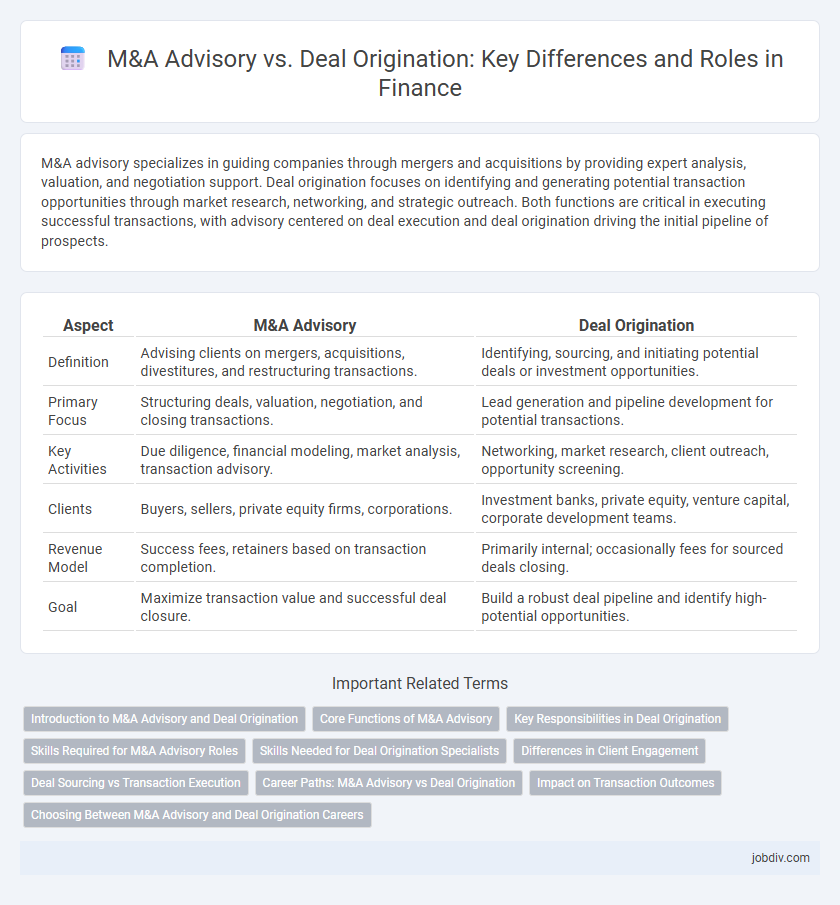

M&A advisory specializes in guiding companies through mergers and acquisitions by providing expert analysis, valuation, and negotiation support. Deal origination focuses on identifying and generating potential transaction opportunities through market research, networking, and strategic outreach. Both functions are critical in executing successful transactions, with advisory centered on deal execution and deal origination driving the initial pipeline of prospects.

Table of Comparison

| Aspect | M&A Advisory | Deal Origination |

|---|---|---|

| Definition | Advising clients on mergers, acquisitions, divestitures, and restructuring transactions. | Identifying, sourcing, and initiating potential deals or investment opportunities. |

| Primary Focus | Structuring deals, valuation, negotiation, and closing transactions. | Lead generation and pipeline development for potential transactions. |

| Key Activities | Due diligence, financial modeling, market analysis, transaction advisory. | Networking, market research, client outreach, opportunity screening. |

| Clients | Buyers, sellers, private equity firms, corporations. | Investment banks, private equity, venture capital, corporate development teams. |

| Revenue Model | Success fees, retainers based on transaction completion. | Primarily internal; occasionally fees for sourced deals closing. |

| Goal | Maximize transaction value and successful deal closure. | Build a robust deal pipeline and identify high-potential opportunities. |

Introduction to M&A Advisory and Deal Origination

M&A advisory involves providing strategic consulting services, valuation analysis, and negotiation support to clients engaged in mergers and acquisitions, ensuring optimal deal structuring and value creation. Deal origination focuses on identifying and sourcing potential acquisition targets or buyers, leveraging extensive networks and market intelligence to generate proprietary deal flow. Both functions are critical in facilitating successful transactions by aligning buyer and seller objectives with market opportunities.

Core Functions of M&A Advisory

M&A advisory primarily focuses on providing expert guidance throughout the merger and acquisition process, including target identification, valuation, negotiation, and due diligence. This service aims to maximize transaction value and minimize risks by leveraging market insights and financial expertise. Deal origination, in contrast, centers on sourcing and initiating potential transaction opportunities rather than executing the advisory components.

Key Responsibilities in Deal Origination

Deal Origination involves identifying potential acquisition targets or merger opportunities through market research, networking, and relationship-building with industry stakeholders. Key responsibilities include sourcing deal flow, conducting preliminary due diligence, and qualifying prospects to align with strategic investment criteria. Professionals in deal origination must maintain extensive market intelligence to proactively uncover opportunities before competitors.

Skills Required for M&A Advisory Roles

Expertise in financial modeling, valuation techniques, and due diligence is essential for M&A advisory roles to accurately assess transaction viability and risks. Strong negotiation skills and strategic thinking enable advisors to structure deals that maximize client value and align with long-term goals. Proficiency in regulatory compliance, market analysis, and effective communication supports seamless transaction execution and stakeholder management.

Skills Needed for Deal Origination Specialists

Deal Origination specialists require strong market research skills, deep industry knowledge, and exceptional networking abilities to identify and create potential acquisition opportunities. Proficiency in financial analysis and valuation models is essential for assessing deal feasibility and aligning target companies with client strategic goals. Effective communication and negotiation skills enable these specialists to build relationships with stakeholders and facilitate initial deal discussions.

Differences in Client Engagement

M&A Advisory primarily involves guiding clients through the complexities of mergers and acquisitions, providing strategic advice, valuation, and negotiation support to ensure successful transaction execution. Deal Origination focuses on proactively identifying and sourcing potential transaction opportunities, building relationships with target companies, and generating deal flow to match client investment criteria. Client engagement in M&A Advisory is intensive and transaction-specific, while Deal Origination emphasizes ongoing relationship management and market insight to uncover new deals.

Deal Sourcing vs Transaction Execution

Deal sourcing involves identifying and generating potential acquisition targets or buyers, leveraging extensive networks and market research to build a robust pipeline of opportunities. Transaction execution centers on managing the due diligence process, negotiating terms, and coordinating closing activities to finalize mergers or acquisitions efficiently. Effective M&A advisory integrates deal sourcing and transaction execution to maximize deal value and streamline the entire M&A process.

Career Paths: M&A Advisory vs Deal Origination

Career paths in M&A Advisory emphasize financial analysis, negotiation, and deal execution, often requiring strong skills in valuation, due diligence, and strategic advisory. In contrast, Deal Origination roles focus on identifying and sourcing potential acquisition targets, building client relationships, and market research to generate new deal flow. Professionals in Deal Origination develop expertise in networking, sales strategies, and market intelligence, while M&A Advisory specialists gain deep technical knowledge and experience in closing complex transactions.

Impact on Transaction Outcomes

M&A advisory plays a critical role in maximizing transaction value by providing expert guidance throughout deal structuring, negotiation, and due diligence, directly influencing successful outcomes. Deal origination focuses on identifying potential targets and buyers, which sets the foundation for deal flow and quality of opportunities available. Effective integration of M&A advisory and deal origination enhances deal efficiency and increases the likelihood of favorable transaction terms and post-merger performance.

Choosing Between M&A Advisory and Deal Origination Careers

Choosing between M&A advisory and deal origination careers depends on one's skills and interests in client interaction and deal execution. M&A advisory focuses on providing strategic guidance, valuation, and negotiation support during mergers and acquisitions, requiring strong analytical and communication skills. Deal origination emphasizes sourcing and initiating new transaction opportunities, demanding extensive networking, market insight, and proactive relationship-building capabilities.

M&A Advisory vs Deal Origination Infographic

jobdiv.com

jobdiv.com