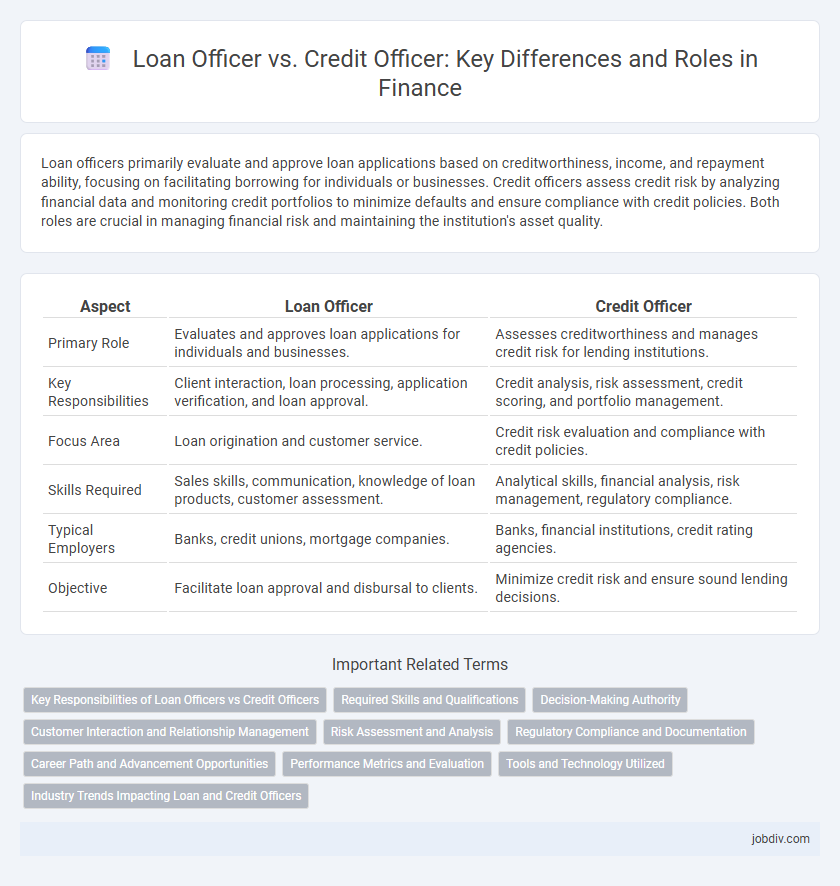

Loan officers primarily evaluate and approve loan applications based on creditworthiness, income, and repayment ability, focusing on facilitating borrowing for individuals or businesses. Credit officers assess credit risk by analyzing financial data and monitoring credit portfolios to minimize defaults and ensure compliance with credit policies. Both roles are crucial in managing financial risk and maintaining the institution's asset quality.

Table of Comparison

| Aspect | Loan Officer | Credit Officer |

|---|---|---|

| Primary Role | Evaluates and approves loan applications for individuals and businesses. | Assesses creditworthiness and manages credit risk for lending institutions. |

| Key Responsibilities | Client interaction, loan processing, application verification, and loan approval. | Credit analysis, risk assessment, credit scoring, and portfolio management. |

| Focus Area | Loan origination and customer service. | Credit risk evaluation and compliance with credit policies. |

| Skills Required | Sales skills, communication, knowledge of loan products, customer assessment. | Analytical skills, financial analysis, risk management, regulatory compliance. |

| Typical Employers | Banks, credit unions, mortgage companies. | Banks, financial institutions, credit rating agencies. |

| Objective | Facilitate loan approval and disbursal to clients. | Minimize credit risk and ensure sound lending decisions. |

Key Responsibilities of Loan Officers vs Credit Officers

Loan Officers primarily assess, authorize, and recommend approval of loan applications based on financial data and creditworthiness, while Credit Officers focus on evaluating credit risk and ensuring compliance with credit policies. Loan Officers interact directly with clients to facilitate loan processing and documentation, whereas Credit Officers analyze financial statements, credit reports, and market conditions to determine credit limits and risk mitigation strategies. Both roles require expertise in financial analysis, regulatory guidelines, and risk assessment within banking and lending institutions.

Required Skills and Qualifications

Loan Officers require strong interpersonal skills, knowledge of loan products, and the ability to assess borrowers' creditworthiness through financial analysis and risk evaluation. Credit Officers must have expertise in credit risk management, in-depth understanding of credit policies, and proficiency in analyzing financial statements and market conditions to make informed credit decisions. Both roles demand a bachelor's degree in finance or related fields, coupled with experience in lending regulations and excellent communication skills.

Decision-Making Authority

Loan officers primarily evaluate borrower creditworthiness and approve or deny loan applications based on risk assessment and financial criteria. Credit officers possess broader decision-making authority, overseeing credit policies, setting credit limits, and managing portfolio risk to ensure institutional compliance and profitability. The distinction in authority levels directly impacts loan approval speed and risk management efficacy within financial institutions.

Customer Interaction and Relationship Management

Loan Officers primarily engage with customers during the loan application process, providing personalized guidance, assessing financial needs, and building trust to facilitate loan approval. Credit Officers focus on evaluating creditworthiness and managing risk, often interacting with customers to clarify credit information and ensure compliance with lending policies. Effective customer interaction and relationship management by both roles contribute significantly to customer satisfaction and long-term client retention in financial institutions.

Risk Assessment and Analysis

Loan Officers primarily evaluate borrowers' creditworthiness and repayment capacity by analyzing income, employment history, and credit scores to approve loan applications. Credit Officers focus on assessing risk by reviewing credit terms, borrower financial statements, and market conditions to minimize default probabilities and manage portfolio quality. Both roles collaborate to ensure comprehensive risk assessment and effective credit decision-making in financial institutions.

Regulatory Compliance and Documentation

Loan officers primarily focus on originating loans while ensuring adherence to regulatory compliance by verifying borrower eligibility and maintaining accurate documentation throughout the lending process. Credit officers concentrate on evaluating creditworthiness, analyzing financial statements, and ensuring all credit decisions align with regulatory standards and internal policies. Both roles require meticulous documentation and strict compliance with banking regulations such as the Equal Credit Opportunity Act (ECOA) and the Dodd-Frank Act to mitigate risk and protect the institution.

Career Path and Advancement Opportunities

Loan Officers primarily focus on evaluating and approving personal and commercial loan applications, often progressing to senior loan officer or branch manager roles by gaining extensive client interaction and credit analysis experience. Credit Officers specialize in assessing credit risks and developing credit policies, positioning themselves for advancement into credit risk management or senior credit analyst roles within banks or financial institutions. Both career paths offer growth through certifications like Certified Credit Professional (CCP) and positions in financial management, with advancement often influenced by industry knowledge, regulatory expertise, and demonstrated decision-making skills.

Performance Metrics and Evaluation

Loan Officers are typically evaluated based on loan origination volume, approval rates, and client satisfaction scores, reflecting their ability to attract and process qualified borrowers efficiently. Credit Officers' performance metrics focus on risk assessment accuracy, default rates, and portfolio quality, highlighting their expertise in creditworthiness analysis and risk mitigation. Both roles rely on key indicators such as turnaround time and compliance adherence, but Loan Officers emphasize sales performance while Credit Officers prioritize credit risk management.

Tools and Technology Utilized

Loan officers leverage customer relationship management (CRM) software and automated underwriting systems to assess borrower qualifications efficiently, streamlining loan approval processes. Credit officers utilize advanced credit scoring models, risk management software, and data analytics tools to evaluate creditworthiness and manage portfolio risk effectively. Both roles increasingly depend on fintech innovations like artificial intelligence and machine learning to enhance decision accuracy and operational speed.

Industry Trends Impacting Loan and Credit Officers

Loan officers and credit officers face increasing integration of AI-driven credit assessment tools reshaping risk evaluation and decision-making processes. Regulatory changes emphasize enhanced transparency and compliance, compelling officers to adapt swiftly to evolving guidelines within banking and financial institutions. The rise of digital lending platforms accelerates automation, requiring expertise in both traditional credit analysis and innovative fintech solutions to remain competitive.

Loan Officer vs Credit Officer Infographic

jobdiv.com

jobdiv.com