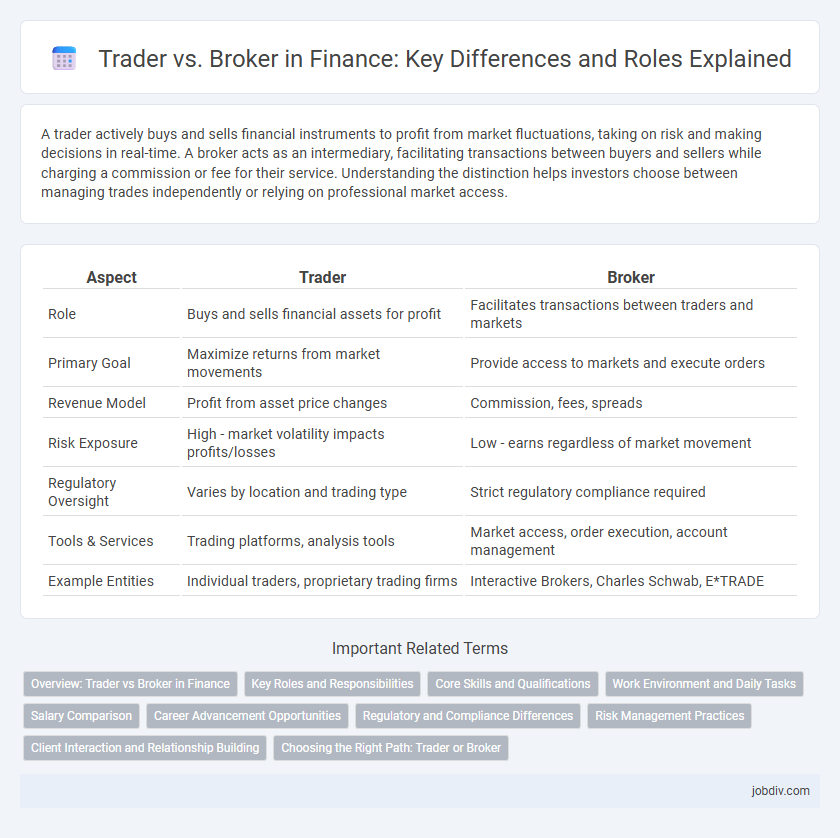

A trader actively buys and sells financial instruments to profit from market fluctuations, taking on risk and making decisions in real-time. A broker acts as an intermediary, facilitating transactions between buyers and sellers while charging a commission or fee for their service. Understanding the distinction helps investors choose between managing trades independently or relying on professional market access.

Table of Comparison

| Aspect | Trader | Broker |

|---|---|---|

| Role | Buys and sells financial assets for profit | Facilitates transactions between traders and markets |

| Primary Goal | Maximize returns from market movements | Provide access to markets and execute orders |

| Revenue Model | Profit from asset price changes | Commission, fees, spreads |

| Risk Exposure | High - market volatility impacts profits/losses | Low - earns regardless of market movement |

| Regulatory Oversight | Varies by location and trading type | Strict regulatory compliance required |

| Tools & Services | Trading platforms, analysis tools | Market access, order execution, account management |

| Example Entities | Individual traders, proprietary trading firms | Interactive Brokers, Charles Schwab, E*TRADE |

Overview: Trader vs Broker in Finance

Traders actively buy and sell financial instruments like stocks, bonds, or commodities aiming to profit from market fluctuations, while brokers serve as intermediaries facilitating these transactions between traders and the market. Traders assume direct market risk and make independent decisions, whereas brokers execute trades on behalf of clients, earning commissions or fees. Understanding the distinct roles helps clarify how capital flows and market liquidity are maintained within the financial ecosystem.

Key Roles and Responsibilities

Traders execute buy and sell orders for securities to capitalize on market movements and maximize profit, often managing portfolios and analyzing market trends. Brokers act as intermediaries between traders and the financial markets, facilitating transactions while ensuring compliance with regulatory requirements and providing clients with market insights. Both roles demand strong analytical skills, but traders focus on decision-making and risk management, whereas brokers emphasize client relations and transaction execution.

Core Skills and Qualifications

Traders require strong analytical skills, risk management expertise, and proficiency in financial modeling to make informed decisions and execute profitable trades. Brokers must demonstrate excellent communication abilities, regulatory compliance knowledge, and client management experience to effectively facilitate transactions and build trust. Both roles demand a deep understanding of market trends, financial instruments, and economic indicators to succeed in the finance industry.

Work Environment and Daily Tasks

Traders operate in fast-paced financial markets, making rapid decisions based on market data and trends to execute buy and sell orders for securities. Brokers work closely with clients, offering investment advice, executing trades on behalf of clients, and managing client portfolios in a structured office setting. While traders focus on short-term market movements and risk management, brokers prioritize client relationships and compliance with regulatory requirements.

Salary Comparison

Traders typically earn a salary combined with performance bonuses based on profits generated, with averages ranging from $70,000 to over $200,000 annually depending on experience and firm size. Brokers earn commissions and fees from facilitating trades, often earning between $50,000 and $150,000 per year, with top brokers exceeding this through client portfolio growth. Compensation for traders tends to be more variable and tied directly to trading success, while brokers have more stable, commission-based income streams.

Career Advancement Opportunities

Traders often advance by developing specialized market knowledge and achieving consistent profitability, leading to roles such as portfolio manager or proprietary trader. Brokers progress by building client relationships and mastering regulatory compliance, which can elevate them to senior broker or relationship manager positions. Both careers offer pathways to leadership roles within financial firms, but traders typically focus on market strategies while brokers emphasize client acquisition and retention.

Regulatory and Compliance Differences

Traders operate by executing buy and sell orders for their own accounts, subject to regulatory frameworks such as the Securities Exchange Act and filing requirements with entities like the SEC or FINRA to ensure market integrity. Brokers act as intermediaries for clients' trades and must comply with stricter licensing obligations, including registration as broker-dealers and adherence to fiduciary duties under regulations like MiFID II or the Dodd-Frank Act. Compliance differences include brokers maintaining detailed client records, implementing anti-money laundering (AML) procedures, and ensuring transparent fee disclosures, whereas traders focus primarily on risk management and maintaining capital adequacy as per regulatory capital requirements.

Risk Management Practices

Traders manage their own capital, employing risk management techniques such as stop-loss orders, position sizing, and diversification to minimize potential losses. Brokers act as intermediaries, providing clients with access to markets while offering risk management tools like margin requirements and real-time risk monitoring. Effective risk management in trading relies on disciplined strategy implementation and leveraging broker-provided resources to safeguard investment portfolios.

Client Interaction and Relationship Building

Traders engage directly with market instruments, making rapid decisions based on market conditions, while brokers act as intermediaries facilitating transactions between clients and the market. Brokers prioritize client interaction and relationship building by offering personalized advice, ensuring compliance, and providing tailored service to meet clients' investment goals. Effective brokers foster trust through transparent communication, thereby enhancing client satisfaction and loyalty in the financial sector.

Choosing the Right Path: Trader or Broker

Traders actively buy and sell financial instruments aiming for short-term profits, leveraging market volatility and technical analysis to maximize returns. Brokers facilitate transactions by connecting buyers and sellers, earning commissions while providing essential market access and advisory services. Selecting the right path depends on your risk tolerance, market knowledge, and preferred involvement level in trading activities.

Trader vs Broker Infographic

jobdiv.com

jobdiv.com