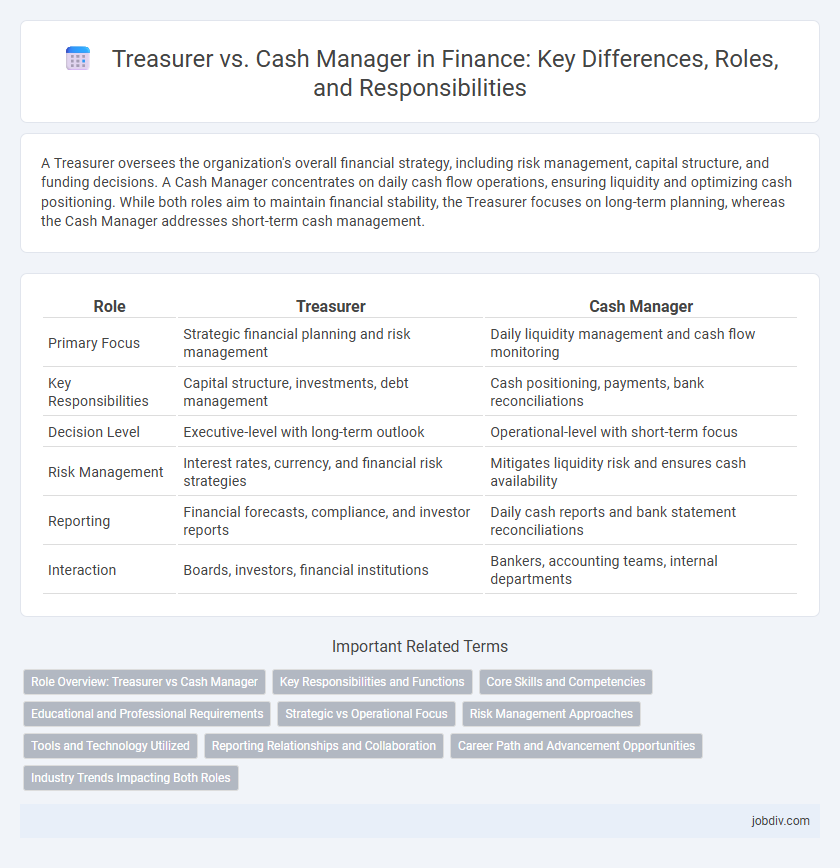

A Treasurer oversees the organization's overall financial strategy, including risk management, capital structure, and funding decisions. A Cash Manager concentrates on daily cash flow operations, ensuring liquidity and optimizing cash positioning. While both roles aim to maintain financial stability, the Treasurer focuses on long-term planning, whereas the Cash Manager addresses short-term cash management.

Table of Comparison

| Role | Treasurer | Cash Manager |

|---|---|---|

| Primary Focus | Strategic financial planning and risk management | Daily liquidity management and cash flow monitoring |

| Key Responsibilities | Capital structure, investments, debt management | Cash positioning, payments, bank reconciliations |

| Decision Level | Executive-level with long-term outlook | Operational-level with short-term focus |

| Risk Management | Interest rates, currency, and financial risk strategies | Mitigates liquidity risk and ensures cash availability |

| Reporting | Financial forecasts, compliance, and investor reports | Daily cash reports and bank statement reconciliations |

| Interaction | Boards, investors, financial institutions | Bankers, accounting teams, internal departments |

Role Overview: Treasurer vs Cash Manager

A Treasurer oversees the company's overall financial strategy, including investment management, risk assessment, and capital structure optimization. A Cash Manager focuses primarily on daily liquidity management, cash flow forecasting, and maintaining optimal cash balances to support operational needs. Both roles are critical in ensuring financial stability but differ in scope, with the Treasurer handling long-term financial planning and the Cash Manager managing short-term cash operations.

Key Responsibilities and Functions

A Treasurer primarily oversees the organization's overall financial strategy, managing investments, risk assessment, and capital structure, ensuring long-term financial stability. In contrast, a Cash Manager focuses on daily liquidity management, optimizing cash flow, forecasting cash positions, and handling short-term funding needs. While Treasurers drive strategic financial planning and regulatory compliance, Cash Managers execute tactical cash operations to maintain operational efficiency.

Core Skills and Competencies

Treasurers excel in strategic financial planning, risk management, and capital structuring, demonstrating strong competencies in forecasting cash flows and managing corporate financing. Cash Managers specialize in liquidity management, cash flow optimization, and day-to-day treasury operations, with expertise in bank relationship management and payment processing. Both roles require proficiency in financial analysis, regulatory compliance, and the use of treasury management systems to ensure effective cash and risk management.

Educational and Professional Requirements

Treasurers typically require a bachelor's degree in finance, accounting, or business administration, with many holding advanced degrees such as an MBA or certifications like CFA or CPA to strengthen strategic financial management skills. Cash managers often need a bachelor's degree in finance or accounting, with professional certifications such as Certified Treasury Professional (CTP) or Certified Management Accountant (CMA) enhancing their expertise in cash flow optimization and daily liquidity management. Both roles benefit from experience in financial analysis, risk management, and strong proficiency in financial software and regulatory compliance.

Strategic vs Operational Focus

A Treasurer concentrates on strategic financial planning, risk management, and long-term capital structure, ensuring the organization's financial stability and growth. In contrast, a Cash Manager handles the operational aspects of daily cash flow, liquidity management, and short-term funding requirements to maintain efficient working capital. The Treasurer's role involves high-level decision-making aligned with corporate strategy, while the Cash Manager focuses on executing tactical cash operations.

Risk Management Approaches

Treasurers focus on strategic risk management by overseeing the company's overall financial risks, including market, credit, and liquidity risks, implementing policies to safeguard assets and ensure long-term financial stability. Cash managers specialize in operational risk management, optimizing daily cash flow, maintaining optimal liquidity levels, and preventing cash shortfalls through precise forecasting and transaction oversight. Both roles collaborate to balance risk exposure and maintain efficient capital allocation within corporate finance.

Tools and Technology Utilized

Treasure professionals leverage advanced treasury management systems (TMS) like Kyriba and SAP Treasury to oversee liquidity, risk management, and investment strategies effectively. Cash Managers primarily utilize cash forecasting software and bank integration tools, such as BlackLine and TIS, to optimize daily cash flows and ensure operational efficiency. Both roles increasingly adopt automation, AI-driven analytics, and cloud-based platforms to enhance accuracy and real-time decision-making in financial operations.

Reporting Relationships and Collaboration

The Treasurer typically reports to the Chief Financial Officer (CFO) and oversees the organization's overall financial strategy, including risk management and capital structure decisions. The Cash Manager usually reports to the Treasurer or Finance Director, concentrating on daily cash flow operations, liquidity management, and bank relationships. Close collaboration between the Treasurer and Cash Manager ensures alignment in financial reporting, cash forecasting, and effective capital allocation.

Career Path and Advancement Opportunities

Treasurers typically oversee an organization's overall financial strategy, risk management, and capital structure, positioning them for executive roles such as Chief Financial Officer (CFO) or Vice President of Finance. Cash Managers concentrate on daily liquidity management, cash flow optimization, and short-term funding, providing a solid foundation for advancement into senior treasury or finance operations roles. Career paths diverge as Treasurers pursue strategic leadership while Cash Managers develop expertise in operational efficiency and cash management systems.

Industry Trends Impacting Both Roles

Industry trends such as digital transformation, increased regulatory scrutiny, and the rise of real-time payment systems are significantly reshaping the responsibilities of Treasurers and Cash Managers. Both roles are adapting to advanced cash forecasting technologies, enhanced risk management frameworks, and greater integration of blockchain for secure transactions. The growing emphasis on sustainable finance and ESG considerations also requires Treasurers and Cash Managers to align liquidity strategies with corporate social responsibility goals.

Treasurer vs Cash Manager Infographic

jobdiv.com

jobdiv.com