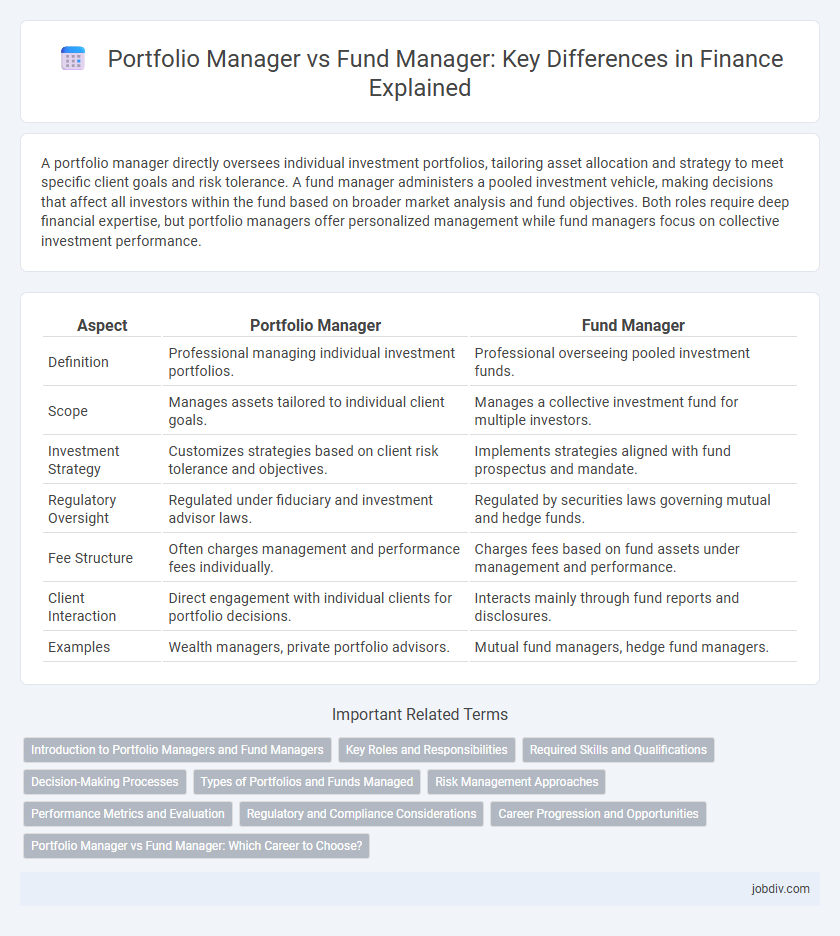

A portfolio manager directly oversees individual investment portfolios, tailoring asset allocation and strategy to meet specific client goals and risk tolerance. A fund manager administers a pooled investment vehicle, making decisions that affect all investors within the fund based on broader market analysis and fund objectives. Both roles require deep financial expertise, but portfolio managers offer personalized management while fund managers focus on collective investment performance.

Table of Comparison

| Aspect | Portfolio Manager | Fund Manager |

|---|---|---|

| Definition | Professional managing individual investment portfolios. | Professional overseeing pooled investment funds. |

| Scope | Manages assets tailored to individual client goals. | Manages a collective investment fund for multiple investors. |

| Investment Strategy | Customizes strategies based on client risk tolerance and objectives. | Implements strategies aligned with fund prospectus and mandate. |

| Regulatory Oversight | Regulated under fiduciary and investment advisor laws. | Regulated by securities laws governing mutual and hedge funds. |

| Fee Structure | Often charges management and performance fees individually. | Charges fees based on fund assets under management and performance. |

| Client Interaction | Direct engagement with individual clients for portfolio decisions. | Interacts mainly through fund reports and disclosures. |

| Examples | Wealth managers, private portfolio advisors. | Mutual fund managers, hedge fund managers. |

Introduction to Portfolio Managers and Fund Managers

Portfolio managers oversee individual investment portfolios tailored to clients' risk tolerance and financial goals, utilizing asset allocation and security selection strategies to maximize returns. Fund managers direct collective investment schemes such as mutual funds or hedge funds, making decisions on fund composition and trading activities to achieve performance benchmarks. Both roles require deep market analysis, risk management, and alignment with investment mandates to optimize portfolio performance.

Key Roles and Responsibilities

Portfolio managers analyze market trends and individual securities to create diversified investment portfolios tailored to client goals and risk tolerance. Fund managers oversee pooled investment funds, making decisions on asset allocation, fund strategy, and compliance while monitoring fund performance against benchmarks. Both roles require strong analytical skills, risk management expertise, and regulatory knowledge to maximize returns and safeguard investor interests.

Required Skills and Qualifications

Portfolio managers require strong analytical skills, proficiency in financial modeling, and expertise in risk management to optimize asset allocation. Fund managers need deep industry knowledge, experience in regulatory compliance, and effective communication skills to engage with stakeholders and attract investors. Both roles demand a solid background in finance, typically supported by CFA certification or equivalent qualifications.

Decision-Making Processes

Portfolio managers analyze individual assets within a portfolio to optimize risk-adjusted returns while aligning with clients' investment goals. Fund managers oversee entire funds, making strategic decisions based on market conditions and fund mandates to achieve overall performance objectives. Both roles require rigorous data analysis, but portfolio managers focus on asset allocation and security selection, whereas fund managers emphasize broader fund strategy and regulatory compliance.

Types of Portfolios and Funds Managed

Portfolio managers primarily handle diverse investment portfolios tailored to individual or institutional clients, including equity, fixed income, and balanced portfolios, while fund managers oversee pooled investment vehicles such as mutual funds, hedge funds, and exchange-traded funds (ETFs). Portfolio managers focus on customizing asset allocation and risk management strategies based on client objectives, whereas fund managers concentrate on achieving fund-specific goals through active or passive management within regulatory frameworks. The distinction lies in the personalized approach of portfolio management versus the collective investment strategy employed by fund managers in managing various fund types.

Risk Management Approaches

Portfolio managers implement tailored risk management strategies by diversifying assets and regularly adjusting allocations based on market volatility and individual client risk tolerance. Fund managers emphasize systematic risk controls through compliance with regulatory guidelines, employing hedging techniques and stress testing to safeguard the fund's overall performance. Both roles utilize quantitative risk models and scenario analysis, but portfolio managers focus more on personalized risk-return optimization, while fund managers prioritize collective fund stability and investor protection.

Performance Metrics and Evaluation

Portfolio managers are evaluated primarily on risk-adjusted returns, alpha generation, and consistency relative to benchmark indices. Fund managers' performance metrics emphasize net asset value (NAV) growth, expense ratios, and fund inflows/outflows to gauge investor confidence and operational efficiency. Both roles require rigorous analysis of Sharpe ratio, beta, and tracking error for a comprehensive assessment of performance within their respective scopes.

Regulatory and Compliance Considerations

Portfolio managers directly manage client investments within regulatory frameworks such as the SEC's Investment Advisers Act, ensuring compliance with fiduciary duties and reporting requirements. Fund managers oversee collective investment schemes like mutual funds and must adhere to regulations including the Investment Company Act of 1940, focusing on fund disclosures and shareholder protections. Both roles require rigorous adherence to anti-money laundering (AML) policies, risk management protocols, and continual regulatory filings to maintain transparency and legal compliance.

Career Progression and Opportunities

Portfolio managers typically manage individual client portfolios and focus on personalized investment strategies, allowing for specialization in asset allocation and risk management. Fund managers oversee pooled investment funds, offering broader exposure to diverse asset classes and potentially larger scale operational responsibilities. Career progression for portfolio managers often leads to senior investment strategist roles or chief investment officer positions, while fund managers may advance to fund director or executive management roles within asset management firms.

Portfolio Manager vs Fund Manager: Which Career to Choose?

Portfolio managers oversee diversified investment portfolios tailored to individual or institutional client goals, emphasizing risk management and asset allocation to optimize returns. Fund managers focus on managing mutual funds or hedge funds, making strategic decisions to maximize fund performance and meet shareholder expectations. Choosing between these careers depends on preferences for direct client interaction and customization versus managing pooled investments with broader market exposure.

Portfolio Manager vs Fund Manager Infographic

jobdiv.com

jobdiv.com