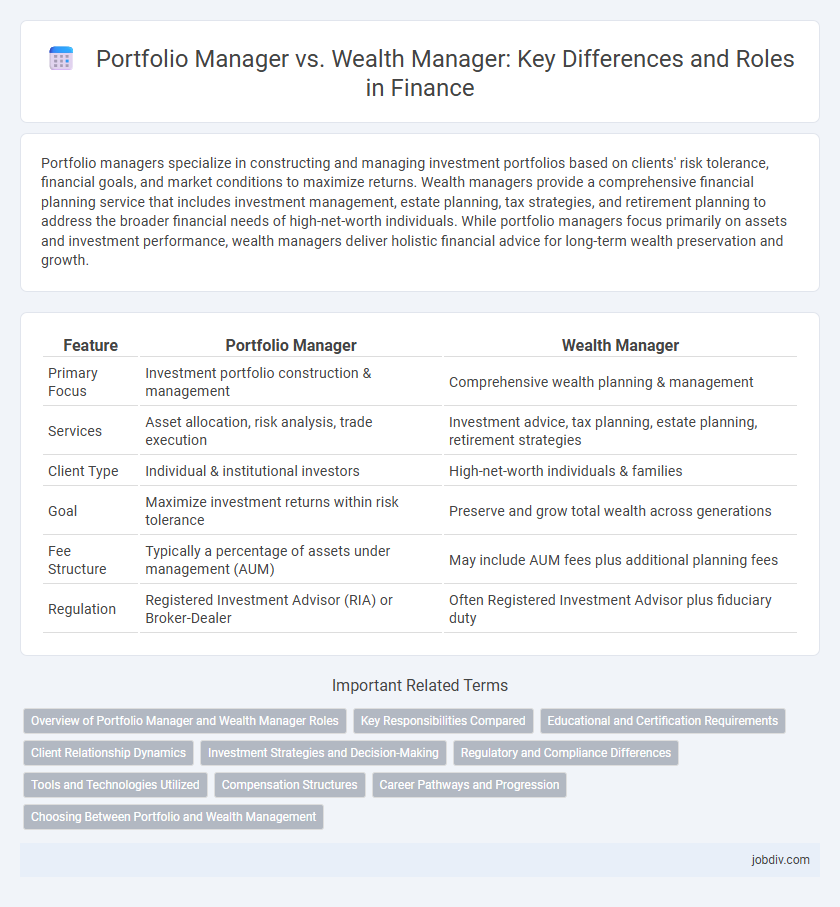

Portfolio managers specialize in constructing and managing investment portfolios based on clients' risk tolerance, financial goals, and market conditions to maximize returns. Wealth managers provide a comprehensive financial planning service that includes investment management, estate planning, tax strategies, and retirement planning to address the broader financial needs of high-net-worth individuals. While portfolio managers focus primarily on assets and investment performance, wealth managers deliver holistic financial advice for long-term wealth preservation and growth.

Table of Comparison

| Feature | Portfolio Manager | Wealth Manager |

|---|---|---|

| Primary Focus | Investment portfolio construction & management | Comprehensive wealth planning & management |

| Services | Asset allocation, risk analysis, trade execution | Investment advice, tax planning, estate planning, retirement strategies |

| Client Type | Individual & institutional investors | High-net-worth individuals & families |

| Goal | Maximize investment returns within risk tolerance | Preserve and grow total wealth across generations |

| Fee Structure | Typically a percentage of assets under management (AUM) | May include AUM fees plus additional planning fees |

| Regulation | Registered Investment Advisor (RIA) or Broker-Dealer | Often Registered Investment Advisor plus fiduciary duty |

Overview of Portfolio Manager and Wealth Manager Roles

A Portfolio Manager focuses on managing investment portfolios by analyzing market trends, selecting securities, and optimizing asset allocation to maximize returns based on clients' risk tolerance and financial goals. A Wealth Manager provides holistic financial services, including investment management, estate planning, tax advisory, and retirement planning to high-net-worth individuals. Both roles require deep financial expertise, but portfolio managers concentrate primarily on investment decisions, while wealth managers address broader financial needs.

Key Responsibilities Compared

Portfolio managers primarily focus on the selection and management of investment assets, including stocks, bonds, and mutual funds, to achieve specific financial goals based on risk tolerance and market conditions. Wealth managers offer a broader range of services encompassing financial planning, tax strategies, estate planning, and investment management tailored to high-net-worth clients. The key distinction lies in portfolio managers' emphasis on asset performance and allocation, whereas wealth managers provide comprehensive financial advice and holistic wealth preservation strategies.

Educational and Certification Requirements

Portfolio managers typically require a bachelor's degree in finance, economics, or a related field, often supplemented by certifications such as the Chartered Financial Analyst (CFA) designation to demonstrate expertise in investment analysis and portfolio construction. Wealth managers usually possess similar academic credentials but often pursue additional certifications like Certified Financial Planner (CFP) to emphasize comprehensive financial planning, tax, estate, and retirement strategies for high-net-worth individuals. Both roles benefit from continuous education and professional development to stay current with regulatory changes and market trends.

Client Relationship Dynamics

Portfolio managers concentrate on managing investment assets and making data-driven decisions to optimize returns, often engaging with clients primarily through performance reporting and investment strategy discussions. Wealth managers provide a holistic approach, addressing broader financial planning needs such as estate planning, tax optimization, and risk management while fostering deep, ongoing personal relationships with clients. Client relationship dynamics vary as portfolio managers emphasize technical expertise and portfolio performance, whereas wealth managers prioritize trust, tailored advice, and long-term financial well-being.

Investment Strategies and Decision-Making

Portfolio managers concentrate on crafting and executing investment strategies tailored to specific asset allocations and risk profiles within a client's portfolio. Wealth managers take a broader approach, integrating investment decisions with comprehensive financial planning, including tax optimization, estate planning, and retirement goals. Investment strategies by portfolio managers are more focused on market analysis, asset selection, and performance metrics, while wealth managers emphasize holistic financial health and long-term wealth preservation.

Regulatory and Compliance Differences

Portfolio managers operate under stringent regulations such as the Investment Advisers Act of 1940, focusing on investment decisions and fiduciary duties related to client portfolios. Wealth managers adhere to broader compliance frameworks encompassing estate planning, tax advisory, and trust services, often requiring multidisciplinary licenses and adherence to both financial and legal regulatory standards. Regulatory bodies including the SEC, FINRA, and state-level agencies oversee portfolio managers, while wealth managers may also be subject to regulations from IRS and state trust departments due to the comprehensive nature of their services.

Tools and Technologies Utilized

Portfolio managers leverage advanced analytics software, algorithm-driven trading platforms, and risk management tools to optimize asset allocation and performance. Wealth managers utilize comprehensive financial planning software, client relationship management (CRM) systems, and tax optimization tools to provide holistic and personalized wealth advisory services. Both professionals increasingly adopt artificial intelligence (AI) and machine learning technologies to enhance decision-making and client outcomes.

Compensation Structures

Portfolio managers typically receive compensation through a combination of base salary, performance bonuses, and a percentage of assets under management (AUM), incentivizing returns and asset growth. Wealth managers often have a more diverse compensation structure including fixed fees, commissions on financial products, and advisory fees, aligning payments with client service and holistic financial planning. Understanding these differences helps clients and professionals navigate fee transparency and align expectations with compensation motivation.

Career Pathways and Progression

Portfolio managers typically advance through roles in investment analysis, asset management, and risk assessment, emphasizing quantitative skills and market expertise to oversee client portfolios. Wealth managers follow a broader career pathway involving financial planning, tax strategies, and client relationship management, focusing on holistic wealth preservation and growth. Both career tracks offer progression from junior analyst or advisor positions to senior management or chief investment officer roles, with increasing responsibility for client assets and strategic decision-making.

Choosing Between Portfolio and Wealth Management

Choosing between a portfolio manager and a wealth manager depends on the scope of financial goals and service needs; portfolio managers specialize in managing investment portfolios based on risk tolerance, asset allocation, and market conditions, while wealth managers provide comprehensive financial planning, including tax, estate, retirement, and investment strategies. Investors seeking focused asset management prioritize portfolio managers for optimizing returns and mitigating risks, whereas those requiring holistic financial advice and coordination of various financial aspects lean towards wealth managers. Understanding the differences in expertise, service breadth, and client objectives is critical for aligning with the right professional to achieve personalized financial success.

Portfolio Manager vs Wealth Manager Infographic

jobdiv.com

jobdiv.com