Quantitative analysts utilize mathematical models to assess financial risks and make trading decisions, often working in investment banks or hedge funds. Actuaries apply statistical methods and financial theory to evaluate insurance risks and design policies that minimize cost and maximize profit. Both roles require strong analytical skills, but quantitative analysts focus more on market dynamics while actuaries specialize in risk assessment for insurance and pensions.

Table of Comparison

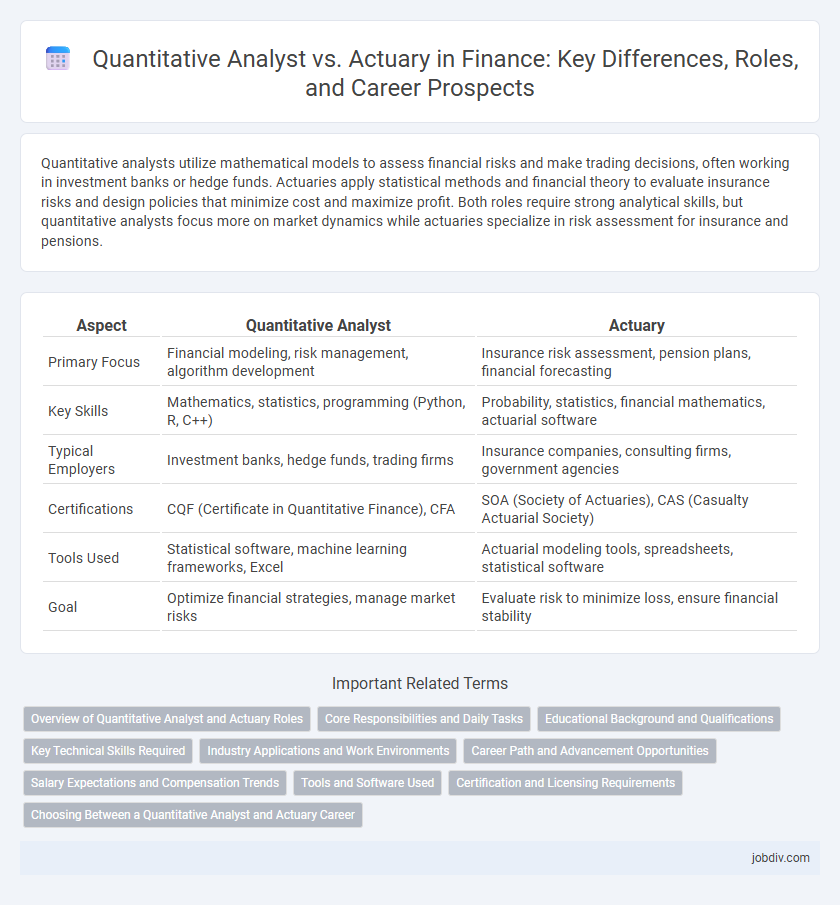

| Aspect | Quantitative Analyst | Actuary |

|---|---|---|

| Primary Focus | Financial modeling, risk management, algorithm development | Insurance risk assessment, pension plans, financial forecasting |

| Key Skills | Mathematics, statistics, programming (Python, R, C++) | Probability, statistics, financial mathematics, actuarial software |

| Typical Employers | Investment banks, hedge funds, trading firms | Insurance companies, consulting firms, government agencies |

| Certifications | CQF (Certificate in Quantitative Finance), CFA | SOA (Society of Actuaries), CAS (Casualty Actuarial Society) |

| Tools Used | Statistical software, machine learning frameworks, Excel | Actuarial modeling tools, spreadsheets, statistical software |

| Goal | Optimize financial strategies, manage market risks | Evaluate risk to minimize loss, ensure financial stability |

Overview of Quantitative Analyst and Actuary Roles

Quantitative analysts apply mathematical models and statistical techniques to assess financial risks and develop investment strategies, often working with large data sets and complex algorithms in areas like portfolio management and derivative pricing. Actuaries specialize in evaluating financial consequences of risk, using probability theory, statistics, and financial theory to model uncertainty in insurance, pension plans, and other long-term financial projects. Both roles require strong analytical skills, but quantitative analysts focus more on financial markets and securities, whereas actuaries concentrate on insurance, risk management, and regulatory compliance.

Core Responsibilities and Daily Tasks

Quantitative analysts develop mathematical models to analyze financial data, optimize investment strategies, and manage risk, using advanced statistical techniques and programming languages like Python or R. Actuaries focus on evaluating insurance risks, calculating premiums, and forecasting future financial costs based on probability and statistics, applying actuarial science principles and regulatory compliance. Both roles require strong analytical skills but differ in their primary domains: quantitative analysts concentrate on financial markets, while actuaries specialize in insurance and pension risk assessment.

Educational Background and Qualifications

Quantitative analysts typically hold advanced degrees in fields such as mathematics, statistics, finance, or computer science, often complemented by proficiency in programming languages like Python or R and knowledge of financial modeling. Actuaries require a strong foundation in mathematics, actuarial science, or statistics, coupled with a series of professional exams administered by actuarial societies such as the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS). The rigorous certification process for actuaries emphasizes risk assessment and insurance mathematics, distinguishing their qualifications from the broader quantitative and analytical skills emphasized in quantitative analyst training.

Key Technical Skills Required

Quantitative analysts require strong expertise in statistical modeling, programming languages such as Python and R, and advanced knowledge of financial instruments and risk management. Actuaries focus on proficiency in actuarial science, probability theory, and mastery of actuarial software like SAS and Excel for life insurance, pensions, and risk assessment. Both roles demand strong analytical skills, but quantitative analysts emphasize programming and algorithm development, while actuaries specialize in regulatory compliance and long-term forecasting models.

Industry Applications and Work Environments

Quantitative analysts primarily work in investment banks, hedge funds, and asset management firms, utilizing mathematical models to optimize trading strategies and risk management. Actuaries are predominantly employed by insurance companies, pension funds, and government agencies to assess financial risks related to life expectancy, health, and other contingencies. While quantitative analysts focus on developing predictive models for financial markets, actuaries concentrate on regulatory compliance and long-term risk assessment in insurance and retirement planning sectors.

Career Path and Advancement Opportunities

Quantitative analysts often advance through roles in risk management, financial modeling, and algorithm development within investment banks, hedge funds, or fintech firms, leveraging advanced statistical and programming skills. Actuaries progress by obtaining professional certifications from organizations like the Society of Actuaries, with career advancement opportunities in insurance, pension planning, and enterprise risk management. Both careers offer leadership roles such as chief risk officer or head of quantitative research, but actuaries typically follow a more structured certification-driven path while quantitative analysts emphasize technical innovation and adaptable skill sets.

Salary Expectations and Compensation Trends

Quantitative analysts typically command higher base salaries due to their demand in high-frequency trading and risk modeling sectors, with median annual earnings around $125,000 to $150,000, while actuaries earn between $100,000 and $130,000, reflecting steady growth tied to insurance and pension industries. Compensation trends show quantitative analysts benefiting from lucrative bonuses linked to firm performance and market conditions, whereas actuaries experience more stable, incremental raises aligned with industry regulations and longevity. Both roles enjoy strong career prospects, but quantitative analysts often see faster salary escalation driven by technological advancements and complex financial product development.

Tools and Software Used

Quantitative analysts commonly utilize programming languages such as Python, R, and MATLAB alongside advanced statistical software like SAS and Bloomberg Terminal for financial modeling and risk assessment. Actuaries primarily rely on specialized actuarial software like Prophet, AXIS, and MoSes, integrated with Excel and R for statistical analysis and forecasting insurance risks. Both professions leverage databases and cloud computing tools, but quantitative analysts often emphasize machine learning platforms and algorithmic trading systems.

Certification and Licensing Requirements

Quantitative analysts typically require strong skills in mathematics, statistics, and computer science, often holding certifications such as the Chartered Financial Analyst (CFA) designation or the Certificate in Quantitative Finance (CQF). Actuaries must pass a series of rigorous exams administered by professional bodies like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS) to achieve credentialing such as Associate (ASA) or Fellow (FSA) status. While quantitative analysts focus on financial modeling certifications, actuaries are mandated by regulatory frameworks to secure licenses enabling them to provide risk assessment and insurance consulting services.

Choosing Between a Quantitative Analyst and Actuary Career

Choosing between a Quantitative Analyst and Actuary career depends on your strengths in statistical modeling and risk assessment. Quantitative Analysts primarily focus on financial markets, developing complex algorithms for asset valuation and trading strategies using advanced mathematics and programming skills. Actuaries specialize in assessing risk for insurance and pension plans through rigorous statistical analysis, requiring professional certification and a strong foundation in economics and finance.

Quantitative Analyst vs Actuary Infographic

jobdiv.com

jobdiv.com