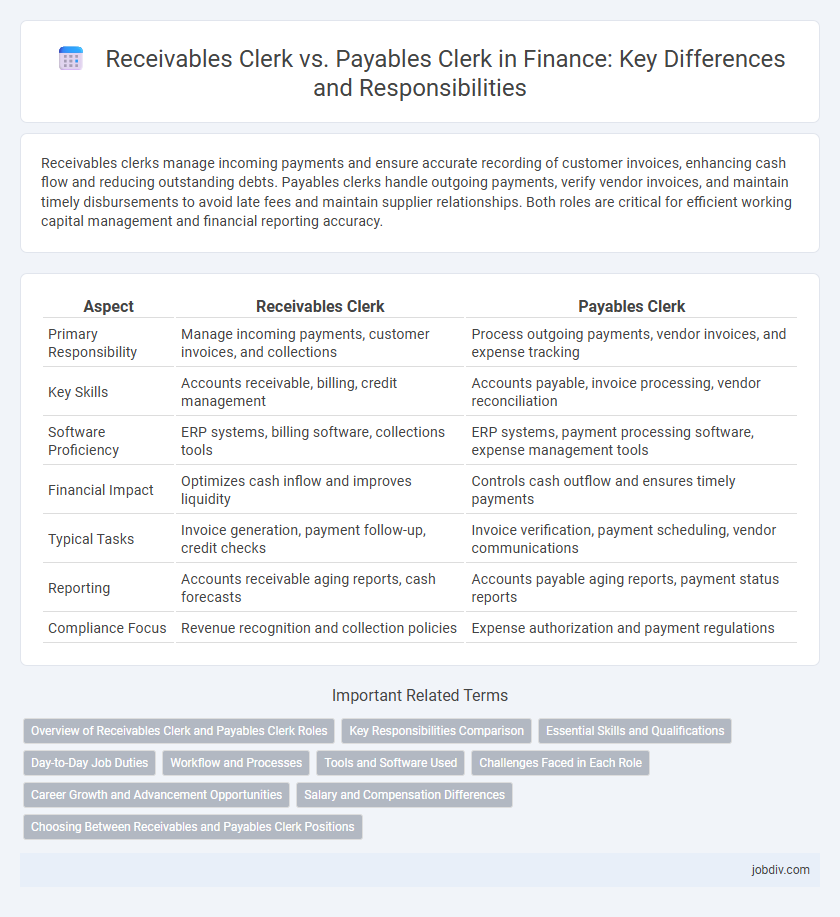

Receivables clerks manage incoming payments and ensure accurate recording of customer invoices, enhancing cash flow and reducing outstanding debts. Payables clerks handle outgoing payments, verify vendor invoices, and maintain timely disbursements to avoid late fees and maintain supplier relationships. Both roles are critical for efficient working capital management and financial reporting accuracy.

Table of Comparison

| Aspect | Receivables Clerk | Payables Clerk |

|---|---|---|

| Primary Responsibility | Manage incoming payments, customer invoices, and collections | Process outgoing payments, vendor invoices, and expense tracking |

| Key Skills | Accounts receivable, billing, credit management | Accounts payable, invoice processing, vendor reconciliation |

| Software Proficiency | ERP systems, billing software, collections tools | ERP systems, payment processing software, expense management tools |

| Financial Impact | Optimizes cash inflow and improves liquidity | Controls cash outflow and ensures timely payments |

| Typical Tasks | Invoice generation, payment follow-up, credit checks | Invoice verification, payment scheduling, vendor communications |

| Reporting | Accounts receivable aging reports, cash forecasts | Accounts payable aging reports, payment status reports |

| Compliance Focus | Revenue recognition and collection policies | Expense authorization and payment regulations |

Overview of Receivables Clerk and Payables Clerk Roles

Receivables Clerks manage incoming payments, ensuring accurate recording and timely collection of customer invoices to maintain cash flow. Payables Clerks handle outgoing payments by verifying, processing, and reconciling vendor invoices to avoid discrepancies and maintain good supplier relationships. Both roles require strong attention to detail and proficiency in accounting software to support financial accuracy and operational efficiency.

Key Responsibilities Comparison

Receivables clerks manage and monitor incoming payments, ensuring accurate invoicing and timely collection of accounts receivable, while payables clerks handle outgoing payments, verifying invoices, processing expense reports, and maintaining vendor relationships. Both roles require meticulous record-keeping and reconciliation to maintain financial accuracy and support audit compliance. Effective coordination between receivables and payables clerks enhances cash flow management and overall financial stability.

Essential Skills and Qualifications

Receivables Clerks require strong attention to detail, proficiency in accounting software such as QuickBooks or SAP, and excellent communication skills to manage customer accounts and collections effectively. Payables Clerks need expertise in invoice processing, vendor relationship management, and accuracy in data entry using ERP systems like Oracle or Microsoft Dynamics. Both roles demand solid mathematical abilities, understanding of financial regulations, and the capacity to reconcile discrepancies efficiently.

Day-to-Day Job Duties

Receivables Clerks focus on managing incoming payments, processing invoices, and reconciling account balances to ensure accurate tracking of customer payments. Payables Clerks handle outgoing payments by verifying, processing, and recording vendor invoices while maintaining timely disbursement to suppliers. Both roles require attention to detail, strong organizational skills, and proficiency in accounting software to maintain accurate financial records.

Workflow and Processes

Receivables clerks manage incoming payments, ensuring accurate invoicing, payment application, and account reconciliation to maintain cash flow. Payables clerks handle outgoing payments, processing vendor invoices, verifying expenses, and scheduling disbursements to optimize accounts payable schedules. Both roles require strict adherence to financial controls and accurate record-keeping to support overall accounting integrity and financial reporting.

Tools and Software Used

Receivables clerks primarily use accounting software such as QuickBooks, SAP, and Oracle Financials to track incoming payments and manage customer invoices efficiently. Payables clerks rely on tools like Microsoft Excel, SAP Ariba, and AP automation software to process vendor invoices and ensure timely payments. Both roles benefit from ERP systems integration to streamline financial workflows and maintain accurate records.

Challenges Faced in Each Role

Receivables clerks face challenges such as managing overdue payments, reconciling discrepancies in customer accounts, and maintaining accurate records to ensure timely cash flow. Payables clerks struggle with verifying the accuracy of invoices, preventing duplicate payments, and ensuring compliance with company policies and regulatory requirements. Both roles require strong attention to detail, effective communication skills, and proficiency in financial software to minimize errors and support overall financial health.

Career Growth and Advancement Opportunities

Receivables Clerks often gain experience in credit management and customer account analysis, positioning them for advancement into roles like Credit Analyst or Accounts Receivable Supervisor. Payables Clerks develop expertise in vendor relations and payment processing, which can lead to promotions such as Accounts Payable Manager or Procurement Specialist. Both career paths offer solid growth potential within financial operations, but the Receivables Clerk role may provide broader exposure to revenue cycle management, enhancing upward mobility.

Salary and Compensation Differences

Receivables clerks typically earn an average salary ranging from $35,000 to $50,000 annually, focusing on managing incoming payments and customer invoices. Payables clerks, responsible for processing outgoing payments and vendor invoices, usually have a slightly lower salary range of $32,000 to $45,000 per year. Compensation differences are influenced by the complexity of tasks and regional market demand, with receivables clerks often receiving more in bonuses due to their direct impact on cash flow.

Choosing Between Receivables and Payables Clerk Positions

Choosing between receivables and payables clerk positions depends on skills in managing incoming and outgoing financial transactions. Receivables clerks focus on tracking customer payments, invoicing, and maintaining accurate accounts receivable records, which requires strong attention to detail and communication abilities. Payables clerks handle vendor invoices, authorize payments, and manage cash flow, demanding proficiency in reconciliations and compliance with company policies.

Receivables Clerk vs Payables Clerk Infographic

jobdiv.com

jobdiv.com