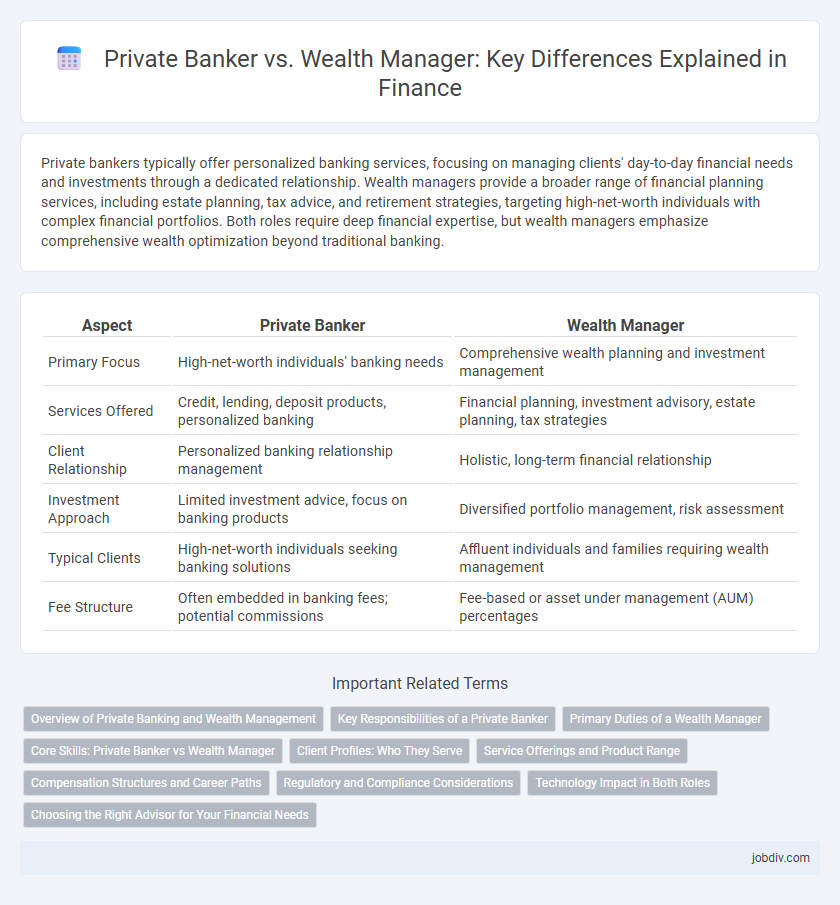

Private bankers typically offer personalized banking services, focusing on managing clients' day-to-day financial needs and investments through a dedicated relationship. Wealth managers provide a broader range of financial planning services, including estate planning, tax advice, and retirement strategies, targeting high-net-worth individuals with complex financial portfolios. Both roles require deep financial expertise, but wealth managers emphasize comprehensive wealth optimization beyond traditional banking.

Table of Comparison

| Aspect | Private Banker | Wealth Manager |

|---|---|---|

| Primary Focus | High-net-worth individuals' banking needs | Comprehensive wealth planning and investment management |

| Services Offered | Credit, lending, deposit products, personalized banking | Financial planning, investment advisory, estate planning, tax strategies |

| Client Relationship | Personalized banking relationship management | Holistic, long-term financial relationship |

| Investment Approach | Limited investment advice, focus on banking products | Diversified portfolio management, risk assessment |

| Typical Clients | High-net-worth individuals seeking banking solutions | Affluent individuals and families requiring wealth management |

| Fee Structure | Often embedded in banking fees; potential commissions | Fee-based or asset under management (AUM) percentages |

Overview of Private Banking and Wealth Management

Private banking offers personalized financial services focused on high-net-worth individuals, including tailored investment strategies, credit, and estate planning. Wealth management provides a comprehensive approach combining investment management, financial planning, tax optimization, and retirement strategies for affluent clients. Both services emphasize confidentiality, customized advice, and long-term financial growth tailored to clients' unique financial goals.

Key Responsibilities of a Private Banker

A Private Banker manages high-net-worth clients' financial portfolios by providing personalized banking services, including lending, deposit products, and cash management solutions. They focus on building and maintaining long-term client relationships, understanding clients' financial goals, and offering customized credit and investment advice. Private Bankers work closely with wealth management teams but primarily emphasize tailored banking solutions and risk management to support clients' broader financial strategies.

Primary Duties of a Wealth Manager

Wealth managers primarily focus on creating comprehensive financial plans tailored to high-net-worth clients, including investment management, estate planning, tax optimization, and retirement strategies. They coordinate with various specialists such as accountants, lawyers, and tax advisors to ensure integrated wealth preservation and growth. Wealth managers emphasize holistic financial well-being beyond just investment advice, addressing multifaceted client needs to secure long-term financial goals.

Core Skills: Private Banker vs Wealth Manager

Private bankers excel in credit management, risk assessment, and personalized banking solutions, catering primarily to high-net-worth individuals with complex financing needs. Wealth managers focus on investment strategies, portfolio diversification, and holistic financial planning to grow and preserve client assets across multiple channels. Both roles demand strong client relationship skills, but private bankers prioritize transactional banking expertise while wealth managers emphasize long-term wealth optimization.

Client Profiles: Who They Serve

Private bankers primarily serve high-net-worth individuals and ultra-high-net-worth clients, offering personalized financial services such as tailored investment strategies, credit solutions, and estate planning. Wealth managers cater to a broader range of clients, including affluent individuals and families seeking comprehensive financial planning, retirement strategies, and portfolio management. Both professionals emphasize building long-term relationships but differ in client segmentation and service customization intensity.

Service Offerings and Product Range

Private Bankers primarily offer personalized banking services, such as tailored lending, deposit accounts, and cash management solutions designed for high-net-worth clients, emphasizing exclusive banking products and credit facilities. Wealth Managers provide a broader spectrum, including investment management, financial planning, tax advisory, estate planning, and risk management, covering diverse assets like stocks, bonds, mutual funds, and alternative investments. The service offerings of Private Bankers revolve around individualized banking relationships, while Wealth Managers focus on comprehensive, holistic financial strategies for asset growth and preservation.

Compensation Structures and Career Paths

Private bankers typically earn compensation through a combination of base salary, performance bonuses, and commissions tied to client assets and transactions, reflecting their focus on direct client relationships and product sales. Wealth managers receive a fee-based income often linked to assets under management (AUM), supplemented by performance incentives, emphasizing long-term portfolio growth and holistic financial planning. Career paths for private bankers often progress towards senior advisory roles within banks or financial institutions, while wealth managers may advance into specialized advisory positions or leadership roles in wealth management firms.

Regulatory and Compliance Considerations

Private bankers operate under stringent banking regulations and must comply with anti-money laundering (AML) laws, Know Your Customer (KYC) requirements, and fiduciary duties established by financial regulatory authorities like the SEC or FCA. Wealth managers face overlapping compliance obligations but often navigate broader investment advisory standards, including fiduciary responsibilities under the Investment Advisers Act of 1940, and must ensure transparent disclosure of fees and conflicts of interest. Both roles require meticulous adherence to data privacy laws such as GDPR or CCPA, emphasizing client confidentiality and secure handling of sensitive financial information.

Technology Impact in Both Roles

Private bankers and wealth managers increasingly rely on advanced technology platforms such as AI-driven analytics and robo-advisors to enhance personalized client service and portfolio management. The integration of blockchain for secure transactions and digital onboarding processes streamlines client acquisition and compliance in both roles. Data-driven insights and real-time reporting tools empower private bankers and wealth managers to optimize investment strategies and improve client engagement.

Choosing the Right Advisor for Your Financial Needs

Private bankers specialize in managing high-net-worth clients' banking services, offering personalized credit, lending, and investment solutions tailored to complex financial needs. Wealth managers provide comprehensive financial planning, including investment management, tax strategies, estate planning, and retirement advice, addressing broader wealth accumulation and preservation goals. Selecting the right advisor depends on your specific financial objectives, asset complexity, and desired level of integrated service, with private bankers suited for banking-focused wealth needs and wealth managers ideal for holistic financial planning.

Private Banker vs Wealth Manager Infographic

jobdiv.com

jobdiv.com