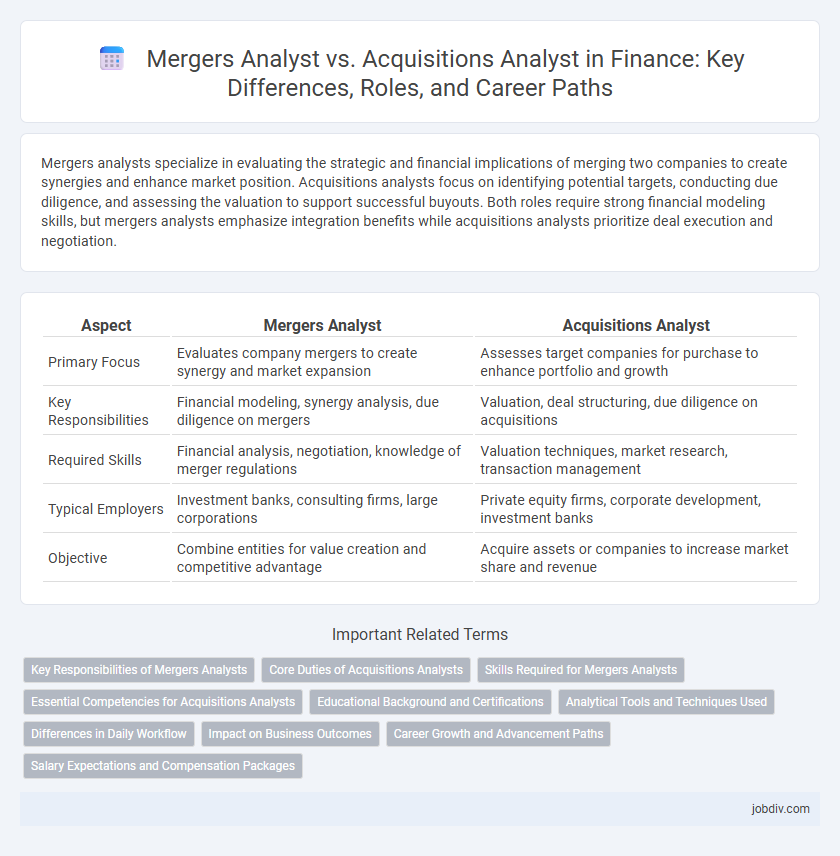

Mergers analysts specialize in evaluating the strategic and financial implications of merging two companies to create synergies and enhance market position. Acquisitions analysts focus on identifying potential targets, conducting due diligence, and assessing the valuation to support successful buyouts. Both roles require strong financial modeling skills, but mergers analysts emphasize integration benefits while acquisitions analysts prioritize deal execution and negotiation.

Table of Comparison

| Aspect | Mergers Analyst | Acquisitions Analyst |

|---|---|---|

| Primary Focus | Evaluates company mergers to create synergy and market expansion | Assesses target companies for purchase to enhance portfolio and growth |

| Key Responsibilities | Financial modeling, synergy analysis, due diligence on mergers | Valuation, deal structuring, due diligence on acquisitions |

| Required Skills | Financial analysis, negotiation, knowledge of merger regulations | Valuation techniques, market research, transaction management |

| Typical Employers | Investment banks, consulting firms, large corporations | Private equity firms, corporate development, investment banks |

| Objective | Combine entities for value creation and competitive advantage | Acquire assets or companies to increase market share and revenue |

Key Responsibilities of Mergers Analysts

Mergers Analysts specialize in evaluating potential merger opportunities by conducting in-depth financial modeling, due diligence, and risk assessments to determine synergistic benefits and integration feasibility. They analyze market trends, assess company valuations, and prepare detailed reports to support strategic decision-making in the merger process. Their key responsibilities include coordinating cross-functional teams, identifying potential operational efficiencies, and forecasting post-merger financial performance.

Core Duties of Acquisitions Analysts

Acquisitions Analysts primarily evaluate potential target companies by conducting comprehensive financial due diligence, assessing valuation models, and identifying risk factors that could impact transaction success. Their core duties include analyzing market conditions, preparing detailed acquisition proposals, and collaborating with legal and financial teams to ensure regulatory compliance and deal feasibility. This role demands expertise in financial modeling, negotiation support, and post-acquisition integration strategies to maximize value creation for stakeholders.

Skills Required for Mergers Analysts

Mergers Analysts require strong financial modeling and valuation skills to assess the strategic fit and financial impact of potential mergers. Proficiency in due diligence, market research, and regulatory compliance is essential to identify risks and synergies during the merger process. Advanced analytical abilities combined with effective communication skills enable Mergers Analysts to present findings clearly to stakeholders and guide decision-making.

Essential Competencies for Acquisitions Analysts

Acquisitions Analysts excel in financial modeling, due diligence, and market analysis to identify strategic acquisition targets and assess value. Proficiency in negotiation, risk assessment, and integration planning is crucial to ensure seamless transaction execution and maximize return on investment. Strong skills in data interpretation, regulatory compliance, and cross-functional collaboration enhance decision-making throughout the acquisition process.

Educational Background and Certifications

Mergers Analysts typically hold degrees in finance, economics, or business administration, often complemented by certifications like the Chartered Financial Analyst (CFA) designation to enhance expertise in valuation and market analysis. Acquisitions Analysts also pursue similar academic paths but may benefit from additional certifications such as the Certified Merger & Acquisition Professional (CMAP) to deepen practical knowledge in deal structuring and due diligence. Both roles require strong analytical skills, yet specialized certifications tailored to their specific focus areas significantly boost career advancement and effectiveness in transaction assessments.

Analytical Tools and Techniques Used

Mergers Analysts primarily utilize financial modeling, discounted cash flow (DCF) analysis, and comparative company assessments to evaluate merger synergies and strategic fit. Acquisitions Analysts focus on due diligence processes, valuation metrics such as EBITDA multiples, and risk assessment frameworks to determine acquisition targets' financial health and integration feasibility. Both roles extensively employ advanced Excel, Bloomberg Terminal, and data visualization tools like Tableau to derive actionable insights for decision-making.

Differences in Daily Workflow

Mergers analysts primarily focus on evaluating potential merger deals by analyzing financial statements, assessing synergistic opportunities, and modeling combined company forecasts, while acquisitions analysts concentrate on target company due diligence, valuation, and negotiation support for purchase transactions. Workflow for mergers involves extensive collaboration with integration teams and strategic planning to optimize post-merger efficiency. Acquisitions analysts spend significant time on market research, deal structuring, and financial impact analysis to ensure transaction feasibility and value creation.

Impact on Business Outcomes

Mergers analysts evaluate the strategic fit and potential synergies of combining two companies, directly influencing long-term growth and market positioning through detailed financial modeling and risk assessment. Acquisitions analysts focus on identifying and valuing target companies, ensuring optimal deal structuring to maximize shareholder value and immediate financial returns. Both roles are critical in shaping business outcomes by driving informed decisions that enhance competitive advantage and operational efficiency.

Career Growth and Advancement Paths

Mergers analysts typically focus on evaluating the strategic fit and financial impact of merging companies, offering career growth opportunities that lead to senior roles in corporate development or investment banking. Acquisitions analysts specialize in identifying and assessing potential target companies for purchase, with advancement paths often steering toward leadership positions in private equity, venture capital, or corporate strategy. Both roles emphasize analytical expertise, but mergers analysts may develop broader strategic skills, while acquisitions analysts gain deep transactional experience crucial for executive management careers.

Salary Expectations and Compensation Packages

Mergers Analysts typically earn between $70,000 and $110,000 annually, with bonuses ranging from 10% to 20% of their base salary, reflecting the complexity and strategic nature of merger transactions. Acquisitions Analysts often command slightly higher salaries, averaging $80,000 to $120,000, complemented by performance-based incentives and equity options linked to successful acquisition deals. Compensation packages for both roles frequently include benefits such as health insurance, retirement plans, and professional development allowances, with acquisition roles generally offering greater variable pay due to deal-driven benchmarks.

Mergers Analyst vs Acquisitions Analyst Infographic

jobdiv.com

jobdiv.com