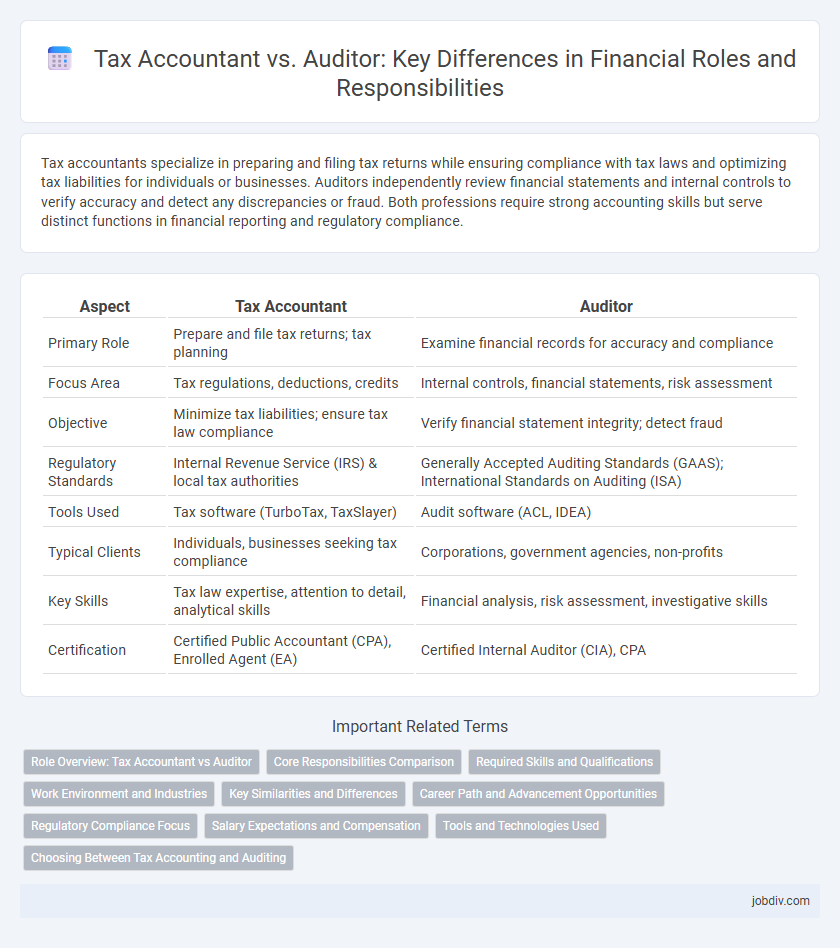

Tax accountants specialize in preparing and filing tax returns while ensuring compliance with tax laws and optimizing tax liabilities for individuals or businesses. Auditors independently review financial statements and internal controls to verify accuracy and detect any discrepancies or fraud. Both professions require strong accounting skills but serve distinct functions in financial reporting and regulatory compliance.

Table of Comparison

| Aspect | Tax Accountant | Auditor |

|---|---|---|

| Primary Role | Prepare and file tax returns; tax planning | Examine financial records for accuracy and compliance |

| Focus Area | Tax regulations, deductions, credits | Internal controls, financial statements, risk assessment |

| Objective | Minimize tax liabilities; ensure tax law compliance | Verify financial statement integrity; detect fraud |

| Regulatory Standards | Internal Revenue Service (IRS) & local tax authorities | Generally Accepted Auditing Standards (GAAS); International Standards on Auditing (ISA) |

| Tools Used | Tax software (TurboTax, TaxSlayer) | Audit software (ACL, IDEA) |

| Typical Clients | Individuals, businesses seeking tax compliance | Corporations, government agencies, non-profits |

| Key Skills | Tax law expertise, attention to detail, analytical skills | Financial analysis, risk assessment, investigative skills |

| Certification | Certified Public Accountant (CPA), Enrolled Agent (EA) | Certified Internal Auditor (CIA), CPA |

Role Overview: Tax Accountant vs Auditor

Tax accountants specialize in preparing tax returns, ensuring compliance with tax laws, and planning strategies to minimize tax liabilities for individuals and businesses. Auditors examine financial records and processes to verify accuracy, detect fraud, and assess internal controls in accordance with regulatory standards. Both roles require deep knowledge of accounting principles but serve distinct functions in financial reporting and regulatory compliance.

Core Responsibilities Comparison

Tax accountants specialize in preparing and filing tax returns, ensuring compliance with tax laws, and advising clients on tax planning strategies to minimize liabilities. Auditors focus on examining financial statements, evaluating internal controls, and verifying the accuracy of records to detect fraud or errors. While tax accountants aim to optimize tax outcomes, auditors provide independent assessments to enhance financial transparency and accountability.

Required Skills and Qualifications

Tax accountants require expertise in tax laws, proficiency in accounting software, and strong analytical skills to prepare and file accurate tax returns. Auditors need a deep understanding of auditing standards, risk assessment capabilities, and attention to detail to evaluate financial statements and ensure regulatory compliance. Both professions typically require a degree in accounting or finance, with certifications like CPA (Certified Public Accountant) enhancing job prospects.

Work Environment and Industries

Tax accountants primarily work within accounting firms, corporate finance departments, and government tax agencies, specializing in industries such as retail, manufacturing, and financial services to ensure compliance with tax regulations. Auditors operate in diverse settings including public accounting firms, internal audit departments of corporations, and regulatory bodies, focusing on industries like banking, insurance, and healthcare to verify financial accuracy and risk management. Both professions often require collaboration with clients and stakeholders across various sectors, but auditors typically engage in more fieldwork and onsite assessments compared to tax accountants.

Key Similarities and Differences

Tax accountants and auditors both play critical roles in financial compliance and reporting, with tax accountants specializing in preparing tax returns and ensuring tax code adherence, while auditors focus on examining financial records for accuracy and regulatory compliance. Both professionals require strong analytical skills and a deep understanding of accounting principles, but auditors typically work independently or for regulatory agencies to provide objective assessments, whereas tax accountants often serve individual clients or businesses directly. The key difference lies in their primary objectives: tax accountants aim to optimize tax strategies and minimize liabilities, whereas auditors verify the integrity of financial statements and safeguard against fraud.

Career Path and Advancement Opportunities

Tax accountants specialize in preparing and strategizing tax returns, offering potential advancement into senior tax advisory roles or becoming certified public accountants (CPAs) with expertise in tax law. Auditors focus on examining financial records for accuracy and compliance, with career paths often leading to senior audit manager positions or certifications like Certified Internal Auditor (CIA). Both fields provide opportunities for progressing into executive roles such as Chief Financial Officer (CFO) or finance director, depending on experience and additional qualifications.

Regulatory Compliance Focus

Tax accountants specialize in ensuring businesses comply with tax laws and regulations, preparing accurate tax returns and advising on tax strategies to minimize liabilities. Auditors focus on evaluating financial statements and internal controls to verify accuracy, detect fraud, and ensure compliance with accounting standards and regulatory requirements. Both roles are critical for regulatory compliance but differ in scope, with tax accountants centered on tax regulations and auditors encompassing broader financial oversight.

Salary Expectations and Compensation

Tax accountants typically earn a median salary ranging from $55,000 to $85,000 annually, with potential for bonuses based on performance and experience. Auditors often command higher compensation, averaging between $60,000 and $95,000 per year, reflecting the critical role in financial compliance and risk assessment. Both positions may see salary variations depending on firm size, geographic location, and professional certifications such as CPA or CMA.

Tools and Technologies Used

Tax accountants primarily use tax preparation software such as TurboTax, H&R Block, and specialized platforms like Lacerte and ProSeries to ensure accurate filing and compliance with tax laws. Auditors rely on advanced data analytics tools, including ACL Analytics, IDEA, and Tableau, to examine financial records, identify irregularities, and assess risk factors. Both professionals increasingly integrate cloud-based accounting systems like QuickBooks Online and Xero to streamline data access and improve collaborative workflows.

Choosing Between Tax Accounting and Auditing

Choosing between tax accounting and auditing depends on your career goals and expertise in financial regulations. Tax accountants specialize in preparing tax returns, ensuring compliance with tax laws, and strategizing to minimize tax liabilities, while auditors focus on examining financial statements to verify accuracy and adherence to accounting standards. Professionals aiming for client advisory roles and tax strategy often prefer tax accounting, whereas those interested in risk assessment and financial statement analysis gravitate towards auditing.

Tax Accountant vs Auditor Infographic

jobdiv.com

jobdiv.com