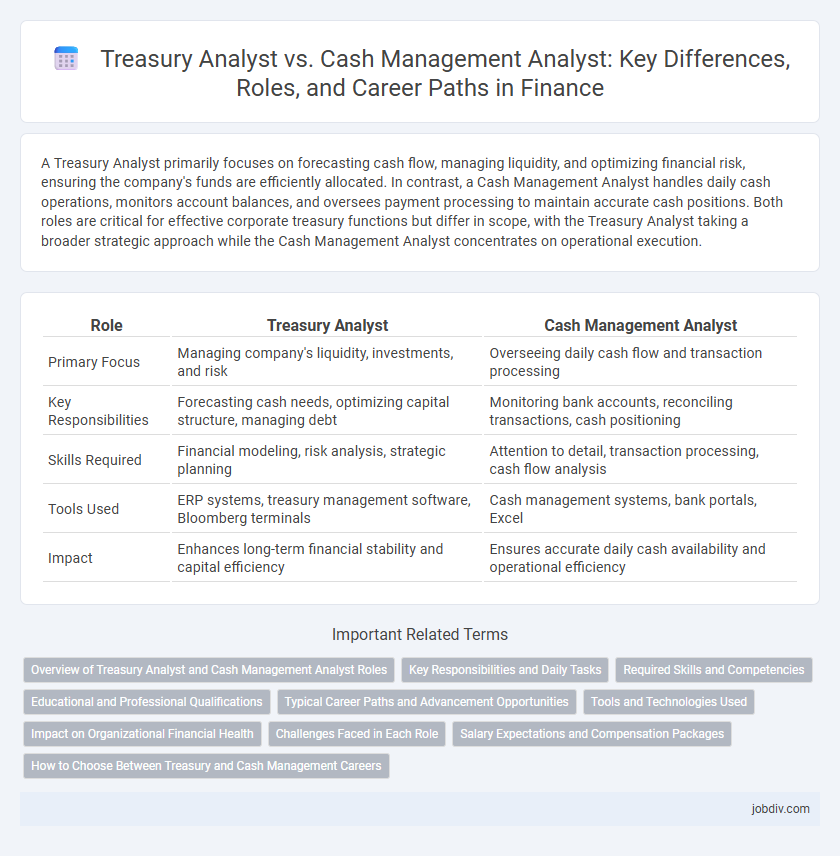

A Treasury Analyst primarily focuses on forecasting cash flow, managing liquidity, and optimizing financial risk, ensuring the company's funds are efficiently allocated. In contrast, a Cash Management Analyst handles daily cash operations, monitors account balances, and oversees payment processing to maintain accurate cash positions. Both roles are critical for effective corporate treasury functions but differ in scope, with the Treasury Analyst taking a broader strategic approach while the Cash Management Analyst concentrates on operational execution.

Table of Comparison

| Role | Treasury Analyst | Cash Management Analyst |

|---|---|---|

| Primary Focus | Managing company's liquidity, investments, and risk | Overseeing daily cash flow and transaction processing |

| Key Responsibilities | Forecasting cash needs, optimizing capital structure, managing debt | Monitoring bank accounts, reconciling transactions, cash positioning |

| Skills Required | Financial modeling, risk analysis, strategic planning | Attention to detail, transaction processing, cash flow analysis |

| Tools Used | ERP systems, treasury management software, Bloomberg terminals | Cash management systems, bank portals, Excel |

| Impact | Enhances long-term financial stability and capital efficiency | Ensures accurate daily cash availability and operational efficiency |

Overview of Treasury Analyst and Cash Management Analyst Roles

Treasury Analysts specialize in managing an organization's liquidity, forecasting cash flow, and optimizing capital structure to reduce financial risk. Cash Management Analysts focus on monitoring daily cash activities, processing payments, and ensuring efficient cash inflows and outflows to maintain operational liquidity. Both roles require proficiency in cash forecasting, banking relationships, and financial reporting to support corporate finance strategies.

Key Responsibilities and Daily Tasks

Treasury Analysts manage corporate liquidity, forecast cash flow, and optimize capital structure to ensure financial stability. Cash Management Analysts focus on daily cash positioning, transaction monitoring, and bank relationship management to maximize operational efficiency. Both roles require strong analytical skills and collaboration with finance teams to support overall treasury functions.

Required Skills and Competencies

Treasury Analysts require strong skills in cash flow forecasting, risk management, and financial modeling, with proficiency in ERP systems and regulatory compliance. Cash Management Analysts focus on liquidity optimization, bank relationship management, and transaction processing, emphasizing expertise in payment systems and reconciliation techniques. Both roles demand advanced analytical abilities, attention to detail, and proficiency in Excel and financial software tools.

Educational and Professional Qualifications

Treasury Analysts typically hold a bachelor's degree in finance, accounting, or economics, often complemented by certifications such as CFA or CPA, emphasizing expertise in risk management and investment strategies. Cash Management Analysts usually possess degrees in finance, business administration, or accounting, with a strong focus on cash flow forecasting, liquidity management, and short-term financing solutions, supported by certifications like Certified Treasury Professional (CTP). Both roles require proficiency in financial software, analytical skills, and an understanding of corporate finance principles, but Treasury Analysts tend to engage more in strategic fund allocation while Cash Management Analysts concentrate on day-to-day cash operations.

Typical Career Paths and Advancement Opportunities

Treasury Analysts often advance to roles such as Senior Treasury Analyst, Treasury Manager, or Corporate Treasurer, leveraging skills in liquidity management and risk assessment to oversee an organization's financial stability. Cash Management Analysts typically progress to positions like Cash Manager or Treasury Operations Manager, focusing on optimizing cash flow, banking relationships, and payment processes. Both career paths offer advancement into strategic financial leadership roles, with Treasury Analysts generally moving towards broader financial planning and risk management, while Cash Management Analysts specialize in operational efficiency and cash optimization.

Tools and Technologies Used

Treasury Analysts primarily utilize advanced financial modeling software such as SAP Treasury, Kyriba, and Bloomberg Terminal to manage liquidity, risk, and investment portfolios effectively. Cash Management Analysts rely heavily on treasury management systems (TMS), automated payment platforms, and real-time cash flow forecasting tools like FIS Global and Fiserv to optimize daily cash operations and ensure accurate fund allocation. Both roles increasingly incorporate data analytics and ERP integration to enhance financial decision-making and operational efficiency.

Impact on Organizational Financial Health

Treasury Analysts optimize liquidity and manage financial risks by forecasting cash flow and coordinating debt to ensure organizational solvency and investment efficiency. Cash Management Analysts focus on daily cash position, accelerating receivables, and controlling disbursements to maximize working capital and maintain operational liquidity. Both roles critically support financial stability, but Treasury Analysts emphasize strategic financial planning while Cash Management Analysts drive tactical cash operations impacting the organization's immediate financial health.

Challenges Faced in Each Role

Treasury Analysts face challenges such as managing liquidity risk, forecasting cash flow accurately, and optimizing capital allocation to support organizational financial stability. Cash Management Analysts contend with ensuring efficient daily cash operations, reconciling bank accounts promptly, and preventing fraud through vigilant transaction monitoring. Both roles demand advanced analytical skills and real-time decision making to maintain the firm's financial health and operational efficiency.

Salary Expectations and Compensation Packages

Treasury Analysts typically command median salaries ranging from $65,000 to $85,000 annually, reflecting their advanced expertise in liquidity risk management and debt issuance. Cash Management Analysts generally earn between $55,000 and $75,000, with compensation packages often including performance bonuses tied to cash flow optimization and transaction efficiency. Both roles may offer benefits such as retirement plans, health insurance, and potential stock options, but Treasury Analysts usually have higher earning potential due to broader strategic responsibilities.

How to Choose Between Treasury and Cash Management Careers

Choosing between a Treasury Analyst and a Cash Management Analyst career depends on evaluating your interest in strategic financial planning versus operational cash flow oversight. Treasury Analysts focus on managing an organization's liquidity, investments, and risk strategies, making them essential for long-term financial stability. Cash Management Analysts emphasize daily cash flow monitoring, bank relationships, and transaction processing, ideal for professionals seeking hands-on control over immediate financial operations.

Treasury Analyst vs Cash Management Analyst Infographic

jobdiv.com

jobdiv.com