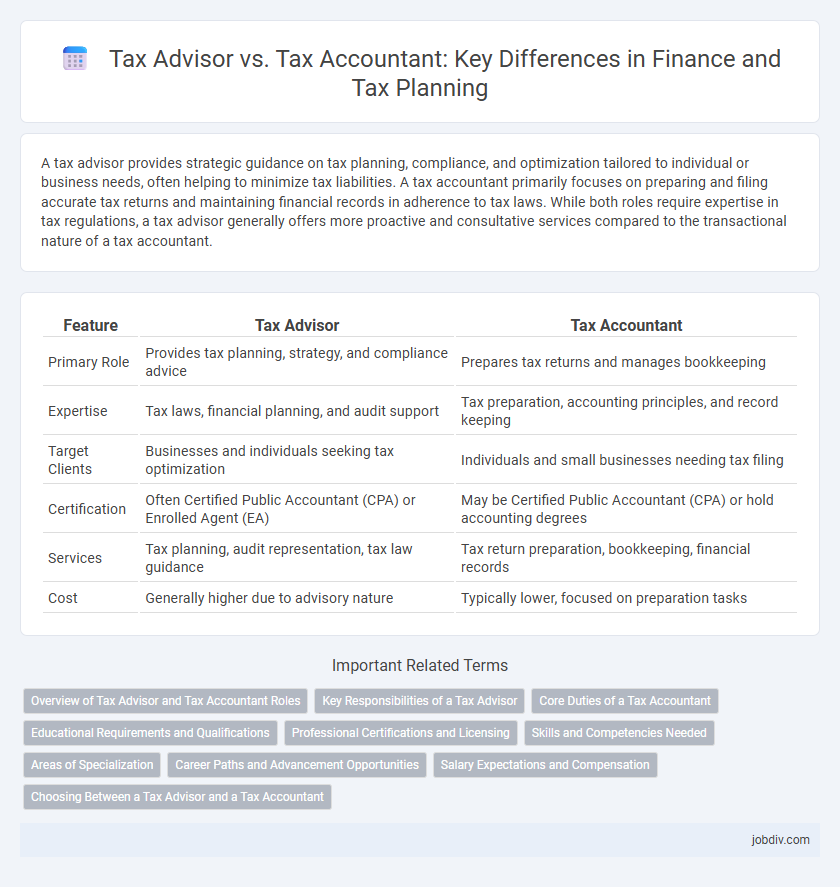

A tax advisor provides strategic guidance on tax planning, compliance, and optimization tailored to individual or business needs, often helping to minimize tax liabilities. A tax accountant primarily focuses on preparing and filing accurate tax returns and maintaining financial records in adherence to tax laws. While both roles require expertise in tax regulations, a tax advisor generally offers more proactive and consultative services compared to the transactional nature of a tax accountant.

Table of Comparison

| Feature | Tax Advisor | Tax Accountant |

|---|---|---|

| Primary Role | Provides tax planning, strategy, and compliance advice | Prepares tax returns and manages bookkeeping |

| Expertise | Tax laws, financial planning, and audit support | Tax preparation, accounting principles, and record keeping |

| Target Clients | Businesses and individuals seeking tax optimization | Individuals and small businesses needing tax filing |

| Certification | Often Certified Public Accountant (CPA) or Enrolled Agent (EA) | May be Certified Public Accountant (CPA) or hold accounting degrees |

| Services | Tax planning, audit representation, tax law guidance | Tax return preparation, bookkeeping, financial records |

| Cost | Generally higher due to advisory nature | Typically lower, focused on preparation tasks |

Overview of Tax Advisor and Tax Accountant Roles

Tax advisors specialize in offering strategic tax planning, compliance advice, and personalized tax-saving strategies for individuals and businesses, often working closely with clients to minimize tax liabilities. Tax accountants focus primarily on preparing and filing tax returns, maintaining accurate financial records, and ensuring compliance with tax regulations. Both roles require a deep understanding of tax laws but differ in scope, with advisors providing broader consulting services and accountants handling detailed tax documentation and reporting.

Key Responsibilities of a Tax Advisor

A Tax Advisor specializes in providing strategic tax planning, ensuring compliance with tax laws, and optimizing tax liabilities for individuals and businesses. Their key responsibilities include analyzing financial documents to identify tax-saving opportunities, advising on complex tax regulations, and representing clients during tax audits. Unlike Tax Accountants who primarily focus on preparing tax returns and financial statements, Tax Advisors deliver comprehensive guidance to minimize tax risks and enhance fiscal efficiency.

Core Duties of a Tax Accountant

A Tax Accountant primarily focuses on preparing and filing tax returns, ensuring compliance with tax laws, and managing financial records related to taxation. They analyze financial documents to identify tax liabilities and deductions, helping individuals and businesses optimize their tax positions. Unlike Tax Advisors, Tax Accountants handle detailed record-keeping and execute tax strategies based on established regulations.

Educational Requirements and Qualifications

Tax advisors typically hold advanced degrees in finance, accounting, or law, often complemented by certifications such as CPA (Certified Public Accountant) or EA (Enrolled Agent). Tax accountants usually possess a bachelor's degree in accounting or finance and may pursue additional certifications like CPA to enhance expertise. Both roles require a strong understanding of tax laws and regulations, but tax advisors often engage in strategic tax planning while tax accountants focus on tax preparation and compliance.

Professional Certifications and Licensing

Tax advisors typically hold certifications such as the Certified Public Accountant (CPA) or Enrolled Agent (EA) licenses, enabling them to provide comprehensive tax planning and representation before the IRS. Tax accountants often have credentials like the CPA or Chartered Accountant (CA), focusing more on preparing and reviewing financial statements and tax returns. Licensing requirements vary by jurisdiction but generally mandate passing rigorous exams and fulfilling continuing education to maintain professional standards.

Skills and Competencies Needed

Tax advisors require advanced strategic planning skills, deep knowledge of tax laws, and the ability to interpret complex regulations to optimize client tax liabilities. Tax accountants need strong analytical abilities, proficiency in accounting software, and expertise in preparing accurate tax returns and financial statements. Both roles demand attention to detail, ethical standards, and continuous education to stay updated with evolving tax codes.

Areas of Specialization

Tax advisors specialize in strategic tax planning, compliance, and advising clients on minimizing tax liabilities through legal means, often focusing on complex tax codes and regulations in areas such as corporate, international, and estate tax. Tax accountants concentrate on preparing and filing tax returns, maintaining financial records, and ensuring accurate tax reporting according to current tax laws, commonly working with individual, business, and payroll tax issues. Both professionals play critical roles in tax management but differ in their emphasis on proactive planning versus meticulous record-keeping and compliance.

Career Paths and Advancement Opportunities

Tax advisors specialize in strategic tax planning and compliance, often pursuing certifications like CPA or EA to advance into consultancy or senior advisory roles. Tax accountants focus on preparing and analyzing financial records and tax returns, with career progression typically involving roles such as senior accountant, audit manager, or financial controller. Both careers offer advancement opportunities, but tax advisors generally experience broader consulting roles in corporate finance, while tax accountants may transition into finance management or accounting leadership positions.

Salary Expectations and Compensation

Tax advisors typically command higher salaries than tax accountants due to their specialized expertise in tax strategy and planning, with average annual earnings ranging from $70,000 to $120,000 depending on experience and location. Tax accountants usually earn between $50,000 and $90,000 annually, focusing on preparing tax returns and ensuring compliance, with compensation influenced by certifications such as CPA. Bonuses and benefits for tax advisors often include performance-based incentives and profit sharing, while tax accountants may receive standard firm benefits and smaller performance bonuses.

Choosing Between a Tax Advisor and a Tax Accountant

Choosing between a tax advisor and a tax accountant depends on the complexity of your financial situation and your specific tax needs. Tax advisors offer strategic planning, helping minimize liabilities and optimize tax outcomes through personalized advice, while tax accountants focus on accurate tax return preparation and compliance with regulations. For businesses or individuals facing intricate tax issues, consulting a tax advisor may provide comprehensive guidance, whereas routine filings typically benefit from a tax accountant's expertise.

Tax Advisor vs Tax Accountant Infographic

jobdiv.com

jobdiv.com