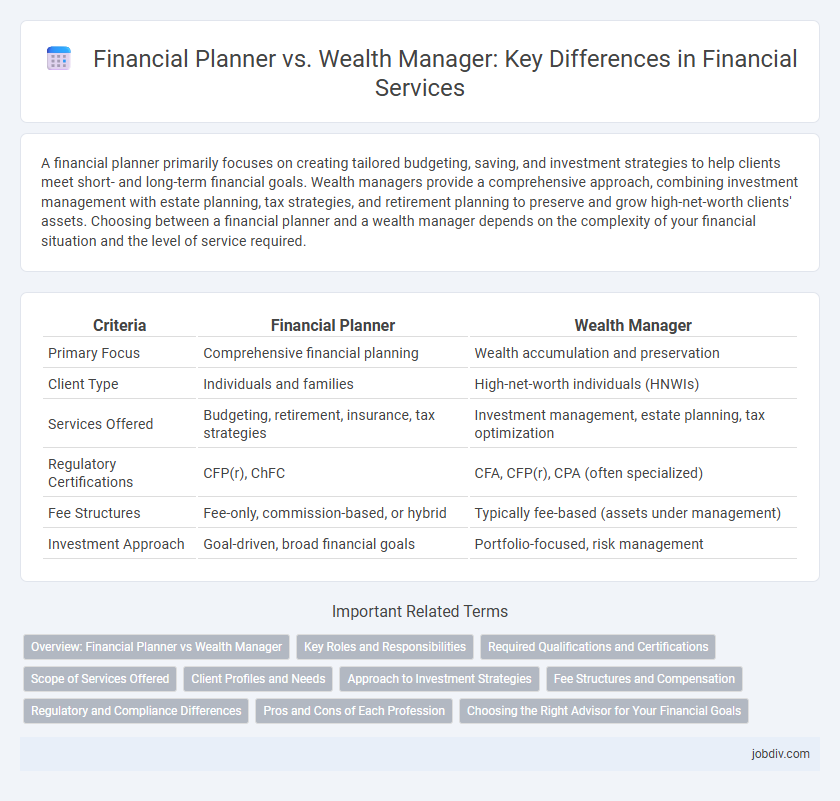

A financial planner primarily focuses on creating tailored budgeting, saving, and investment strategies to help clients meet short- and long-term financial goals. Wealth managers provide a comprehensive approach, combining investment management with estate planning, tax strategies, and retirement planning to preserve and grow high-net-worth clients' assets. Choosing between a financial planner and a wealth manager depends on the complexity of your financial situation and the level of service required.

Table of Comparison

| Criteria | Financial Planner | Wealth Manager |

|---|---|---|

| Primary Focus | Comprehensive financial planning | Wealth accumulation and preservation |

| Client Type | Individuals and families | High-net-worth individuals (HNWIs) |

| Services Offered | Budgeting, retirement, insurance, tax strategies | Investment management, estate planning, tax optimization |

| Regulatory Certifications | CFP(r), ChFC | CFA, CFP(r), CPA (often specialized) |

| Fee Structures | Fee-only, commission-based, or hybrid | Typically fee-based (assets under management) |

| Investment Approach | Goal-driven, broad financial goals | Portfolio-focused, risk management |

Overview: Financial Planner vs Wealth Manager

A financial planner provides comprehensive guidance on budgeting, retirement planning, tax strategies, and insurance, focusing on creating personalized financial plans for individual clients. Wealth managers offer a broader scope of services including investment management, estate planning, tax optimization, and portfolio diversification, targeting high-net-worth individuals. Both professionals aim to secure financial well-being but differ in specialization and client focus, with wealth managers typically handling more complex financial portfolios.

Key Roles and Responsibilities

Financial planners specialize in creating comprehensive budgets, retirement plans, and tax strategies to help clients meet specific financial goals. Wealth managers provide a more holistic approach, including estate planning, investment management, and risk assessment for high-net-worth individuals. Both roles require in-depth financial analysis, but wealth managers typically handle more complex portfolios and personalized asset allocation.

Required Qualifications and Certifications

Financial planners typically hold certifications such as the Certified Financial Planner (CFP) designation, requiring a bachelor's degree, completion of specific coursework, passing a rigorous exam, and adherence to ethical standards. Wealth managers often possess advanced qualifications like Chartered Financial Analyst (CFA) or Certified Private Wealth Advisor (CPWA), emphasizing expertise in investment management, estate planning, and tax strategies for high-net-worth clients. Both roles require ongoing education and state licensing where applicable, ensuring adherence to evolving industry regulations and best practices.

Scope of Services Offered

Financial planners primarily focus on creating comprehensive budgets, retirement plans, and tax strategies tailored to individual clients' financial goals. Wealth managers provide a broader range of services, including investment management, estate planning, and tax optimization for high-net-worth individuals. Both professionals aim to enhance financial well-being, but wealth managers offer more specialized investment and asset management solutions.

Client Profiles and Needs

Financial planners primarily serve individuals and families seeking comprehensive budgeting, retirement planning, and debt management strategies tailored to varying income levels. Wealth managers focus on high-net-worth clients requiring integrated investment management, estate planning, tax optimization, and risk management solutions. Client needs dictate service scope: financial planners address broad financial wellness, while wealth managers provide specialized asset growth and preservation strategies.

Approach to Investment Strategies

Financial planners typically emphasize goal-based investment strategies by assessing clients' financial situations, risk tolerance, and long-term objectives to create diversified portfolios tailored for retirement, education, or debt management. Wealth managers adopt a more holistic and personalized approach, integrating tax planning, estate strategies, and alternative investments to optimize wealth preservation and growth for high-net-worth individuals. Both professionals conduct thorough risk assessments but differ in scope, with wealth managers providing broader financial solutions beyond traditional investment management.

Fee Structures and Compensation

Financial planners typically charge hourly rates, flat fees, or a percentage of assets under management (AUM), often ranging from 0.5% to 2% annually, while wealth managers usually focus on AUM-based fees, which can include tiered percentages decreasing with higher asset levels. Both may earn commissions on financial products, but fee-only financial planners avoid conflicts of interest by not accepting commissions, contrasting with wealth managers who might incorporate performance-based fees or retainers. Understanding these fee structures is crucial for clients when evaluating cost transparency and aligning compensation with financial goals.

Regulatory and Compliance Differences

Financial planners are typically regulated under state insurance and securities laws, often requiring certifications like Certified Financial Planner (CFP) and adherence to fiduciary standards when offering investment advice. Wealth managers operate under more comprehensive regulatory frameworks, such as the Investment Advisers Act of 1940, and must register with the SEC or state regulators, ensuring strict compliance with investment advisory regulations and client disclosure requirements. The distinction in regulatory oversight impacts compliance protocols, client protection measures, and the scope of services each professional can legally offer.

Pros and Cons of Each Profession

Financial planners specialize in creating detailed budgets, retirement plans, and debt management strategies, making them ideal for individuals seeking structured financial guidance; however, their scope may be limited to basic investment advice. Wealth managers offer comprehensive services including investment management, estate planning, and tax optimization, catering to high-net-worth clients but often require higher minimum assets and charge substantial fees. Choosing between the two depends on the client's financial complexity and need for personalized wealth preservation versus straightforward financial planning.

Choosing the Right Advisor for Your Financial Goals

Selecting the right financial advisor depends on your specific financial goals and needs, as a financial planner typically focuses on budgeting, retirement planning, and debt management, while a wealth manager offers comprehensive services including investment management, tax planning, and estate strategies for high-net-worth individuals. Assessing qualifications such as Certified Financial Planner (CFP) or Chartered Wealth Manager (CWM) designations helps ensure expertise aligned with your objectives. Evaluating fee structures, ranging from fee-only to commission-based, is essential for transparency and long-term trust in managing your financial future.

Financial Planner vs Wealth Manager Infographic

jobdiv.com

jobdiv.com