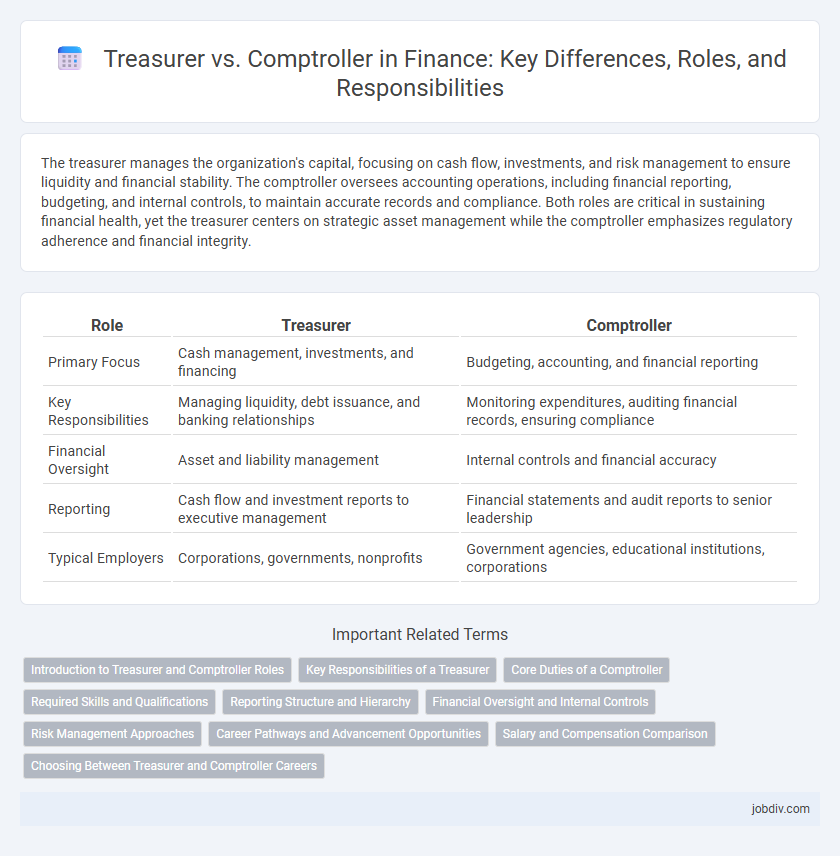

The treasurer manages the organization's capital, focusing on cash flow, investments, and risk management to ensure liquidity and financial stability. The comptroller oversees accounting operations, including financial reporting, budgeting, and internal controls, to maintain accurate records and compliance. Both roles are critical in sustaining financial health, yet the treasurer centers on strategic asset management while the comptroller emphasizes regulatory adherence and financial integrity.

Table of Comparison

| Role | Treasurer | Comptroller |

|---|---|---|

| Primary Focus | Cash management, investments, and financing | Budgeting, accounting, and financial reporting |

| Key Responsibilities | Managing liquidity, debt issuance, and banking relationships | Monitoring expenditures, auditing financial records, ensuring compliance |

| Financial Oversight | Asset and liability management | Internal controls and financial accuracy |

| Reporting | Cash flow and investment reports to executive management | Financial statements and audit reports to senior leadership |

| Typical Employers | Corporations, governments, nonprofits | Government agencies, educational institutions, corporations |

Introduction to Treasurer and Comptroller Roles

The Treasurer manages an organization's cash flow, investments, and financial risk, ensuring liquidity and optimizing capital structure. The Comptroller oversees accounting operations, financial reporting, and internal controls to maintain accuracy and compliance with regulatory standards. Both roles are essential in financial governance, with the Treasurer focused on asset management and the Comptroller on financial integrity.

Key Responsibilities of a Treasurer

A Treasurer manages an organization's cash flow, investment strategies, and liquidity to ensure financial stability and operational efficiency. They oversee banking relationships, risk management related to financial assets, and the securing of capital through debt or equity financing. By forecasting financial needs and monitoring market conditions, Treasurers play a critical role in safeguarding the company's resources and funding future growth initiatives.

Core Duties of a Comptroller

A comptroller primarily oversees an organization's accounting functions, including financial reporting, budgeting, and internal controls to ensure accurate and compliant financial practices. They manage audit processes, enforce regulatory compliance, and safeguard assets through risk assessment and fraud prevention measures. The comptroller's core duties focus on meticulous financial record-keeping, policy enforcement, and providing strategic financial insights to support organizational decision-making.

Required Skills and Qualifications

Treasurers must possess strong financial analysis, risk management, and investment management skills, along with expertise in cash flow forecasting and capital structure optimization; a degree in finance or accounting and certifications such as CFA or CPA are often required. Comptrollers require advanced knowledge of accounting principles, internal controls, financial reporting, and regulatory compliance, typically holding a degree in accounting or finance and certifications like CPA or CMA. Both roles demand excellent leadership, strategic planning, and communication skills to effectively manage organizational finances and ensure fiscal integrity.

Reporting Structure and Hierarchy

The Treasurer typically reports to the Chief Financial Officer (CFO) and oversees cash management, investments, and banking relationships within a company's hierarchy. The Comptroller, often positioned under the CFO as well, manages accounting operations, financial reporting, and internal controls, ensuring compliance and accuracy in financial statements. Both roles operate in parallel within the finance department but focus on distinct areas of financial oversight and reporting structures.

Financial Oversight and Internal Controls

The Treasurer primarily manages an organization's cash flow, investments, and external financial relationships, ensuring liquidity and capital allocation align with strategic goals. The Comptroller is responsible for maintaining internal controls, overseeing accounting processes, and ensuring compliance with financial regulations to safeguard assets and prevent fraud. Both roles collaborate closely to provide comprehensive financial oversight, with the Treasurer focusing on external financial management and the Comptroller ensuring internal financial integrity.

Risk Management Approaches

Treasurers concentrate on liquidity risk management by ensuring sufficient cash flow and optimizing investment portfolios to maintain organizational solvency. Comptrollers implement internal controls and conduct financial audits to mitigate operational and compliance risks, safeguarding assets from fraud and errors. Together, their complementary risk management approaches provide a balanced framework for financial stability and accountability within an organization.

Career Pathways and Advancement Opportunities

Treasurers often advance by gaining expertise in cash management, risk assessment, and investment strategies, positioning themselves for CFO or financial director roles in corporations. Comptrollers typically build careers through experience in budgeting, auditing, and regulatory compliance, leading to senior positions in corporate finance or government agencies. Both roles require strong financial acumen, with treasurers focusing on strategic financial planning and comptrollers specializing in financial reporting and control.

Salary and Compensation Comparison

The average salary for a treasurer typically ranges from $85,000 to $150,000 annually, reflecting responsibilities in cash management and investment oversight, whereas comptrollers often earn between $90,000 and $160,000 due to their focus on budgeting, auditing, and financial reporting. Compensation packages for comptrollers usually include performance bonuses and additional benefits tied to financial accuracy and regulatory compliance, while treasurers may receive bonuses related to liquidity management and risk mitigation. Salary variations depend on organizational size, industry, and geographic location, with comptrollers generally commanding higher pay in larger corporations.

Choosing Between Treasurer and Comptroller Careers

Choosing between treasurer and comptroller careers depends on whether you prefer managing an organization's finances broadly or overseeing detailed financial reporting and compliance. Treasurers focus on cash management, investment strategies, and financial risk, making decisions that directly impact liquidity and funding. Comptrollers handle accounting accuracy, internal controls, and regulatory adherence, ensuring financial statements reflect true organizational performance.

Treasurer vs Comptroller Infographic

jobdiv.com

jobdiv.com