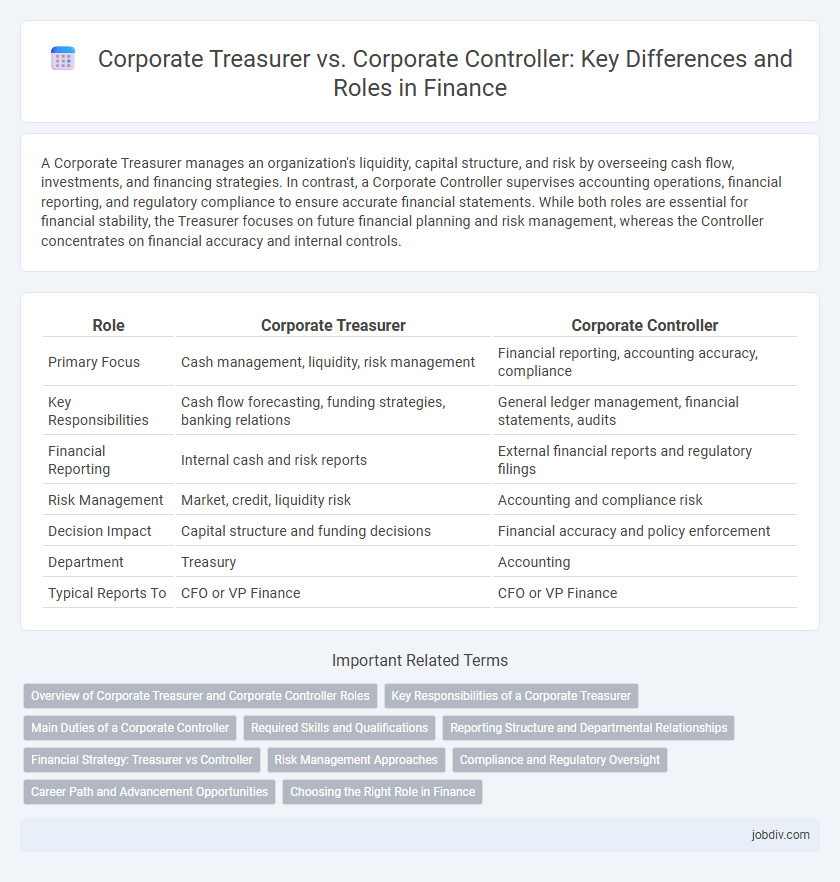

A Corporate Treasurer manages an organization's liquidity, capital structure, and risk by overseeing cash flow, investments, and financing strategies. In contrast, a Corporate Controller supervises accounting operations, financial reporting, and regulatory compliance to ensure accurate financial statements. While both roles are essential for financial stability, the Treasurer focuses on future financial planning and risk management, whereas the Controller concentrates on financial accuracy and internal controls.

Table of Comparison

| Role | Corporate Treasurer | Corporate Controller |

|---|---|---|

| Primary Focus | Cash management, liquidity, risk management | Financial reporting, accounting accuracy, compliance |

| Key Responsibilities | Cash flow forecasting, funding strategies, banking relations | General ledger management, financial statements, audits |

| Financial Reporting | Internal cash and risk reports | External financial reports and regulatory filings |

| Risk Management | Market, credit, liquidity risk | Accounting and compliance risk |

| Decision Impact | Capital structure and funding decisions | Financial accuracy and policy enforcement |

| Department | Treasury | Accounting |

| Typical Reports To | CFO or VP Finance | CFO or VP Finance |

Overview of Corporate Treasurer and Corporate Controller Roles

The Corporate Treasurer manages an organization's liquidity, investment strategies, and risk exposure to ensure optimal cash flow and financial stability. The Corporate Controller oversees financial reporting, accounting operations, and compliance with regulatory standards, ensuring accurate financial statements and internal controls. Both roles are critical in maintaining financial health but focus respectively on strategic cash management and rigorous accounting oversight.

Key Responsibilities of a Corporate Treasurer

A Corporate Treasurer manages an organization's liquidity, risk, and capital structure by overseeing cash flow, investment strategies, and debt issuance to ensure financial stability. They work closely with banks and investors to optimize funding sources and monitor market risks such as interest rate fluctuations and foreign exchange exposure. Unlike a Corporate Controller who focuses on accounting and financial reporting, the Treasurer emphasizes strategic financial planning and risk management to support long-term corporate growth.

Main Duties of a Corporate Controller

The Corporate Controller primarily oversees financial reporting, ensuring accuracy and compliance with accounting standards such as GAAP or IFRS. They manage internal controls, budgeting processes, and financial statement preparation to support strategic decision-making. Their role includes supervising accounting teams and coordinating audits to maintain fiscal integrity within the organization.

Required Skills and Qualifications

A Corporate Treasurer requires expertise in cash management, risk assessment, and financial forecasting, with strong skills in liquidity planning, capital structure optimization, and regulatory compliance. A Corporate Controller must demonstrate proficiency in financial reporting, internal controls, GAAP compliance, and budgeting, alongside advanced knowledge of accounting principles and audit coordination. Both roles demand analytical capabilities, strategic thinking, and experience with financial software, but the Treasurer leans more toward financial strategy while the Controller focuses on accounting accuracy and process management.

Reporting Structure and Departmental Relationships

The Corporate Treasurer reports directly to the CFO, managing the company's liquidity, investments, and financial risk, while the Corporate Controller oversees accounting operations and financial reporting, typically reporting to the CFO or VP of Finance. The Treasurer collaborates closely with banking institutions, risk management, and investor relations departments, whereas the Controller coordinates with accounting, audit, and compliance teams. Both roles require strong interdepartmental communication to ensure accurate financial data and strategic fiscal management.

Financial Strategy: Treasurer vs Controller

Corporate Treasurers drive financial strategy by managing liquidity, risk, and capital structure to optimize cash flow and funding sources, directly influencing corporate investment and borrowing decisions. Corporate Controllers focus on financial reporting, compliance, and internal controls, ensuring accurate accounting and regulatory adherence to support strategic financial planning. Together, Treasurers emphasize forward-looking financial strategy while Controllers ensure historical financial accuracy and governance.

Risk Management Approaches

Corporate Treasurers prioritize enterprise-wide risk management by overseeing liquidity, currency exposure, and interest rate fluctuations to safeguard company assets and ensure financial stability. Corporate Controllers concentrate on internal financial risks by managing accurate financial reporting, compliance, and internal audits to maintain regulatory adherence and reduce fraud risk. Together, their risk management approaches balance external market volatility with internal operational controls for comprehensive financial security.

Compliance and Regulatory Oversight

The Corporate Treasurer primarily oversees compliance related to cash management, liquidity risk, and funding regulations, ensuring adherence to banking laws and investment policies. The Corporate Controller manages regulatory oversight connected to financial reporting, internal controls, and accounting standards such as GAAP or IFRS. Both roles collaborate to ensure comprehensive compliance with SEC regulations, Sarbanes-Oxley Act requirements, and other financial governance mandates.

Career Path and Advancement Opportunities

Corporate Treasurer roles often focus on cash management, risk assessment, and capital structure, requiring expertise in financial strategy and market trends, which pave the way to executive positions like CFO or VP of Finance. Corporate Controller positions emphasize accounting, compliance, and internal controls, building a foundation for advancement into senior finance roles such as Director of Finance or Chief Accounting Officer. Both paths offer distinct yet complementary skill sets, with Treasurers gravitating toward strategic financial leadership and Controllers toward operational finance management.

Choosing the Right Role in Finance

Choosing between a Corporate Treasurer and a Corporate Controller depends on whether the focus is on managing liquidity, investments, and risk versus overseeing accounting, financial reporting, and compliance. Corporate Treasurers excel in cash flow optimization, capital structure management, and strategic financial planning, while Corporate Controllers specialize in accurate financial statements, internal controls, and regulatory adherence. Understanding these distinctions is crucial for aligning talent with organizational finance goals and operational priorities.

Corporate Treasurer vs Corporate Controller Infographic

jobdiv.com

jobdiv.com