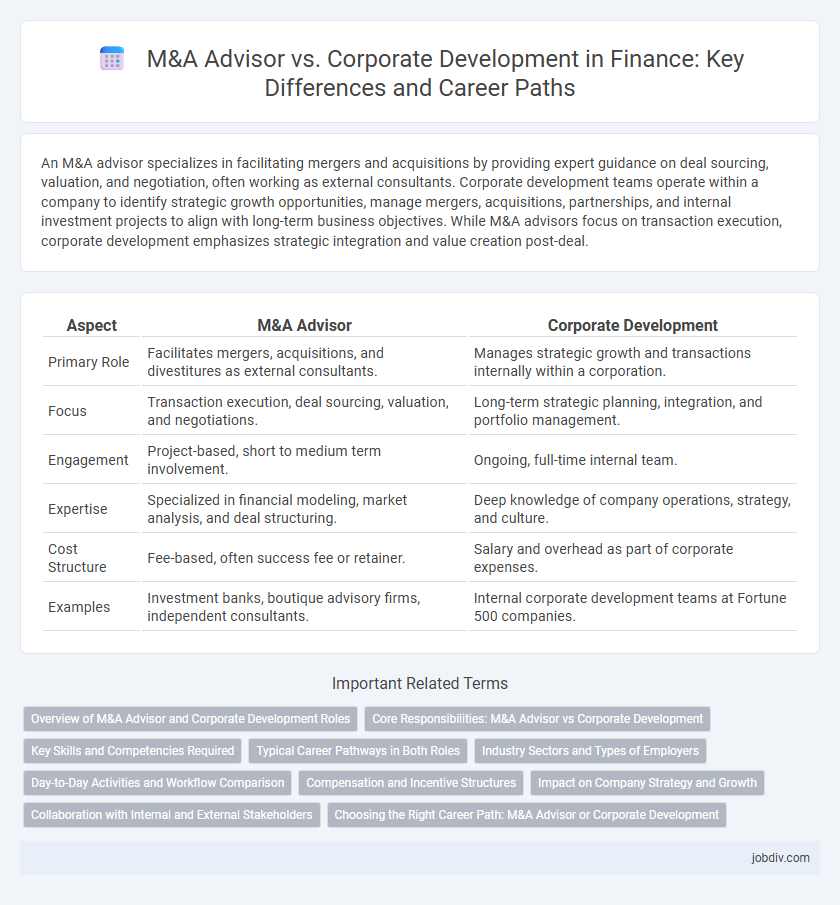

An M&A advisor specializes in facilitating mergers and acquisitions by providing expert guidance on deal sourcing, valuation, and negotiation, often working as external consultants. Corporate development teams operate within a company to identify strategic growth opportunities, manage mergers, acquisitions, partnerships, and internal investment projects to align with long-term business objectives. While M&A advisors focus on transaction execution, corporate development emphasizes strategic integration and value creation post-deal.

Table of Comparison

| Aspect | M&A Advisor | Corporate Development |

|---|---|---|

| Primary Role | Facilitates mergers, acquisitions, and divestitures as external consultants. | Manages strategic growth and transactions internally within a corporation. |

| Focus | Transaction execution, deal sourcing, valuation, and negotiations. | Long-term strategic planning, integration, and portfolio management. |

| Engagement | Project-based, short to medium term involvement. | Ongoing, full-time internal team. |

| Expertise | Specialized in financial modeling, market analysis, and deal structuring. | Deep knowledge of company operations, strategy, and culture. |

| Cost Structure | Fee-based, often success fee or retainer. | Salary and overhead as part of corporate expenses. |

| Examples | Investment banks, boutique advisory firms, independent consultants. | Internal corporate development teams at Fortune 500 companies. |

Overview of M&A Advisor and Corporate Development Roles

M&A Advisors specialize in facilitating mergers and acquisitions by advising clients on deal structuring, valuation, and negotiation to maximize transaction value. Corporate Development professionals operate within companies, focusing on strategic growth initiatives such as identifying acquisition targets, conducting due diligence, and integrating businesses post-merger. Both roles require deep financial analysis and market insight but differ in scope, with M&A Advisors serving external clients and Corporate Development teams driving internal corporate strategy.

Core Responsibilities: M&A Advisor vs Corporate Development

M&A advisors specialize in facilitating mergers and acquisitions by providing valuation, due diligence, negotiation support, and deal structuring expertise primarily for external clients. Corporate development teams focus on internal strategic growth initiatives, including identifying acquisition targets, executing transactions, and integrating acquired businesses to align with the company's long-term objectives. Both roles require financial analysis and market assessment skills but differ in client scope and operational focus.

Key Skills and Competencies Required

M&A Advisors require strong negotiation skills, financial modeling expertise, and deep knowledge of deal structuring to drive successful transactions. Corporate Development professionals must excel in strategic analysis, internal stakeholder management, and integration planning to align acquisitions with long-term business goals. Both roles demand proficiency in valuation techniques, market due diligence, and risk assessment to maximize deal value and ensure operational synergy.

Typical Career Pathways in Both Roles

M&A Advisors typically begin their careers in investment banking or consulting, leveraging deal execution and financial modeling expertise to advance into senior advisory roles. Corporate Development professionals often start within a company's finance or strategy departments, progressing through roles focused on internal strategic planning, mergers, and acquisitions integration. Career advancement in both fields favors strong analytical skills, market knowledge, and relationship management, but M&A Advisors tend to have more exposure to external deal sourcing while Corporate Development roles emphasize internal growth initiatives.

Industry Sectors and Types of Employers

M&A advisors primarily operate in investment banks, boutique advisory firms, and private equity firms, focusing on diverse industry sectors such as technology, healthcare, and energy to facilitate mergers and acquisitions. Corporate development professionals are typically employed by large corporations across various industries, including manufacturing, consumer goods, and financial services, where they drive strategic growth through internal acquisitions and partnerships. Both roles demand strong analytical skills but differ in employer type and industry emphasis, with M&A advisors serving multiple clients and corporate development teams concentrating on their company's sector-specific growth.

Day-to-Day Activities and Workflow Comparison

M&A advisors primarily focus on deal sourcing, valuation analysis, due diligence coordination, and negotiation support to facilitate mergers and acquisitions transactions. Corporate development professionals manage internal strategic initiatives, identify growth opportunities, and oversee post-merger integration while collaborating closely with finance, legal, and business units. Their workflows diverge as M&A advisors concentrate on external client engagement and deal execution, whereas corporate development teams emphasize internal strategy implementation and long-term value creation.

Compensation and Incentive Structures

M&A Advisors typically earn compensation through a combination of retainers and success fees, which align incentives directly with transaction completion and deal size. Corporate Development professionals receive a fixed salary supplemented by performance bonuses and long-term incentives such as stock options, fostering alignment with the company's strategic growth and value creation. The variable pay structure in M&A Advisory emphasizes deal execution, whereas Corporate Development compensation prioritizes sustained corporate performance and integration success.

Impact on Company Strategy and Growth

M&A Advisors drive company strategy and growth by identifying acquisition targets, facilitating deal negotiations, and structuring transactions to unlock value quickly. Corporate Development teams shape long-term growth by integrating acquisitions, aligning M&A activity with strategic goals, and managing internal innovation pipelines. Both functions are essential, with M&A Advisors accelerating external growth while Corporate Development ensures sustainable expansion and strategic cohesion.

Collaboration with Internal and External Stakeholders

M&A Advisors coordinate extensively with external stakeholders such as investment banks, legal teams, and regulatory bodies to ensure smooth transaction processes. Corporate Development teams work closely with internal departments including finance, operations, and strategy to align acquisitions with the company's long-term goals. Effective collaboration between M&A Advisors and Corporate Development is essential for negotiating deal terms and integrating acquired assets seamlessly.

Choosing the Right Career Path: M&A Advisor or Corporate Development

Choosing the right career path between an M&A Advisor and Corporate Development depends on your interests in deal execution versus strategic growth. M&A Advisors specialize in facilitating mergers and acquisitions, leveraging strong negotiation skills and market knowledge to close transactions for multiple clients. Corporate Development professionals focus on internal growth strategies, including identifying acquisition targets and executing integrations, aligning directly with a company's long-term vision and operational objectives.

M&A Advisor vs Corporate Development Infographic

jobdiv.com

jobdiv.com