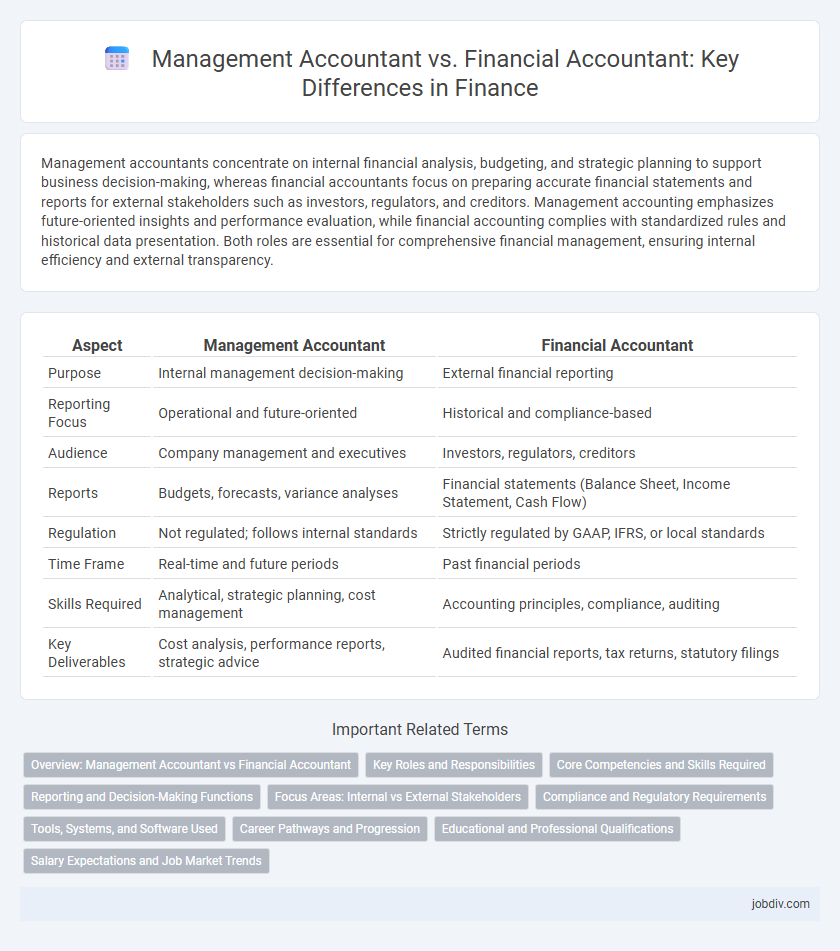

Management accountants concentrate on internal financial analysis, budgeting, and strategic planning to support business decision-making, whereas financial accountants focus on preparing accurate financial statements and reports for external stakeholders such as investors, regulators, and creditors. Management accounting emphasizes future-oriented insights and performance evaluation, while financial accounting complies with standardized rules and historical data presentation. Both roles are essential for comprehensive financial management, ensuring internal efficiency and external transparency.

Table of Comparison

| Aspect | Management Accountant | Financial Accountant |

|---|---|---|

| Purpose | Internal management decision-making | External financial reporting |

| Reporting Focus | Operational and future-oriented | Historical and compliance-based |

| Audience | Company management and executives | Investors, regulators, creditors |

| Reports | Budgets, forecasts, variance analyses | Financial statements (Balance Sheet, Income Statement, Cash Flow) |

| Regulation | Not regulated; follows internal standards | Strictly regulated by GAAP, IFRS, or local standards |

| Time Frame | Real-time and future periods | Past financial periods |

| Skills Required | Analytical, strategic planning, cost management | Accounting principles, compliance, auditing |

| Key Deliverables | Cost analysis, performance reports, strategic advice | Audited financial reports, tax returns, statutory filings |

Overview: Management Accountant vs Financial Accountant

Management accountants specialize in internal financial analysis, budgeting, and strategic planning to support business decision-making and operational control. Financial accountants focus on preparing accurate financial statements, ensuring regulatory compliance, and reporting historical financial performance to external stakeholders. Both roles require strong accounting skills but differ in scope, with management accountants emphasizing forward-looking management insights and financial accountants prioritizing standardized financial reporting.

Key Roles and Responsibilities

Management accountants focus on internal financial analysis, budgeting, and performance evaluation to assist in strategic decision-making and operational efficiency. Financial accountants prepare accurate financial statements, ensure compliance with accounting standards, and manage external reporting for stakeholders such as investors and regulators. Both roles require expertise in financial data but differ in their emphasis on internal versus external financial information and regulatory obligations.

Core Competencies and Skills Required

Management accountants excel in budgeting, cost analysis, and performance management, requiring strong analytical skills, strategic thinking, and proficiency in internal reporting systems. Financial accountants focus on external financial reporting, compliance with accounting standards such as GAAP or IFRS, and accurate financial statement preparation, demanding attention to detail, regulatory knowledge, and expertise in audit processes. Both roles necessitate proficiency in accounting software and strong numerical aptitude, but management accountants emphasize decision-support skills while financial accountants prioritize regulatory accuracy and transparency.

Reporting and Decision-Making Functions

Management accountants specialize in internal reporting, providing detailed financial analyses and forecasts to support strategic decision-making and operational efficiency. Financial accountants focus on external reporting, preparing standardized financial statements in compliance with regulatory frameworks for stakeholders such as investors and regulators. The management accountant's reports are forward-looking and flexible, while the financial accountant's outputs are historical, structured, and aimed at evaluating overall company performance.

Focus Areas: Internal vs External Stakeholders

Management accountants primarily concentrate on providing detailed financial insights and forecasts to internal stakeholders such as company executives and department managers, enabling strategic decision-making and operational efficiency. Financial accountants focus on preparing standardized financial statements and reports adhering to regulatory frameworks for external stakeholders like investors, creditors, and tax authorities. The distinction in focus areas reflects management accountants' role in internal planning and control, while financial accountants ensure transparency and compliance for external users.

Compliance and Regulatory Requirements

Management accountants focus on internal compliance, ensuring adherence to company policies and operational standards to support strategic decision-making. Financial accountants emphasize external regulatory requirements, preparing financial statements in accordance with GAAP or IFRS to meet statutory reporting obligations. Both roles require thorough knowledge of financial regulations, but financial accountants bear primary responsibility for statutory audits and government filings.

Tools, Systems, and Software Used

Management accountants primarily utilize advanced budgeting software like Adaptive Insights and planning tools such as Hyperion to support internal decision-making and performance analysis. Financial accountants rely heavily on ERP systems including SAP and Oracle Financials for accurate financial reporting, compliance, and audit processes. Both roles increasingly incorporate data analytics platforms like Power BI and Excel for enhanced financial data interpretation and strategic insights.

Career Pathways and Progression

Management accountants specialize in internal business analysis and strategic planning, often progressing into roles such as financial controller, finance manager, or chief financial officer. Financial accountants focus on preparing accurate financial statements and compliance, with career advancement typically leading to positions like auditor, financial analyst, or chief accountant. Both pathways offer opportunities for certification, such as CMA for management accountants and CPA for financial accountants, enhancing career growth and specialization.

Educational and Professional Qualifications

Management accountants typically hold certifications such as CMA (Certified Management Accountant) or CIMA (Chartered Institute of Management Accountants), emphasizing skills in budgeting, financial analysis, and strategic planning. Financial accountants often pursue qualifications like CPA (Certified Public Accountant) or ACCA (Association of Chartered Certified Accountants), focusing on financial reporting, auditing, and compliance with accounting standards. Both roles require strong foundational knowledge in accounting principles, but their professional qualifications align with their specific functions within corporate finance.

Salary Expectations and Job Market Trends

Management accountants typically earn higher salaries than financial accountants due to their strategic role in budgeting, forecasting, and performance analysis. The job market shows strong demand for management accountants with expertise in data analytics and business partnering, driven by organizations seeking to optimize internal decision-making. Financial accountants remain essential for compliance and reporting, with steady demand influenced by regulatory changes and the need for accurate financial statements.

Management Accountant vs Financial Accountant Infographic

jobdiv.com

jobdiv.com