Auditors primarily evaluate financial statements to ensure accuracy and compliance with accounting standards, identifying errors or irregularities through systematic reviews. Forensic accountants specialize in investigating financial fraud by analyzing complex data, uncovering hidden assets, and providing litigation support. Both roles are crucial for maintaining financial integrity, but forensic accounting emphasizes detailed fraud detection and legal proceedings.

Table of Comparison

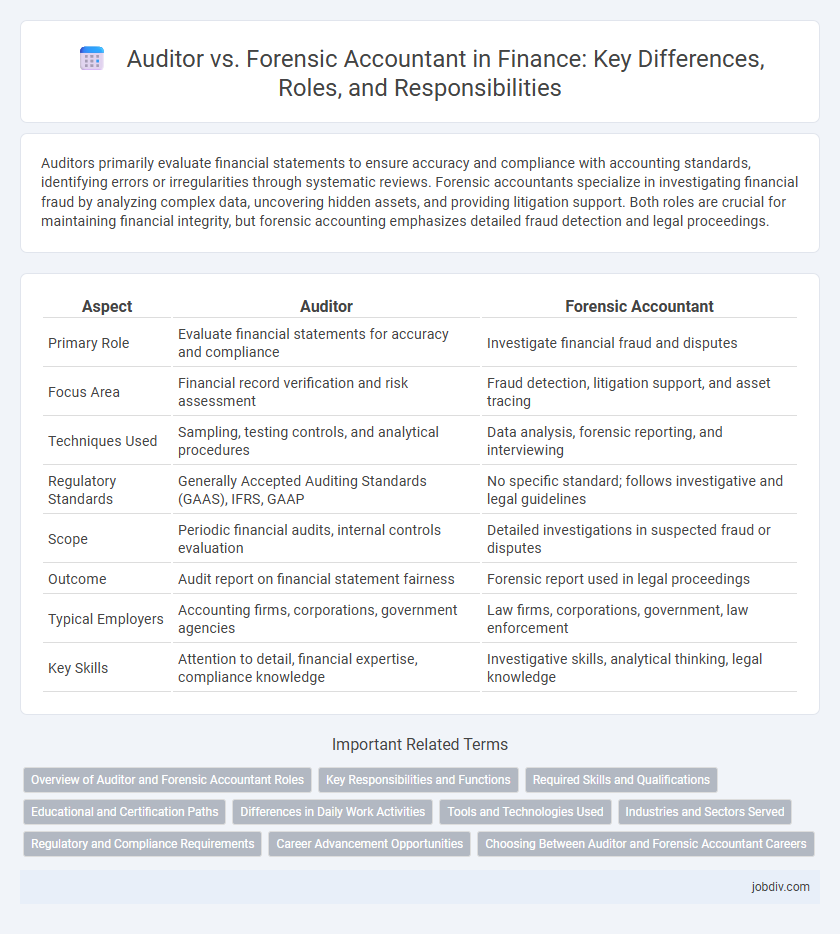

| Aspect | Auditor | Forensic Accountant |

|---|---|---|

| Primary Role | Evaluate financial statements for accuracy and compliance | Investigate financial fraud and disputes |

| Focus Area | Financial record verification and risk assessment | Fraud detection, litigation support, and asset tracing |

| Techniques Used | Sampling, testing controls, and analytical procedures | Data analysis, forensic reporting, and interviewing |

| Regulatory Standards | Generally Accepted Auditing Standards (GAAS), IFRS, GAAP | No specific standard; follows investigative and legal guidelines |

| Scope | Periodic financial audits, internal controls evaluation | Detailed investigations in suspected fraud or disputes |

| Outcome | Audit report on financial statement fairness | Forensic report used in legal proceedings |

| Typical Employers | Accounting firms, corporations, government agencies | Law firms, corporations, government, law enforcement |

| Key Skills | Attention to detail, financial expertise, compliance knowledge | Investigative skills, analytical thinking, legal knowledge |

Overview of Auditor and Forensic Accountant Roles

Auditors conduct systematic examinations of financial records to ensure accuracy, compliance, and adherence to regulatory standards, primarily focusing on verifying financial statements. Forensic accountants specialize in investigating financial discrepancies, fraud, and legal disputes, using accounting skills to analyze complex financial data for litigation support. Both roles require a strong understanding of accounting principles but differ in scope, with auditors concentrating on assurance services and forensic accountants addressing investigative and legal matters.

Key Responsibilities and Functions

Auditors primarily focus on evaluating financial statements to ensure accuracy, compliance with accounting standards, and regulatory requirements through systematic examination and testing of records. Forensic accountants specialize in investigating financial discrepancies, fraud, and legal disputes by analyzing complex financial data and preparing evidence for litigation. Both roles require strong analytical skills, but auditors emphasize assurance and compliance, while forensic accountants focus on detection and prevention of financial crimes.

Required Skills and Qualifications

Auditors require strong analytical skills, attention to detail, and proficiency in accounting principles such as GAAP or IFRS, along with certifications like CPA or ACCA to ensure financial statements' accuracy and compliance. Forensic accountants need expertise in investigative techniques, fraud detection methodologies, and legal knowledge, often holding credentials such as CFE (Certified Fraud Examiner) or CrFA (Certified Forensic Accountant) to effectively unravel financial discrepancies. Both roles demand advanced knowledge of financial reporting, data analysis software, and strong ethical standards to maintain financial integrity in their respective domains.

Educational and Certification Paths

Auditors typically pursue a bachelor's degree in accounting or finance, followed by certifications such as the Certified Public Accountant (CPA) to validate their expertise in financial compliance and reporting. Forensic accountants often complement a similar educational background with specialized certifications like the Certified Fraud Examiner (CFE) or Certified Forensic Accountant (Cr.FA) to enhance their skills in fraud detection and litigation support. Both careers demand rigorous knowledge of accounting principles, but forensic accounting emphasizes investigative techniques and legal standards.

Differences in Daily Work Activities

Auditors primarily examine financial statements and ensure compliance with accounting standards to verify accuracy and regulatory adherence. Forensic accountants investigate financial records to detect fraud, analyze transactions for legal cases, and provide expert testimony in court. While auditors focus on validating the integrity of financial reports, forensic accountants specialize in uncovering financial crimes and disputes.

Tools and Technologies Used

Auditors primarily use audit management software, data analytics tools, and ERP systems like SAP and Oracle to streamline financial statement reviews and compliance checks. Forensic accountants leverage advanced forensic data analysis software, digital forensics tools, and specialized platforms such as EnCase and IDEA to detect fraud, perform detailed transaction tracing, and conduct litigation support. Both professionals rely on Excel and SQL databases, but forensic accountants emphasize technologies that uncover financial discrepancies and fraudulent activities.

Industries and Sectors Served

Auditors primarily serve traditional sectors such as manufacturing, banking, and retail, ensuring regulatory compliance and financial accuracy. Forensic accountants are in high demand across legal firms, insurance companies, and government agencies due to their expertise in fraud investigation and litigation support. Both professionals play critical roles in financial services, healthcare, and public sector organizations to uphold transparency and accountability.

Regulatory and Compliance Requirements

Auditors ensure financial statements comply with regulatory standards such as GAAP or IFRS, verifying accuracy and adherence to compliance frameworks established by bodies like the SEC or PCAOB. Forensic accountants investigate financial discrepancies and fraud, often supporting legal proceedings by uncovering violations of regulations like the Sarbanes-Oxley Act or Anti-Money Laundering laws. Both roles require a deep understanding of regulatory requirements, but forensic accountants focus more on detecting and preventing financial crimes within compliance contexts.

Career Advancement Opportunities

Auditors primarily advance by gaining certifications such as CPA or CIA, progressing to senior auditor, audit manager, and eventually director or partner roles within accounting firms. Forensic accountants develop career paths involving specialized certifications like CFE (Certified Fraud Examiner), leading to roles in fraud investigation, compliance, litigation support, and executive positions in risk management. Both career paths offer growth opportunities in public accounting firms, corporate finance departments, government agencies, and consulting firms, with forensic accounting providing niche expertise in fraud detection and legal proceedings.

Choosing Between Auditor and Forensic Accountant Careers

Choosing between auditor and forensic accountant careers involves evaluating specialization and job functions; auditors primarily assess financial statements for accuracy and compliance, while forensic accountants investigate financial fraud and disputes. Career prospects in auditing often offer stability within corporations and regulatory bodies, whereas forensic accounting provides dynamic opportunities in legal cases, litigation support, and fraud detection. Professional certifications such as CPA for auditors and CFE for forensic accountants significantly influence career advancement and specialization in their respective fields.

Auditor vs Forensic Accountant Infographic

jobdiv.com

jobdiv.com