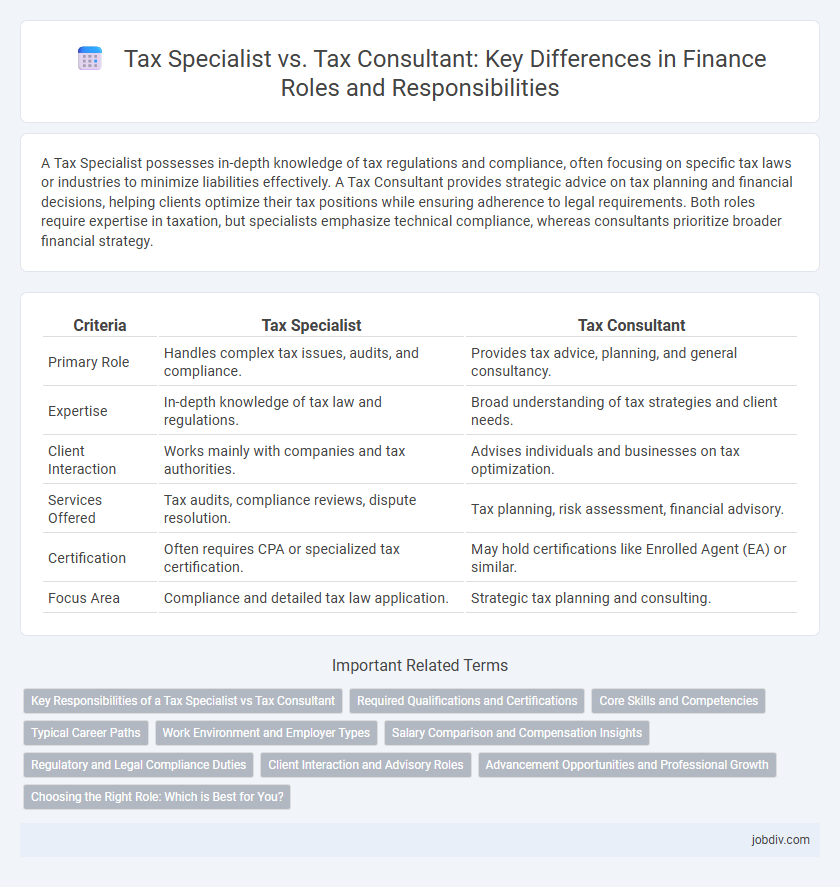

A Tax Specialist possesses in-depth knowledge of tax regulations and compliance, often focusing on specific tax laws or industries to minimize liabilities effectively. A Tax Consultant provides strategic advice on tax planning and financial decisions, helping clients optimize their tax positions while ensuring adherence to legal requirements. Both roles require expertise in taxation, but specialists emphasize technical compliance, whereas consultants prioritize broader financial strategy.

Table of Comparison

| Criteria | Tax Specialist | Tax Consultant |

|---|---|---|

| Primary Role | Handles complex tax issues, audits, and compliance. | Provides tax advice, planning, and general consultancy. |

| Expertise | In-depth knowledge of tax law and regulations. | Broad understanding of tax strategies and client needs. |

| Client Interaction | Works mainly with companies and tax authorities. | Advises individuals and businesses on tax optimization. |

| Services Offered | Tax audits, compliance reviews, dispute resolution. | Tax planning, risk assessment, financial advisory. |

| Certification | Often requires CPA or specialized tax certification. | May hold certifications like Enrolled Agent (EA) or similar. |

| Focus Area | Compliance and detailed tax law application. | Strategic tax planning and consulting. |

Key Responsibilities of a Tax Specialist vs Tax Consultant

A Tax Specialist primarily focuses on preparing tax returns, ensuring compliance with tax laws, and identifying potential tax deductions to optimize financial outcomes. A Tax Consultant offers strategic tax planning advice, helps businesses and individuals minimize tax liabilities through comprehensive analysis, and provides guidance on complex tax regulations and long-term fiscal strategies. Both roles require deep knowledge of tax codes, but specialists often handle technical filing tasks while consultants emphasize advisory and planning services.

Required Qualifications and Certifications

Tax specialists typically require a deep understanding of tax codes and regulations, often holding certifications such as Certified Public Accountant (CPA) or Enrolled Agent (EA) to demonstrate expertise in tax preparation and compliance. Tax consultants, on the other hand, usually possess qualifications that emphasize advisory skills, including certifications like Chartered Tax Adviser (CTA) or Certified Tax Consultant (CTC), which focus on strategic tax planning and client-specific tax solutions. Both roles demand extensive knowledge of federal and state tax laws but differ in certification focus, with tax specialists leaning towards technical proficiency and tax consultants towards strategic advisory capabilities.

Core Skills and Competencies

Tax Specialists possess in-depth expertise in tax regulations, compliance, and detailed tax code analysis, enabling precise tax filing and error minimization. Tax Consultants excel in strategic tax planning, advising clients on tax minimization strategies, and optimizing financial outcomes through comprehensive knowledge of tax laws and client-specific financial situations. Both roles require strong analytical skills, proficiency in tax software, and up-to-date knowledge of evolving tax legislation to ensure effective tax management and advisory services.

Typical Career Paths

Tax Specialists often begin their careers working within corporate finance departments or government tax agencies, gaining expertise in compliance, auditing, and tax law enforcement. Tax Consultants typically start in public accounting firms or consultancy agencies, advising clients on tax planning, optimization, and strategic financial decisions. Progression for Tax Specialists may lead to senior roles such as Tax Manager or Corporate Tax Director, while Tax Consultants often advance to become Senior Consultants, Tax Advisors, or partner-level positions in consulting firms.

Work Environment and Employer Types

Tax Specialists typically work in corporate finance departments, government agencies, or large accounting firms, focusing on compliance and detailed tax reporting within structured environments. Tax Consultants often operate in consulting firms or as independent advisors, providing strategic tax planning and advisory services to a diverse client base including individuals, businesses, and nonprofits. Employers for Tax Specialists tend to be corporations and public sector entities with established tax compliance teams, while Tax Consultants are employed by boutique consultancies, accounting firms, or run private practices.

Salary Comparison and Compensation Insights

Tax specialists typically earn an average annual salary ranging from $55,000 to $85,000, depending on experience and location, while tax consultants command higher compensation, often between $70,000 and $110,000, reflecting their advisory role and client management skills. Bonuses, profit sharing, and performance incentives further enhance total remuneration for tax consultants, who may also benefit from commission-based earnings in consulting firms. Geographic region, firm size, and level of certification such as CPA or EA significantly impact both roles' salary potential and overall compensation packages.

Regulatory and Legal Compliance Duties

Tax specialists ensure strict adherence to current tax laws by preparing accurate filings and maintaining records in compliance with governmental regulations. Tax consultants provide strategic advice on tax planning while interpreting complex legal requirements to optimize clients' tax positions within the bounds of regulatory frameworks. Both roles require comprehensive knowledge of federal, state, and local tax codes to mitigate legal risks and ensure compliance.

Client Interaction and Advisory Roles

Tax Specialists primarily focus on detailed tax compliance and preparation, ensuring clients meet regulatory requirements with accuracy and efficiency. Tax Consultants engage more deeply in advisory roles, offering strategic tax planning and personalized guidance to optimize financial outcomes for clients. Both roles require strong client interaction, but Tax Consultants typically maintain ongoing relationships to adapt strategies according to evolving tax laws and client goals.

Advancement Opportunities and Professional Growth

Tax Specialists often advance by deepening expertise in complex tax codes and certifications such as CPA or Enrolled Agent, enabling roles in senior tax advisory or corporate compliance. Tax Consultants leverage broad industry knowledge and client management skills to progress into strategic advisory positions or partner roles within consulting firms. Both career paths offer professional growth through continuous education and specialization in areas like international tax or tax technology.

Choosing the Right Role: Which is Best for You?

Tax Specialists focus on compliance and detailed knowledge of tax laws, making them ideal for individuals who prefer in-depth technical expertise and working within corporate or government frameworks. Tax Consultants offer broader advisory services, addressing strategic tax planning and personalized financial solutions, suitable for clients seeking proactive tax optimization. Choosing the right role depends on your strengths in regulatory precision versus consultative strategy and your career goals in either specialized tax compliance or comprehensive financial advising.

Tax Specialist vs Tax Consultant Infographic

jobdiv.com

jobdiv.com