The Chief Financial Officer (CFO) typically holds a strategic leadership role, overseeing the company's overall financial planning, risk management, and investor relations. In contrast, the Finance Director often focuses more on managing the finance department, budgeting processes, and ensuring internal financial controls. While both positions are crucial for financial oversight, the CFO usually operates at a higher executive level, driving long-term financial strategy and corporate growth.

Table of Comparison

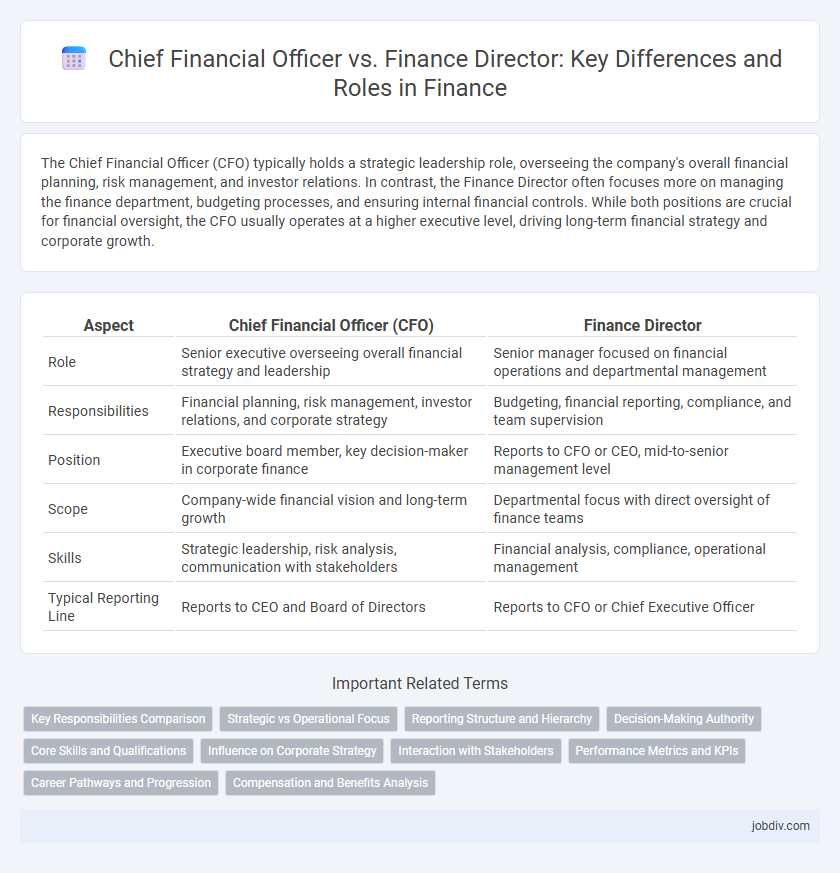

| Aspect | Chief Financial Officer (CFO) | Finance Director |

|---|---|---|

| Role | Senior executive overseeing overall financial strategy and leadership | Senior manager focused on financial operations and departmental management |

| Responsibilities | Financial planning, risk management, investor relations, and corporate strategy | Budgeting, financial reporting, compliance, and team supervision |

| Position | Executive board member, key decision-maker in corporate finance | Reports to CFO or CEO, mid-to-senior management level |

| Scope | Company-wide financial vision and long-term growth | Departmental focus with direct oversight of finance teams |

| Skills | Strategic leadership, risk analysis, communication with stakeholders | Financial analysis, compliance, operational management |

| Typical Reporting Line | Reports to CEO and Board of Directors | Reports to CFO or Chief Executive Officer |

Key Responsibilities Comparison

The Chief Financial Officer (CFO) primarily oversees overall financial strategy, risk management, and investor relations, ensuring the company's financial health and growth. A Finance Director typically manages budgeting, financial reporting, and compliance within departments, focusing on operational financial control. CFOs engage in high-level decision-making and external communications, whereas Finance Directors concentrate on internal financial management and execution.

Strategic vs Operational Focus

A Chief Financial Officer (CFO) primarily drives strategic financial planning, corporate growth initiatives, and investor relations, shaping the overall financial vision of the company. In contrast, a Finance Director concentrates on operational financial management, budgeting, compliance, and day-to-day accounting processes to ensure accurate financial reporting. The CFO's role centers on long-term value creation, while the Finance Director focuses on executing financial strategies through efficient operational control.

Reporting Structure and Hierarchy

The Chief Financial Officer (CFO) typically holds a higher position in the corporate hierarchy, reporting directly to the Chief Executive Officer (CEO) and board of directors, with responsibility for overall financial strategy and corporate governance. In contrast, the Finance Director often reports to the CFO and focuses on managing day-to-day financial operations, budgeting, and compliance within departments. The CFO's role encompasses broader strategic leadership, while the Finance Director ensures operational execution aligned with executive financial goals.

Decision-Making Authority

The Chief Financial Officer (CFO) holds broader decision-making authority, overseeing company-wide financial strategy, risk management, and investor relations. In contrast, the Finance Director typically manages departmental budgets, financial reporting, and operational finance decisions within a specific business unit or region. CFOs influence high-level decisions affecting corporate growth and capital allocation, while Finance Directors ensure accurate execution of financial policies and controls at the divisional level.

Core Skills and Qualifications

Chief Financial Officers (CFOs) typically possess advanced financial expertise, including strategic financial planning, risk management, and leadership skills necessary for overseeing company-wide fiscal health. Finance Directors often focus on operational finance functions such as budgeting, financial reporting, and compliance, requiring strong analytical abilities and detailed knowledge of accounting principles. Both roles demand proficiency in financial software, regulatory frameworks, and excellent communication to drive organizational financial performance.

Influence on Corporate Strategy

The Chief Financial Officer (CFO) plays a pivotal role in shaping corporate strategy through comprehensive financial planning, risk management, and capital allocation, directly influencing long-term business growth and shareholder value. In contrast, the Finance Director primarily oversees financial reporting, budgeting, and compliance, supporting the CFO's strategic initiatives with detailed financial analysis and operational oversight. Both roles contribute to strategic decision-making, but the CFO's influence extends deeper into high-level corporate governance and strategic direction.

Interaction with Stakeholders

The Chief Financial Officer (CFO) primarily engages with external stakeholders such as investors, analysts, and regulatory bodies to communicate financial strategy and ensure compliance. The Finance Director tends to focus on internal stakeholders, including department heads and operational teams, to implement financial policies and optimize resource allocation. Both roles require strong communication skills, but their stakeholder interaction differs in scope and strategic emphasis.

Performance Metrics and KPIs

Chief Financial Officers (CFOs) primarily focus on macro-level performance metrics such as return on equity (ROE), earnings before interest and taxes (EBIT), and cash flow management to drive strategic financial growth. Finance Directors tend to emphasize operational KPIs including budget variance analysis, cost control ratios, and working capital efficiency to optimize day-to-day financial performance. Both roles leverage data-driven insights, but CFOs prioritize enterprise-wide financial health while Finance Directors concentrate on departmental execution and resource allocation.

Career Pathways and Progression

Chief Financial Officer (CFO) roles typically demand extensive experience in strategic financial planning, risk management, and leadership, often evolving from senior finance positions such as Finance Director. Finance Directors usually concentrate on overseeing financial reporting, budgeting, and compliance within departments, serving as a crucial stepping stone toward broader executive responsibilities. Career progression from Finance Director to CFO involves developing skills in corporate strategy, investor relations, and cross-functional leadership to effectively guide overall financial performance.

Compensation and Benefits Analysis

Chief Financial Officers (CFOs) typically command higher compensation packages than Finance Directors due to their broader strategic responsibilities and influence on company-wide financial policies. CFO salaries often include significant performance bonuses, stock options, and long-term incentive plans, reflecting their critical role in corporate governance and investor relations. In contrast, Finance Directors generally receive competitive base salaries with performance-based bonuses and benefits tailored to departmental financial management rather than enterprise-wide strategy.

Chief Financial Officer vs Finance Director Infographic

jobdiv.com

jobdiv.com