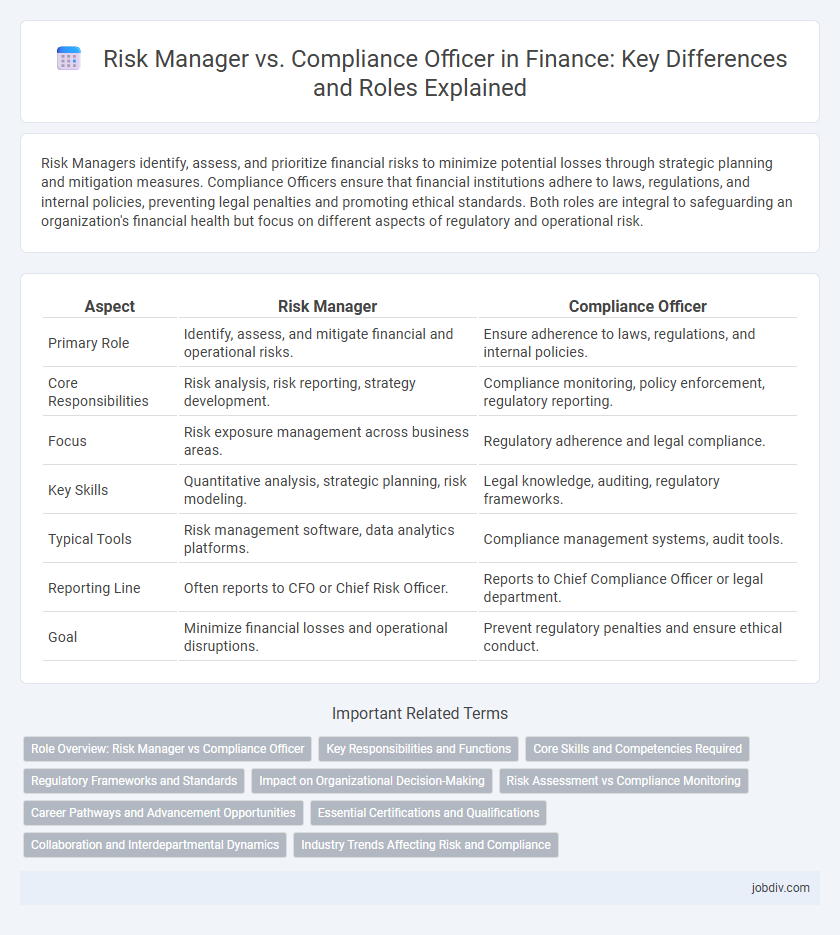

Risk Managers identify, assess, and prioritize financial risks to minimize potential losses through strategic planning and mitigation measures. Compliance Officers ensure that financial institutions adhere to laws, regulations, and internal policies, preventing legal penalties and promoting ethical standards. Both roles are integral to safeguarding an organization's financial health but focus on different aspects of regulatory and operational risk.

Table of Comparison

| Aspect | Risk Manager | Compliance Officer |

|---|---|---|

| Primary Role | Identify, assess, and mitigate financial and operational risks. | Ensure adherence to laws, regulations, and internal policies. |

| Core Responsibilities | Risk analysis, risk reporting, strategy development. | Compliance monitoring, policy enforcement, regulatory reporting. |

| Focus | Risk exposure management across business areas. | Regulatory adherence and legal compliance. |

| Key Skills | Quantitative analysis, strategic planning, risk modeling. | Legal knowledge, auditing, regulatory frameworks. |

| Typical Tools | Risk management software, data analytics platforms. | Compliance management systems, audit tools. |

| Reporting Line | Often reports to CFO or Chief Risk Officer. | Reports to Chief Compliance Officer or legal department. |

| Goal | Minimize financial losses and operational disruptions. | Prevent regulatory penalties and ensure ethical conduct. |

Role Overview: Risk Manager vs Compliance Officer

Risk Managers identify, assess, and mitigate financial risks to protect organizational assets and ensure business continuity, often using quantitative analysis and risk modeling techniques. Compliance Officers develop and enforce internal policies that align with regulatory requirements, ensuring the organization adheres to laws such as Sarbanes-Oxley, GDPR, and Basel III. Both roles collaborate to safeguard the financial institution from operational, legal, and reputational risks but focus respectively on risk evaluation and regulatory adherence.

Key Responsibilities and Functions

Risk Managers identify, assess, and mitigate potential financial risks by developing risk models and monitoring market trends to protect organizational assets. Compliance Officers ensure adherence to regulatory requirements and internal policies by conducting audits, training employees, and reporting compliance status to regulatory bodies. Both roles collaborate to safeguard the organization's integrity, with Risk Managers focusing on risk exposure and Compliance Officers on regulatory adherence.

Core Skills and Competencies Required

Risk Managers must excel in quantitative analysis, risk assessment, and strategic decision-making to identify and mitigate financial risks effectively. Compliance Officers require deep knowledge of regulatory frameworks, attention to detail, and strong ethical judgment to ensure adherence to laws and internal policies. Both roles demand excellent communication skills, critical thinking, and the ability to collaborate across departments for successful risk mitigation and regulatory compliance.

Regulatory Frameworks and Standards

Risk managers focus on identifying, assessing, and mitigating financial and operational risks within regulatory frameworks such as Basel III, SOX, and GDPR, ensuring that risk exposure aligns with organizational tolerance. Compliance officers monitor adherence to legal and regulatory standards like AML (Anti-Money Laundering), MiFID II, and Dodd-Frank, implementing policies to prevent violations and maintaining audit trails. Both roles collaborate to interpret regulatory changes and integrate standards into internal controls, safeguarding the institution from penalties and reputational damage.

Impact on Organizational Decision-Making

A Risk Manager analyzes financial threats and opportunities to influence strategic decisions, enhancing the organization's ability to mitigate losses and capitalize on market conditions. A Compliance Officer ensures adherence to regulatory standards and internal policies, preventing legal penalties and maintaining the company's reputation. Together, they shape organizational decision-making by balancing risk exposure with regulatory requirements, promoting sustainable growth and stability.

Risk Assessment vs Compliance Monitoring

Risk Managers specialize in risk assessment by identifying, analyzing, and mitigating potential financial threats to optimize organizational resilience. Compliance Officers focus on compliance monitoring by ensuring adherence to regulatory requirements and internal policies to prevent legal breaches and fines. Effective collaboration between these roles enhances overall risk governance and safeguards financial stability.

Career Pathways and Advancement Opportunities

Risk Managers often progress from roles in financial analysis or auditing, advancing through certifications like FRM (Financial Risk Manager) to senior risk specialist or chief risk officer positions. Compliance Officers typically start in regulatory affairs or legal support, gaining expertise via certifications such as CRCM (Certified Regulatory Compliance Manager) to move into compliance director or chief compliance officer roles. Both career pathways offer advancement opportunities but emphasize different skill sets: Risk Managers focus on identifying and mitigating financial risks, while Compliance Officers specialize in ensuring adherence to laws and regulations.

Essential Certifications and Qualifications

Risk Managers typically require certifications such as the Financial Risk Manager (FRM) or Professional Risk Manager (PRM) designation, emphasizing expertise in risk assessment and mitigation strategies. Compliance Officers often pursue Certified Compliance & Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM) credentials, highlighting proficiency in regulatory frameworks and adherence standards. Both roles benefit from strong knowledge of laws like Sarbanes-Oxley (SOX) and Basel III, yet their certifications reflect distinct focuses within financial risk management and regulatory compliance.

Collaboration and Interdepartmental Dynamics

Risk Managers and Compliance Officers collaborate closely to ensure organizational resilience by aligning risk mitigation strategies with regulatory requirements. Their interdepartmental dynamics involve continuous communication with legal, audit, and operational teams to identify potential risks and enforce compliance frameworks. Effective collaboration between these roles enhances proactive decision-making and strengthens the overall governance structure.

Industry Trends Affecting Risk and Compliance

Risk managers increasingly leverage artificial intelligence and machine learning to identify and mitigate financial risks, adapting to the growing complexity of cyber threats and market volatility in the banking and investment sectors. Compliance officers face evolving regulatory frameworks, particularly related to anti-money laundering (AML) and data privacy laws like GDPR and CCPA, driving the demand for automated compliance monitoring and real-time reporting tools. Both roles are converging through integrated risk and compliance platforms that enhance decision-making efficiency and regulatory adherence in highly regulated industries such as finance and insurance.

Risk Manager vs Compliance Officer Infographic

jobdiv.com

jobdiv.com