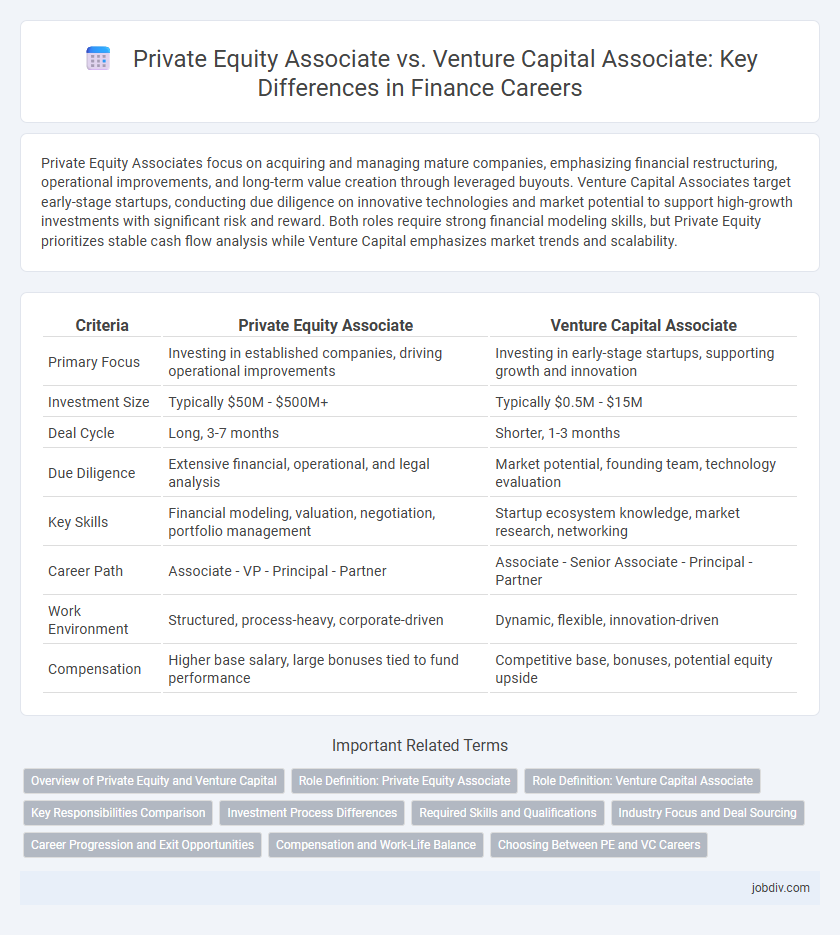

Private Equity Associates focus on acquiring and managing mature companies, emphasizing financial restructuring, operational improvements, and long-term value creation through leveraged buyouts. Venture Capital Associates target early-stage startups, conducting due diligence on innovative technologies and market potential to support high-growth investments with significant risk and reward. Both roles require strong financial modeling skills, but Private Equity prioritizes stable cash flow analysis while Venture Capital emphasizes market trends and scalability.

Table of Comparison

| Criteria | Private Equity Associate | Venture Capital Associate |

|---|---|---|

| Primary Focus | Investing in established companies, driving operational improvements | Investing in early-stage startups, supporting growth and innovation |

| Investment Size | Typically $50M - $500M+ | Typically $0.5M - $15M |

| Deal Cycle | Long, 3-7 months | Shorter, 1-3 months |

| Due Diligence | Extensive financial, operational, and legal analysis | Market potential, founding team, technology evaluation |

| Key Skills | Financial modeling, valuation, negotiation, portfolio management | Startup ecosystem knowledge, market research, networking |

| Career Path | Associate - VP - Principal - Partner | Associate - Senior Associate - Principal - Partner |

| Work Environment | Structured, process-heavy, corporate-driven | Dynamic, flexible, innovation-driven |

| Compensation | Higher base salary, large bonuses tied to fund performance | Competitive base, bonuses, potential equity upside |

Overview of Private Equity and Venture Capital

Private Equity Associates manage investments in established companies through buying, improving, and eventually selling stakes for profit, focusing on mature businesses with steady cash flows. Venture Capital Associates invest in early-stage startups with high growth potential, emphasizing innovation and scalability despite higher risks. Both roles require strong financial analysis, due diligence, and portfolio management skills, but differ fundamentally in investment stage and risk tolerance.

Role Definition: Private Equity Associate

A Private Equity Associate primarily focuses on analyzing established companies with stable cash flows to identify opportunities for leveraged buyouts, operational improvements, and long-term value creation. The role involves extensive financial modeling, due diligence, and deal execution, often requiring collaboration with portfolio companies to optimize performance and drive exit strategies. Emphasis lies on rigorous valuation methodologies, market analysis, and strategic planning to maximize investment returns.

Role Definition: Venture Capital Associate

A Venture Capital Associate is responsible for sourcing, analyzing, and managing investments in early-stage startups with high growth potential. Their role involves conducting thorough market research, performing due diligence on innovative business models, and supporting portfolio companies through strategic guidance. They work closely with founders to identify opportunities that align with fund investment theses, emphasizing scalable technology-driven ventures.

Key Responsibilities Comparison

Private Equity Associates primarily focus on conducting detailed financial modeling, executing leveraged buyouts, and managing portfolio company performance to maximize investment returns. Venture Capital Associates concentrate on sourcing early-stage startups, performing market and technology due diligence, and supporting founders through growth strategies and fundraising efforts. Both roles require robust financial analysis skills, but Private Equity emphasizes operational value creation while Venture Capital prioritizes innovation potential and sector trends.

Investment Process Differences

Private Equity Associates primarily focus on established companies, conducting extensive due diligence, financial modeling, and deal structuring to optimize mature asset performance. Venture Capital Associates emphasize early-stage startup evaluation, market potential analysis, and iterative funding rounds to support high-growth innovation ventures. The investment process in private equity is characterized by asset control and operational improvements, whereas venture capital prioritizes scalable business models and founder collaboration.

Required Skills and Qualifications

Private Equity Associates require strong financial modeling skills, extensive experience in due diligence, and expertise in leveraged buyouts, often supported by a background in investment banking or management consulting. Venture Capital Associates prioritize market research capabilities, entrepreneurial insight, and the ability to assess early-stage company potential, typically enhanced by experience in startups or technology sectors. Both roles demand exceptional analytical skills, strong communication abilities, and proficiency in evaluating investment risks and returns.

Industry Focus and Deal Sourcing

Private Equity Associates primarily focus on established companies across traditional industries such as manufacturing, healthcare, and retail, leveraging deep industry expertise to identify mature businesses with stable cash flows for leveraged buyouts. Venture Capital Associates concentrate on emerging sectors like technology, biotech, and fintech, sourcing deals through startup networks, incubators, and innovation hubs to invest in high-growth potential early-stage companies. Deal sourcing in Private Equity relies heavily on financial intermediaries, proprietary industry relationships, and extensive market research, whereas Venture Capital emphasizes active engagement with founders, attending pitch events, and tapping into venture ecosystems.

Career Progression and Exit Opportunities

Private Equity Associates typically advance through a structured hierarchy, moving from Associate to Vice President and eventually Principal, with exit opportunities often leading to roles in corporate finance, hedge funds, or starting their own investment firms. Venture Capital Associates experience a more fluid career progression, frequently transitioning to roles as Principal or Partner, with exit options including entrepreneurial ventures, startup executive positions, or senior roles at larger VC firms. Both career paths benefit from strong networking and deal execution skills but differ significantly in investment focus and industry exposure.

Compensation and Work-Life Balance

Private Equity Associates typically earn higher base salaries and bonuses compared to Venture Capital Associates, reflecting the larger deal sizes and long-term investment horizons in private equity. Work-life balance in private equity is often more demanding, with longer hours due to intense deal execution and portfolio management responsibilities. Venture Capital Associates generally experience more flexible schedules and a collaborative environment, but compensation, while competitive, tends to be lower than in private equity.

Choosing Between PE and VC Careers

Private Equity Associates typically focus on acquiring established companies with stable cash flows, emphasizing financial restructuring and operational improvements, while Venture Capital Associates invest in early-stage startups, prioritizing growth potential and innovation. Choosing between PE and VC careers depends on one's preference for working with mature companies versus high-risk, high-reward startups, as well as desired involvement in deal sourcing, due diligence, and portfolio management. Compensation structures often differ, with PE roles offering higher base salaries and VC roles providing equity upside linked to startup success.

Private Equity Associate vs Venture Capital Associate Infographic

jobdiv.com

jobdiv.com