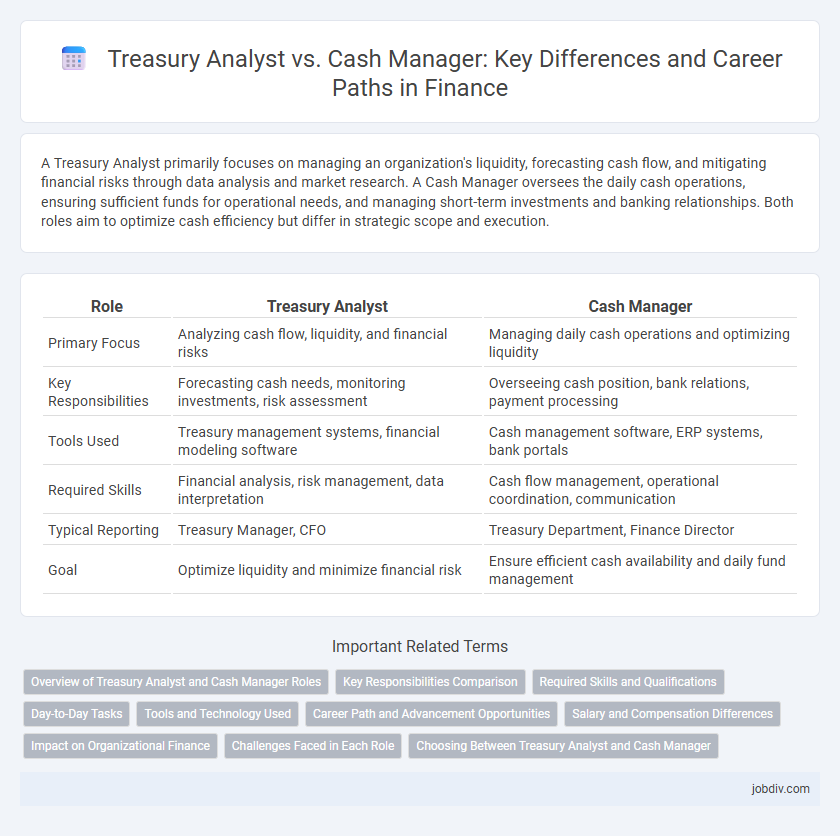

A Treasury Analyst primarily focuses on managing an organization's liquidity, forecasting cash flow, and mitigating financial risks through data analysis and market research. A Cash Manager oversees the daily cash operations, ensuring sufficient funds for operational needs, and managing short-term investments and banking relationships. Both roles aim to optimize cash efficiency but differ in strategic scope and execution.

Table of Comparison

| Role | Treasury Analyst | Cash Manager |

|---|---|---|

| Primary Focus | Analyzing cash flow, liquidity, and financial risks | Managing daily cash operations and optimizing liquidity |

| Key Responsibilities | Forecasting cash needs, monitoring investments, risk assessment | Overseeing cash position, bank relations, payment processing |

| Tools Used | Treasury management systems, financial modeling software | Cash management software, ERP systems, bank portals |

| Required Skills | Financial analysis, risk management, data interpretation | Cash flow management, operational coordination, communication |

| Typical Reporting | Treasury Manager, CFO | Treasury Department, Finance Director |

| Goal | Optimize liquidity and minimize financial risk | Ensure efficient cash availability and daily fund management |

Overview of Treasury Analyst and Cash Manager Roles

Treasury Analysts are responsible for monitoring an organization's liquidity, managing cash flow forecasts, and analyzing financial risks to optimize capital availability. Cash Managers oversee daily cash operations, ensuring accurate cash positioning, managing bank relationships, and facilitating payment processes to maintain operational efficiency. Both roles work closely to balance short-term liquidity needs with long-term financial stability in corporate treasury functions.

Key Responsibilities Comparison

Treasury Analysts concentrate on managing an organization's liquidity, forecasting cash flow, and monitoring financial risk through detailed analysis of market trends and banking activities. Cash Managers oversee daily cash operations, ensuring efficient cash availability, processing payments, and optimizing working capital to meet short-term financial obligations. Both roles collaborate to balance cash management with strategic investment decisions, supporting corporate financial stability and operational efficiency.

Required Skills and Qualifications

Treasury Analysts require strong analytical skills, proficiency in financial modeling, and expertise in risk management to monitor cash flow, forecast liquidity, and optimize investment strategies. Cash Managers demand advanced knowledge of cash flow management, banking operations, and compliance regulations, alongside leadership skills to oversee cash positioning and ensure sufficient liquidity for daily operations. Both roles commonly require a bachelor's degree in finance, accounting, or economics, with certifications such as CFA, CPA, or CTP enhancing career prospects.

Day-to-Day Tasks

Treasury Analysts focus on monitoring daily cash flow, forecasting liquidity needs, and managing banking relationships to optimize the organization's financial stability and investment strategies. Cash Managers handle daily cash operations, including processing payments, reconciling account balances, and ensuring sufficient funds for business transactions. Both roles require precise cash position analysis but differ in scope, with Treasury Analysts emphasizing strategic planning while Cash Managers concentrate on operational efficiency.

Tools and Technology Used

Treasury Analysts primarily utilize advanced financial modeling software, ERP systems like SAP and Oracle, and treasury management systems (TMS) such as Kyriba or GTreasury to forecast cash flow and manage liquidity risks. Cash Managers rely heavily on bank reconciliation tools, automated payment solutions, and real-time cash positioning dashboards to optimize daily cash operations and ensure efficient fund allocation. Both roles increasingly integrate AI-driven analytics and blockchain technology to enhance accuracy and security in cash and treasury management processes.

Career Path and Advancement Opportunities

A Treasury Analyst typically begins their career managing cash flow forecasting, risk analysis, and liquidity optimization, gaining foundational skills critical for advancing into roles like Cash Manager or Treasury Manager. Cash Managers oversee daily cash operations, banking relationships, and short-term investments, offering a broader operational scope that paves the way for senior positions such as Treasurer or Director of Treasury. Career advancement from Treasury Analyst to Cash Manager involves developing expertise in cash management systems, regulatory compliance, and strategic financial planning, enhancing prospects for leadership roles within corporate finance.

Salary and Compensation Differences

Treasury analysts generally earn a median salary ranging from $60,000 to $90,000 annually, reflecting their focus on financial risk assessment and liquidity management. Cash managers typically command higher compensation, often between $80,000 and $120,000, due to their responsibility for optimizing cash flow and managing corporate banking relationships. Variations in salary are influenced by industry, company size, geographic location, and individual experience, with bonuses and incentives frequently tied to financial performance metrics.

Impact on Organizational Finance

Treasury Analysts enhance organizational finance by conducting risk assessments and optimizing liquidity strategies, contributing to improved cash flow forecasting and financial stability. Cash Managers directly impact organizational finance through overseeing daily cash operations, ensuring accurate cash flow management, and maintaining optimal cash balances to meet short-term obligations. Both roles are critical in balancing risk and liquidity, thereby supporting strategic financial planning and operational efficiency.

Challenges Faced in Each Role

Treasury Analysts face challenges in accurately forecasting cash flow and managing liquidity risk amid market volatility, requiring strong data analysis and financial modeling skills. Cash Managers contend with optimizing daily cash positioning and ensuring efficient payment processing while preventing fraud and maintaining compliance with regulatory requirements. Both roles demand strategic decision-making to balance operational efficiency and risk mitigation in dynamic financial environments.

Choosing Between Treasury Analyst and Cash Manager

Choosing between a Treasury Analyst and a Cash Manager depends on organizational priorities: Treasury Analysts specialize in risk assessment, liquidity forecasting, and investment strategy, while Cash Managers focus on optimizing day-to-day cash flow, managing payment systems, and ensuring operational liquidity. Treasury Analysts leverage advanced financial modeling and market analysis to guide strategic decision-making, whereas Cash Managers maintain precise control over cash positions and banking relationships to meet immediate funding needs. Evaluating the organization's complexity and cash flow dynamics determines whether strategic forecasting or operational efficiency is the priority.

Treasury Analyst vs Cash Manager Infographic

jobdiv.com

jobdiv.com